This is a good point. I’m sure I’ve read India is the most expensive market in the world, so I try to time my AIE buys.

Yes, I get that about India. There are some good articles explaining why we should be cautious, but also why it should be good for the long term.

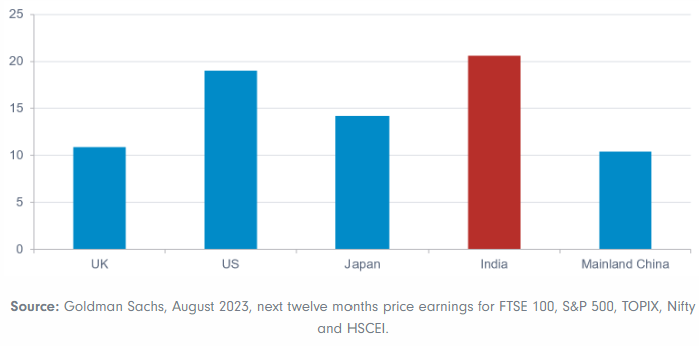

However, India’s P/E is on par with the US; it still poses greater risks than the more regulated and known US economy/potential/history.

With that said, if we wanted to steer clear of India, which other promising country-linked ETF should we look into?

Please see below an extract from an interesting article about China and India

The India vs China rivalry has also been greatly affected by the advent of the China plus one strategy. This is reflected in the fact that global giants seeking to diversify their supply chains beyond China, like Apple and BMW, have already established manufacturing facilities in India.

Along with that, the ensuing trade war between US and China has meant significant trade restrictions on Chinese electronics and computing products by the US. This has translated to a rise in exports of Indian electronics to the US by 260% between 2018 and 2022, as per Oxford Economics.

“India’s key advantage lies in its young and growing workforce, representing not only a source of labour but also of demand once a stronger manufacturing sector can broaden income growth,” added the global economic researcher.

Looking forward to hearing your thoughts.

Vietnam may be chief among the alternatives although I prefer India. There’s a handful of trusts such as VOF which have good long-term records and probably offer more value.

PHI’s worth a mention for broader exposure. Despite having about a quarter in China, it has more in India as well as a good chunk in South Korea, Vietnam and Indonesia. It’s had a relatively rotten few years due to its focus on growth but I’m confident it’ll continue to do well long term.

I’ve heard strong-sounding arguments for investing in more ‘frontier’ markets such as the Gulf too. But the main trust, GIF, is in dollars and too illiquid for me. I did hold BRFI for a few years but I really wasn’t unconvinced so it got the chop.

Your strategy sounds refreshingly simple . I’ve been guilty of collecting investments like stamps over the years, I still hold too many despite a recent cull, with 22 across my Isa and Sipp.

I should whittle it down more but it’s difficult to part with holdings that have done well and you’re still confident in – it’s like deciding between your children.

The other option would be to still include India and Semiconductors, but add a fourth ETF to get some exposure to the rest of the World ex-US with a split of around 70-30 between develop and emerging). I gues you have endless options; however, I am trying to keep it as simple as possible.

Now, to throw another spanner on the table, what do you think about currency-edged ETFs? Is it something you usually consider or not? It shouldn’t matter too much when investing for the long-term; however, I would appreciate any thoughts.

And one last point: S&P 500 or Nasdaq 100? Which one would you pick? (Multiple choice is allowed)

I really love this! ![]()

what do you think about currency-hedged ETFs? Is it something you usually consider or not? It shouldn’t matter too much when investing for the long-term

Currency hedged ETFs don’t matter in the long term as you correctly said. However they are more expensive than their non-hedged versions. I personally don’t use them.

And one last point: S&P 500 or Nasdaq 100? Which one would you pick? (Multiple choice is allowed)

- If you want to get exposure to USA large cap stocks, S&P 500 is the better choice.

- I don’t like Nasdaq 100 because it only has stocks listed on Nasdaq which is an arbitrary choice. If you’d like more tech exposure, there are USA tech ETFs.

What are your thoughts about going a step further by replacing an MSCI World tracker with an S&P500 one, @RLX?

I’m thinking about doing this in my Isa. It would reduce costs from 0.12% to 0.03% for the core of my portfolio. You can make a case that many of the companies are global in nature.

I already hold investment trusts covering the UK, EU, Asia etc and I think I’d prefer going 100% active for non-US markets any way.

@topher, I reckon the Vanguard S&P 500 (VUAG) would do well. It is actually what I have in my portfolio. The fee is 0.07%, so not too greedy.

Below you can see a 10-year performance snapshot of the VUAG compared against the SPDR MSCI World Tracker at a 0.12% fee.

It is totally up to you whether it makes sense according to your goals since I don’t publicly provide any recommendations.

Thanks for your input, @RealValueInvesting.

I think I will sell SWLD to buy SPXL instead and add to my non-US holdings in the weeks/months ahead.

I can’t see many drawbacks as it gives me greater control.

I would lose cheap passive exposure to non-US markets but, on reflection, I don’t think I’ll miss it.

I’m confident FEV and MTE will continue to outperform comparable EU trackers over the long-term, for example.

SPXL seems to be a bargain, considering it offers the same full physical replication as VUAG at less than half the cost.

My pleasure @topher.

SPXL ican definitely be an interesting and appealing choice. I would only add that, over the past 10 years, for long-term investors, especially those focused on growth stocks, VUAG (or similar growth-focused ETFs) could have offered more stable and possibly superior returns compared to the broader market, benefiting from the significant growth in tech and other high-growth sectors. In contrast, the performance of SPXL over a decade would be more volatile, and while it could have periods of spectacular gains, it also risks substantial losses, especially in down markets due to its leveraged nature.

At the end of the day, it all depends what your goals and risk appetite are.

You had me worried with the leverage comment for s moment there. It looks like there’s a leveraged ETF in the US under the same ticker. This is the one I’m referring to.

In which case it looks good!

In Return side, the S&P 500 makes more sense than MSCI World.

In Risk side is the opposite, due to a concentrated US and USD exposure (besides other countries).

In an aggregate view, as you have already exposure to other countries (via ITs), it makes sense, ITs + S&P 500 ETF, that combo covers most countries. The MSCI World had already your ITs exposure, so you had an overexposure to World ex-US. If you want reduce World ex-US and/or rise the US (USD) exposure, could be the way.

If you want go a step further, with a spicey sauce, take a look to ETF related to S&P 500 Tech (e.g. IE00B3VSSL01 ; IE00B3WJKG14).

I have 45% in MSCI World and 55% in US Tech in my ETF portfolio, not taking in account a more diversified stock portfolio and a Global active investment fund I also have, in the end, diluting the % for US Tech and rising the % for Global exposure.

Thanks @RLX, it’s really handy to get a sanity check with things like this.

I don’t know why I didn’t just use an S&P tracker in the first place as it makes so much more sense.

Now I can just add up MTE and FEV to work out my EU exposure without having to worry about X% of an MSCI World ETF too.

And of course, US markets contaminates most all other markets (at least the developed world). If US are in a pickle, the other countries are in a swap. ![]()

US are generally the first to fall, but are the first to rebound and fast.

So, even if you don’t want too much exposure to US, in the end we are subject to the US destiny.

Sometimes, less are more. The KISS design rule could be a solution for the portfolio construction (I’m experiment with that). Specially as studies (with US stocks) shows that a portfolio of 15 stocks are considered almost the whole market, as adding extra stocks would have a decreasing diversification value for each new stock company added. Please note only the correlation aspect of those stocks (Beta), as of course, more stocks would diversify other risks (credit, operational, etc).

I’ve been guilty of overcomplicating things. I think it’s a bit of a safety blanket when you start out. You wrongly think 10 ETFs must be better than one – don’t put all your eggs in one basket etc.

Over the years, as I’ve become more knowledgeable, my portfolio’s become simpler. In the past few years, I’ve reduced my number of holdings by about 50% and I’m seeing much better returns

It’s like that old Buffett quote along the lines of ‘why invest in your 23rd best idea?’. I’ve taken a machete to my holdings and cut anything that I’m not confident will beat the index.

And if, heaven forbid, my portfolio starts to lag VWRL for a prolonged period, I’ll probably just pack up my bags and go 100% passive.

The ol’ KISS analogy reminds me of a story I heard once. In the 1960s, Nasa commissioned someone to design a pen that could write in space while the Russians just took pencils.

This NSFW website always gives me a giggle too. ![]()

Well, I am glad we got here and are apparently on the same page. I have been trying to pass the message of how simplicity usually beats complexity in any situation, and there are plenty of case studies elaborating on that.

Unfortunately, often people tend to praise complexity as having higher value while seeing simplicity as not good enough.

In my over two decades of experience, I have been experiencing the exact opposite; simplicity usually BEATS not only the market but everything else it’s been applied to.

Talking about ETFs, you could argue that one ETF could give you all the diversification you need; however, I do appreciate we might wan to add some specific areas of the markets to add some spice. That being said, adding some spice (e.g., a couple of additional ETFs) is one thing, whereas adding 10 ETFs could create unnecessary complexity, which will not necessarily translate into higher profits.

Because I am sure I have bored you enough, I would conclude by saying that I am a thorough and thorough advocate of simplicity, and that is based on factual evidence. To me, it all boils down to risk and reward; in other words, does simplicity help reduce risk and increase rewards? My answer is yes, and that is all I need.

I think it is better to stick with a MSCI ACWI or FTSE All-World tracker.

The reason for this is that it will likely work out over the long run in most cases.

Example:

- If the USA outperforms, the 50-60% USA exposure gives you that access.

- If other markets such as EM, Japan, Europe, etc outperform you get some exposure to them.

And the crucial benefit: - With an S&P 500 tracker if the USA has a period like the returns of Japan since the 1990’s you will be disapointed. With a global tracker you reduce this risk as other countries would keep you in the game. It simply reduces the risk of getting very poor returns.

This is not investment advice, just some thoughts on how I see it.

Thanks @EquityInvestor, I totally get where you’re coming from.

However, I’m not sure it really applies as my portfolio is geographically balanced at near-real world percentages via other funds.

If I was to hold a global tracker, I would be doubling up on Europe etc.

My logic for divvying it up like this is twofold;

One, it gives me more control. Say I thought the US was going to go through a Japan-style period, I could easily underweight it.

And two, I think active can more easily beat the index outside of US markets and this has been borne out by my experience.

For example, NAVF – my Japan holding – has consistently outperformed VJPN.

It’s not even close over longer periods, eg 75% vs 30% over five years.

The same can be said for my active holdings for emerging markets, Asia, Europe and the UK.

I’m all for simplicity and this is more complicated than I would ideally like but it has worked well for me so I’m hesitant to abandon the approach.

@topher may I ask a simple question? You don’t have to answer though.

How many ETFs donyou currently holdnin your portfolio?