Depending on China and the delisting risks. If people think that the chance is low, then it makes sense to keep holding or averaging down.

People have lost enough money averaging down

Personally, I do not feel any of this is reason for Chinese stock wipeout.

If whole market was in bull mode and chines stonks were sinking then sure.

In reality, most of “risky” assets are/were tanking.

There is plenty of covid high flyers that peaked out at February 2021. STNE/MELI/TDOC/PTON bunch more that I do not follow.

Just as same as BABA and rest of chinese stonks.

So claiming reason for Chinese wipeout is delisting only doesn’t hold much ground in reality.

But reality is, buying at this level short term doesn’t prevent you going 50%+ under, even as it seems you are getting great bargains nowdays.

What does make baba “risky” in this case then? The other companies like TDOC, PTON, and many more are essentially money losers, unlike baba.

Same question can be asked, why in the first place have those same stocks been insanely bid up so high, if they were money losers?

Reality market in 12/24 months is not a real reflection of objective value.

Reason for BABA collapse can be found at many place.

One of them being growth deceleration at higher then expected pace.

Just fun fact, you can check some specific industries and can see interesting pattern of sinking earnings in 2019 pre covid, then covid collapse was just a natural move to short term bottom. As if companies earnings knew covid would be bottom.

Anyway, i doubt anyone knows why some stock is priced the way it is in short term.

Ps:

You can check FB(Meta), future growth concerns. PE dropped below 13. So growth concerns can really depress valuation, however I also don’t think that is the real reason for price drop.

I’m watching the HK index and shares, this is likely to hit 60 and below. I would buy but now only on a platform that supports the HK index.

Trading212 is unable to commit to a timeline which makes me nervous.

AJ bell is my LISA provider and I plan to deploy some there - but I’m waiting for that 60 position, I hope we don’t get there or below but you never know…

You only lose when you sell.

This is the worst advice. So many new investors/traders have been brain washed into this buy the dip and hold forever mentality and are sleep walking into losing tonnes of money.

A 60%% loss on paper doesn’t count? Well that 60% loss needs a 150% gain just to get back to break even, never mind make any money. Imagine stopping that at a 10% max loss and moving into other stocks that actually go up. We are here to make money not massage our egos about being clever or correct.

I don’t agree with this - a loss is a loss, whether you realize it or not.

Agree but the fundamentals of this company are not impacted by market sentiment.

The book value is $57 and current cash alone is $28/share. Yes it is scary to lose money in the stock market but if you apply the concept of a 10% loss limit you’d be selling each time there was a bear market of 20% or more.

You need to be sure about why you are buying a business.

In my case -

Even if BABA continues to grow at 10% per year, it is selling at value. The stock has immense cash flow and is a leading tech company in the worlds second largest economy.

The rest is just noise, not fact or data.

I think the key difference lets remember, some of us posting here are long term investors and others are traders, so some are focused on the business more and others on averages and price moves. I get that Alibaba has frustrated traders as it doesn’t adhere to their ‘rules’. But in my opinion I have not lost money on Alibaba as an investor despite my position currently down. If I needed the money now and had to liquidate then yes I have lost money, this is unlikely unless the whole world goes to hell (possible but unlikely). My thesis was for a long term hold, so my investment hasnt failed, let me know in 10+ years if I am still down then sure lets talk.

If we think like that, people should’ve sold after something like a 30/40% loss during the 2020 crash, right?

Nope they should have sold at max of 10% then would be sitting in cash for any bear markets or Nasdaq style busts with plenty of cash to deploy when the market moves up. Read William O’Neill for how the actual stock market works

How would they know if the stock will drop more than the 10 loss they sold for? Isn’t that considered “timing” the market?

I speak as a long term, value investor. I will be holding for 5-10 years minimum. As long as the fundamentals don’t change.

I will be reward in years to come.

If you’re trading then yes, by all means go and realise your losses.

Have a look into Paul Tudor Jones. A basic principle he uses is the 200 day Simple Moving average (SMA). Just adding this one metric of selling when the stock falls below this can improve investing performance massively and avoid any drawn out corrections that all stocks go through. A good time to buy for a long term investor is when the price goes above it and the 200sma starts positively trending up. You can stay in stocks for a very long time doing this in bull markets and avoid long drawn out bear markets.

Do you not think the fundementals have changed for BABA though. PE of about 20 after all this downtrend. It needs to roughly 4- 5X to get back to its all-time highs and I didn’t think it had a PE of 100 back then

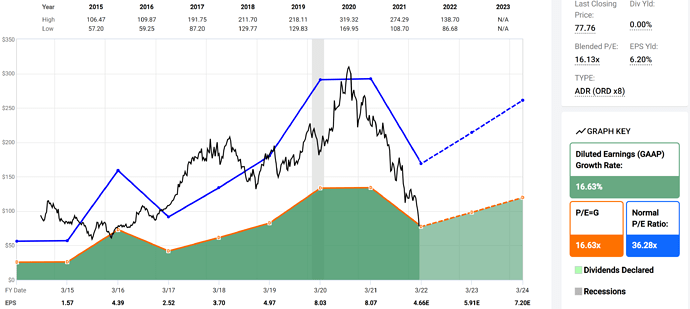

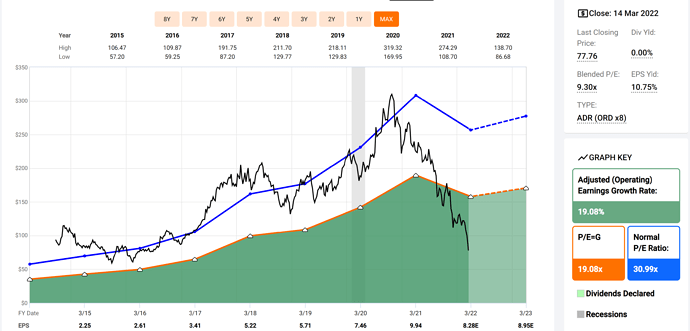

GAAP earnings is 16 PE at 77.76 USD.

Non-GAAP is 9 PE at 77.76 USD.

Lot of dilution.

However Price to Book is getting close to 1. Standing at 1.36 at 77.76USD. Around 50USD it is 1 PB.

Anyway not first time BABA faced sharp drop in earnings.

Happened in 2017, check price movement pre 2017, drop to 50s low and then up.

There was huge tailwinds during Covid which increased revenues/earnings to unsustainable levels, however growth pattern is there.

What are you referring to when you fundamentals? FCF or Net income? If either of these then this has not changed negatively…

PE will of course change as the valuation changes… and is not the only metric to consider

I’m not disagreeing that it is a cheap valuation. Only that being cheap is not what moves stock prices up. Large institutional buying is what moves it and I will stay away until the big money moves back in. (And above its 200sma for me). I’m not trying to time the bottom of any stock personally