Following on from a post from @HRD on this forum querying the spin-off payment (on T212) of Sylvano Corporation by International Paper, I did some searching online and realised that there is little information out there on this spin-off.

As such, I had a quick dive into the SEC filings to see what was going on. Little news and publicity could signify a hidden opportunity.

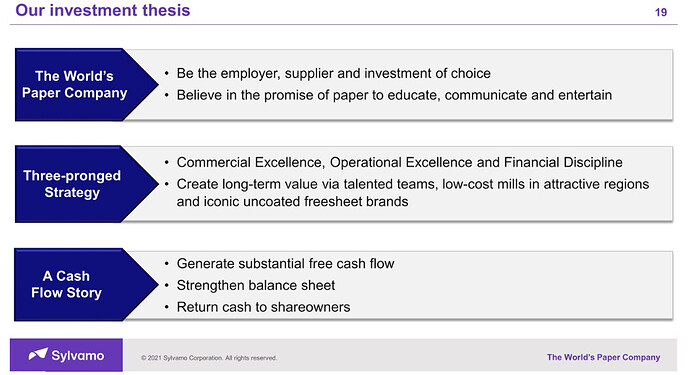

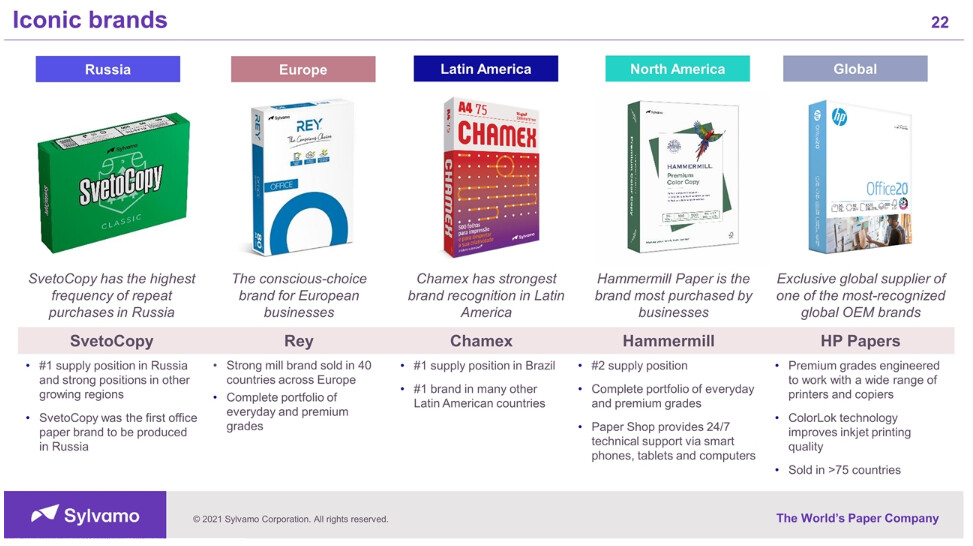

Looking into the company it can be somewhat understood as it produces paper in an increasing electronic world and with additional falling revenues due to the pandemic (and also it’s boost for digital use). I think most of their paper is uncoated free sheet which is used for printing.

So, these are the documents and key values that I have found.

8-K Report with info on the transaction:

https://www.sec.gov/Archives/edgar/data/0001856485/000119312521288889/d237619d8k.htm

Investor presentation:

https://www.sec.gov/Archives/edgar/data/0001856485/000119312521268373/d227022dex991.htm

List of SEC filings in case you want to search for yourself:

https://www.sec.gov/edgar/search/#/ciks=0001856485&entityName=Sylvamo%20Corp%20(SLVM)%20(CIK%200001856485)

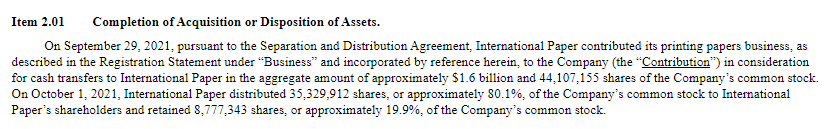

Summary of spin-off indicating 44.1m shares outstanding:

Which at a price of 32.67 USD per share (according to Yahoo, checked after close today 04/10/2021) means it has a market capitalisation of 1.44B USD.

Note: Marketwatch, Yahoo and the Nasdaq websites show very different prices at close today, hence the highest value from Yahoo is used.

From the investor presentation:

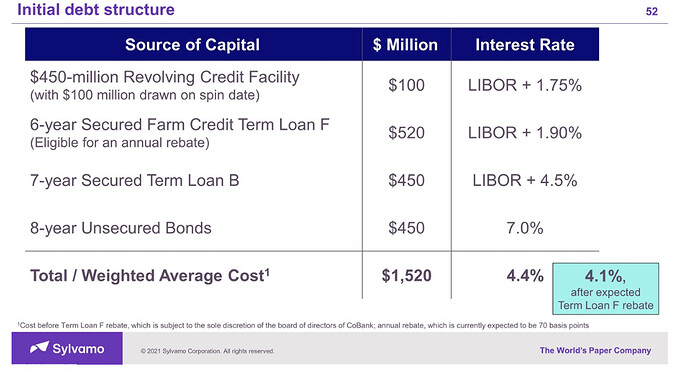

- Debt is 1250 million USD

- Free Cash Flow of last 12 months, including the pandemic is 364 million USD

Based on this, the company has produced a free cash flow equivalent to 25% of its market cap, just in the last 12 months.

Looking at it from an Enterprise Value perspective, it seems to be currently priced such that its Enterprise Value is 7.4 times its Free Cash Flow.

Note: I have not subtracted the cash from the Enterprise Value because I have not been able to find a balance sheet statement (which would provide more useful information).

Also, not being able to see the complete financial statements means that I cannot verify whether the cash flow statement makes sense and is in line with the income statement.

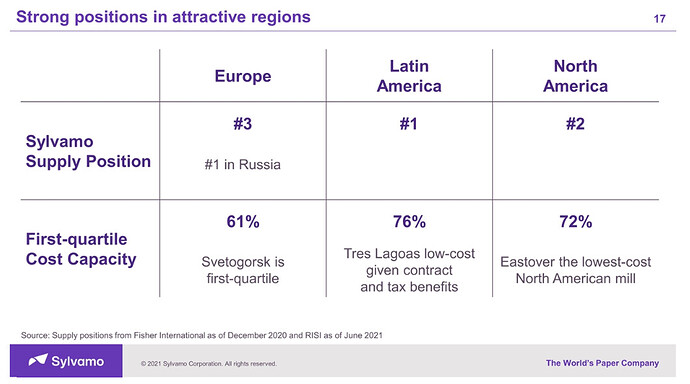

Also, if it is true that it is among the lowest cost producers then even if paper demand or its price falls they are more likely to stay in business and avoid making a loss than other competitors. Nonetheless, it is hard to tell if the numbers/figures they provide in this regard are accurate.

All in all, it seems like it could be a company worth looking into. A sector clearly in distress, but is it maybe priced for failure and yet may it survive many years more with maybe flat-ish revenues and stable profits/cash flows?

If so, that could make it quite interesting with a 25% free cash flow on market capitalisation…

Please let me know your thoughts and if you do find any more information.

P.S. Some screenshots of slides in case anyone doesn’t want to go through the whole presentation:

.

. , I guess it’s also because Europe is more fragmented in different countries and exchanges.

, I guess it’s also because Europe is more fragmented in different countries and exchanges.