Hey, Community ![]()

Another update is now live, as the CFD order screen underwent a design overhaul. The update is now live for all web users, but it will be released gradually on mobile. There are plenty of changes to cover, so let’s jump into the details.

The first thing we’ll go over is the order screen. We removed some components to clean up the interface, while adding others to make placing and managing your orders as simple as possible. Here’s what changed:

- A new order input layout is now available. It replaces the “chevron” we previously displayed with a dedicated action button, allowing you to quickly change between “Value” (set by default) and “Quantity” orders based on your preferences.

- The Limit/Stop tab was removed, and all pending order types are now visible on the order screen. A new ‘Change %’ switch was also added, allowing you to set limit/stop levels by percentage rather than only by price. You can now also attach a trailing stop order when opening a position.

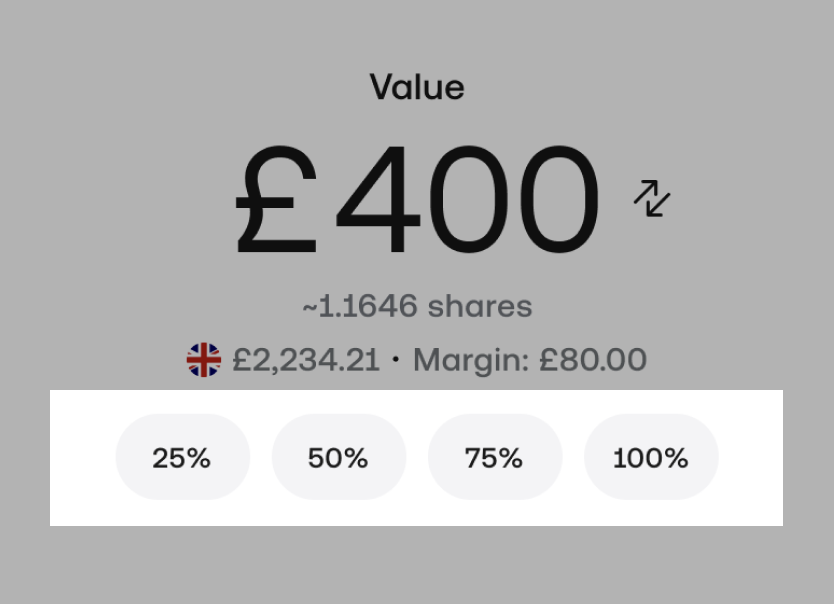

- Quick-sizing pills were added to replace the order slider. They prefill a size that targets a percentage of the margin you can use (your free funds). You can choose between 25%, 50%, or 75%, with all three options using that percentage of your free funds as margin. The 100% pill uses only 98% of your free funds, as the other 2% are left out as a buffer for price moves. You can still choose your own order size by entering it manually and without using the sizing pills.

For opposite-side trades (hedging), the system funds the order by offsetting up to the value of your current position (this doesn’t involve extra margin) and utilising your free funds for any amount beyond the value of the current position. For closing orders, the pills close the percentage you selected of your current position. On this page from our Help Centre, you can find a detailed article covering the pills, along with examples of how they work in different scenarios.

In addition to the above, we also added two new tabs to ensure better transparency whenever you open a position, as well as for already open positions:

- The ‘Order details’ tab provides estimates about the position you’re opening, including the ‘Overnight interest’ that will be due for holding the position each day.

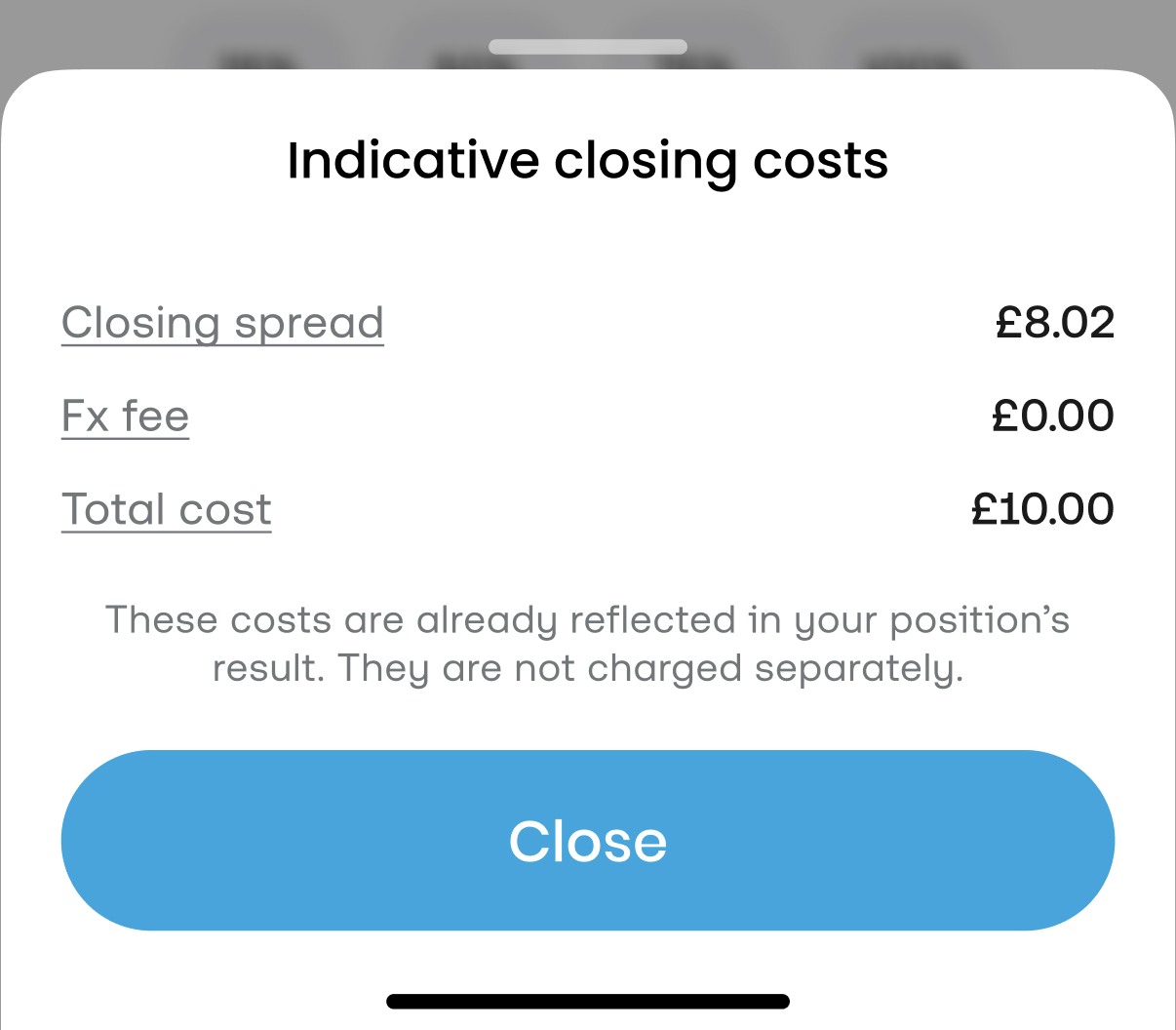

- The closing costs tab provides an estimate of the costs to close the position, including the closing spread, the FX fee (if such is to be applied), and the total cost.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. CFD account not available to customers registered with Trading 212 AU Pty Ltd.