Richard, I hope you don’t mind me asking a question in relation to the exchange rates in your spreadsheet example, which appear to be daily. I see HMRC have monthly and yearly exchange rates on their website, do they have to be used or can daily exchange rates be used and if so from what source? Thank you.

I can answer this question with confidence as I have the answer from a professional UK tax accountant.

HMRC do not specify that any particular exchange rate source must be used. You are free to use any source for spot rates so long as you are consistent.

For dividends it should be the rate on the official payment day of the dividend. For capital gains it should be the day the stock was purchased (for cost) or sold (for proceeds).

The average monthly and yearly rates you see on HMRC website are really for businesses to use in certain circumstances, not for individual taxpayers.

I get my daily rates from Google sheets like this

=GOOGLEFINANCE("USDGBP", "price", "01/01/2019",700)

You should not use tourist rates. If you are with a broker who charges a fee on fx, (eg AJ Bell and Hargreaves 1% and Interactive Investor 1.5%) that fee is not a deductible cost from your taxable dividends or capital gains. The only broker fee that is deductible is the trade fee, like £9.95 on AJ Bell. Here on Trading 212 we do not have that.

So long as the dividend is small I would simply declare what Trading 212 pays you, even though they may pay you a few days after the official payment date. Usually fx is not so volatile that is will make a difference. However, if the dividend is large, say over £100, then you probably should try to be more accurate by using fx figures for the true payment day. Remember to gross up the dividend to account for the US withholding tax. For me that is 15% so if I receive a £8.50 from Trading 212 then I need to report £10. I can take the £1.50 US tax as a credit against the £3.25 UK tax (32.5%) owed.

My protocol is to keep a list of all my US company dividends and their true payment dates (sourced from Yahoo or Nasdaq) and then automatically lookup against an table of Google sheets fx data.

=VLOOKUP(H433+1,‘FX’!H$2:J$700,3,FALSE)

The H433+1 above is because I copy & paste from a Yahoo portfolio of my holdings and Yahoo reports dividend payment dates that are wrong by being 1 day too early.

E.g. I have created a custom view. Yahoo displays this;

Thank you so much Richard, that is really helpful! Just one thing about what you said (see below). If I understood you correctly, the £1.50 US tax that’s already been taken can be subtracted from the £3.25 UK tax owed, so you’d pay £2.75 UK tax only, HMRC are fine with this? Though if the dividends are from shares within an ISA account (not an Invest account), so no UK tax owed, then nothing can be done to offset the US tax already taken? Thanks again.

@Richard.W I’m specifically talking about cryptocurrencies, so CFDs as far as I understand. Is there any way I can export/extract that interests numbers from the website or app so I don’t have to retype those manually for all my 500+ transactions?

That is pretty much correct. What you actually do on the self assessment is claim a foreign tax credit. You compute your total tax with the foreign dividends included, say T1. Then you recompute tax with the foreign dividends excluded, say T2. Suppose you have paid US tax of T3. Then the deduction you can take is the minimum of T3 and T1-T2, ie minimum of the foreign tax paid and how much the foreign dividends have increased your UK tax bill.

For a higher/additional rate taxpayer paying 32.5%/38.1% on dividends this means a credit for the full £1.50, For a basic rate taxpayer paying 7.5% the credit can be only £0.75 since credit cannot exceed the UK tax due.

Nothing can be done about the US tax paid in an ISA account.

Nor can anything be done about the US tax paid internally by an ETF provider. For example, if Vanguard receive $100 of dividends from companies held in your shares of VUSA, they pay 15% US tax. You get $85, minus Vanguard’s fee, and then you owe tax on that, without possibility to take credit for the tax Vanguard has paid. This is one reason why it can be better to own companies directly.

Thanks Richard, that was really useful and interesting! All the best.

Thank you for the thanks. I am not a professional tax accountant. I am only sharing what I know from reading, conversations with tax professionals, social media chats with HMRC agents, and completing my own self-assessment forms for many years. All the best.

It is not a bad idea to hire a UK tax accountant. Some people will find that to be money well spent.

Yes although there’s a ‘30 day bed and breakfast’ restriction to prevent use of the annual allowance where the sale of shares took place near the end of the tax year and were then repurchased early in the new tax year. HMRC views the shares to have never been sold (until they are sold and not repurchased within 30 days) and the purchase price for the CGT calculation to be the original purchase price not the most recent purchase price.

This can get complicated for traders who are racking up multiple trades per day and doing partial sales of shares etc.

The same rules apply for direct trading in cryptocurrency (purchase / sale of the actual crypto not derivatives).

I have sometimes done the following when I want to take some capital gains to “use up” the annual allowance.

Buy more shares, then sell them back the following day. Suppose I have 1000 shares with gain of £11k. I can buy an additional 100 and then sell 100 the next day. I will created a taxable gain of about £1k to use within my tax free allowance. The original shareholding now contains reduced pregnant gains of £10k.

So it’s said that gains in a ISA account is tax free. Is that entirely true? As long you stick to £20k deposited per tax year gains can in theory be infinite without paying any tax? Thanks in advance

Thanks very much Richard. I’ll have to look into this option as I’m only doing the calculation for the first time myself and still familiarising myself with all the rules. I have a lot of transactions  ! Still plenty of time before April though…

! Still plenty of time before April though…

It’s a shame 212 don’t offer this calculation for us to include in our tax return. As I think you already mentioned, strictly speaking even people with a loss or small profit should still be reporting their trades if they have turned over £50k which is easily done if trading most days.

that is correct. you will face restrictions which should make you unable to deposit more even if you wanted to, however currently the ISA system is set so that you are depositing money that has already had income tax applied to it, so there is no further taxation.

once you withdraw the money, spending it will face the normal VAT etc but you won’t be taxed or charged just for withdrawing it and all profits on the deposited money is in a tax-free bubble.

there is worry that due to the pandemic the government may take another look at how ISAs work, but for now there is no need to worry.

Brilliant, thanks alot Dao. Yes, lets hope it’s kept this way.

Yes, this thread on capital gains tax only applies to non-ISA investments (and SIPP which 212 are apparently offering from next year).

Hi @Richard.W,

Thanks for so much all the hard work in your posts.

Regarding your comments on CFD’s

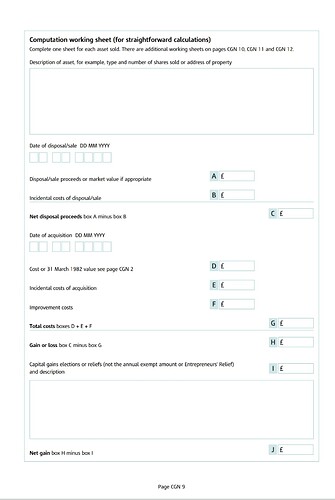

You attach a pdf file to your online tax return that you print from your own spreadsheet, where on each line you state a closing capital gain or loss: instrument and quantity involved, date opened, cost, date closed, closing proceeds and gain/loss.

Find a document from the Association of Chartered Certified Accountants Share matching rules | ACCA Global

The CFD instrument would still have to follow the rules for Capital gains tax based on

- acquisitions on the same day as the disposal;

- acquisitions within 30 days after the day of disposal (thus countering ‘bed and breakfasting’);

- shares comprised in the ‘section 104 holding’ (see below);

- if the shares disposed of are still not exhausted, shares acquired subsequent to the disposal (and beyond the above-mentioned 30-day period).

Does your Google sheet deal with ‘section 104 holding’ ? I don’t think you can just do a just a simple P/L calculation per instrument.

Would love to get your feedback on this?

Regards

P.S. Reason I linked to the ACCA website and not HMRC directly is because this is the page that accounts read to double check the meaning of what is written on HMRC site.

Yes, I carefully take account of all the matching rules 1-4. My personal use of CFDs is sufficiently small that it is not difficult to make the correct calculations by hand. I am always opening/closing a CFD position within one or two days so rules 1 and 2 are the ones that are applicable to my trades. The share matching rules come into play more frequently with my long term shareholdings, where most of my shares are in Section 104 holdings. I just did some trades today for which rule 1 holds, as I was selling shares held with another broker and rebuying them a few seconds later with Trading 212.

Hi,

Do you mix in one sheet diffrent Financial instruments ? or do put a new sheet for each Financial instruments ?

3rd Column in the spreadsheet got “Sales?” Should this be filled in with S or B?

4th Column Buy/Sell ( reason it not showing -150 on row 1, I presume this is the same)

Any more of the sheet design you can sheet would be amazing. I’m trying to build a procces that I can use each year and keep track of all of this.

Thanks so much for your hardwork on posting all this info.

Kind regards

R

I would welcome suggestions from others about how to keep records and criticisms of what I do. Each person has to find the means of record-keeping that works best for them. There is a minimal amount that is needed for tax self-assessment.

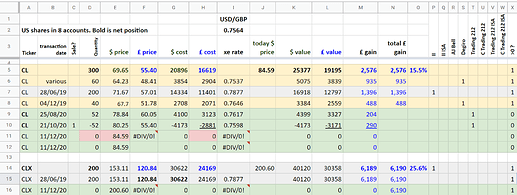

So here is an extract from the Google spreadsheet that I use. Click on Sample diaries. If you use Google sheets you can click on the link and inspect how the cells are calculated. I am curious to see if this post attracts many “likes”.

The first sheet, called “Diary” show how I keep track of some transactions on Colgate and Clorox. Lines are colour-coded to remind me in which account the position is held (and this also appears in columns P-W.)

I keep information for all my investments in a sheet like this, with a block for each stock, in alphabetical order as shown here for CL and CLX. From it I extract data for more sheets of more condensed summary information.

The cells I have temporarily marked in red in line 11 are to show you where I would input information if I were to buy some more CL shares. Other cells in that line are automatically computed. I can add more lines by inserting after line 11 and copying from line 12. When I sell, as in line 10, I manually compute the basis cost to double-check I am correctly applying HMRC matching rules. (Since I am a long-term investor almost all my sales have a basis cost of the average purchase cost in my Section 104 holding, as is seen for this sale of 52 CL). My current basis cost for CL is £55.40 per share.

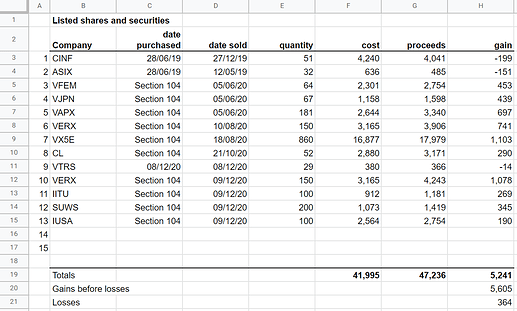

The second sheet called “CG report” shows what I have recorded so far this tax year. You can see the CL sale of 52 shares in line 10. With gains so far of £5241, I will want to realise about £7059 more before the end of the tax year. At the end of the year I will print this as pdf and attach it to the capital gains section of my self assessment tax return.

Notice that I am intending to report losses from CINF and ASIX that were sold in the previous tax year. This is allowed. You can report losses up to 4 years after they have occurred. If I had reported these losses in the previous tax year that would have reduced the benefit I could gain from the capital gains tax free allowance that tax year. So I preferred to delay my report of these losses. It is also interesting to note that 29 shares of VTRS were sold in my AJ Bell account and then rebought in my Trading 212 account the same day. The loss of £14 is due to spread and fees charged by AJ Bell. I was wanting to reorganise all my VTRS stock in one place. I had received VTRS shares from the PFE spin-off in 2 different accounts where I hold some PFE.

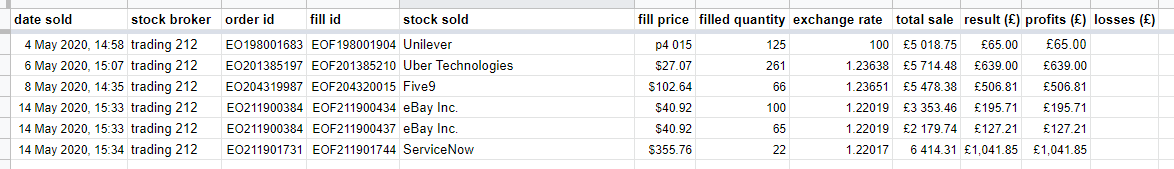

I have a slightly different sheet to report CFD transactions under the “Other property, assets and gains” section of the self assessment form.

I think you do a good job to record everything and more than most people. For me I just have the one bare minimum spreadsheet for capital gains, a snippet as follows which I created manually from my T212 emails. the ‘diary’ part you create is in my T212 history so don’t feel the need to record this in a spreadsheet but can understand why you do it if you have multiple brokers to keep it all in one place.

edit: I don’t have purchase date in the spreadsheet but kept is as simple as possible by just putting sold date, I’m not sure if there is any problem with that.