Some time ago I came across this interesting stock from the dutch insurance sector. So I’ll share a very short look at it and why I think it’s a decent company going forward. This very short analysis does include the earnings release from Feb 18 2021.

What is ASR and what do they do?

ASR Nederland (I’ll just call it ASR from here on) is a Dutch insurance company that offers financial products mainly in the two categories Life and non-life:

- Life consists of health insurance and life insurance.

- Non-life consists of Group and individual pensions, travel, leisure insurance, income protection, Funeral insurance and mortgages

It also Invests in real estate and provides green mortgages among other services like asset management.

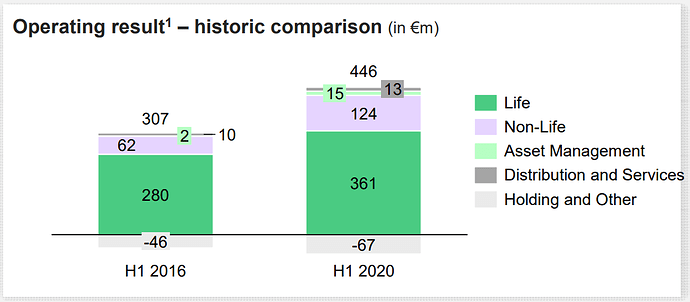

Below we see how the operating result of these operations is distributed.

The all-mighty numbers

When looking at financial institutions pe or dcf analyses become less important. That’s why we will take a look at the ROE, combined ratio, p/b, solvency II ratio among other things.

Almost all insurance companies invest the money from premiums received, that why we will look at ASR in two main ways:

- Insurance side

- Investment side

Insurance side

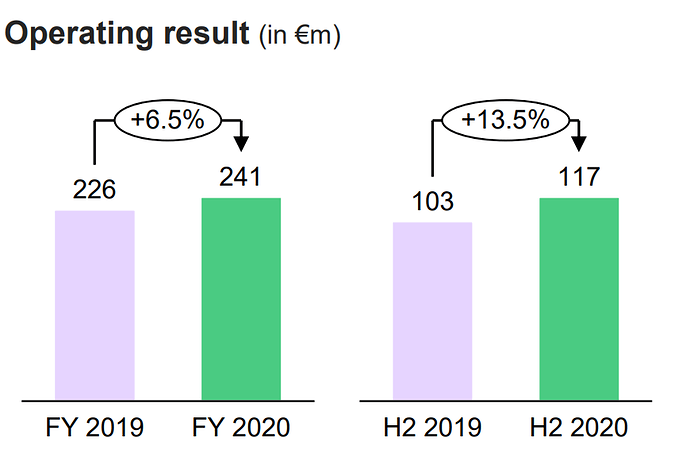

When looking at the underlying insurance business we must look at operating results instead of EBT or net income. Why you may ask? Operating result is EBT - investment income + incidentals.

So it’s a decent metric for looking at how the underlying insurance business works.

For all business lines ASR had decent growth even during covid:

And during covid gross written premiums still increased by double digits (+13.1%) which is a good sign.

Now let’s look at ROE.

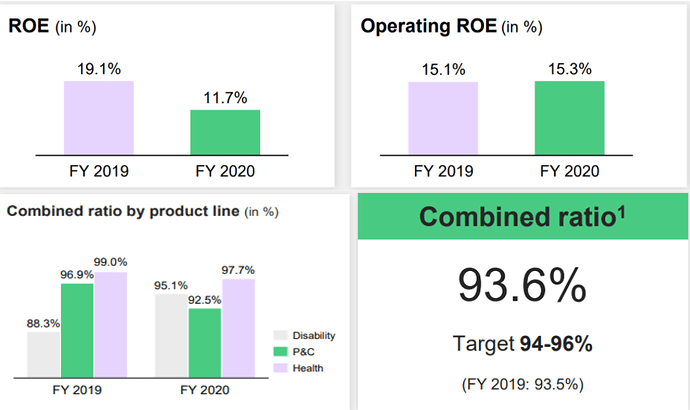

ROE measures the income level an insurance firm is generating as a percentage of shareholders equity, or book value. (the formula is simple: net income/ equity).

We can see that when you include investment returns and incidentals the ROE was very high before covid and took a great hit during covid, but looking at Operating ROE so the ROE of the underlying insurance business we see that there’s still a healthy percentage left which even slightly increased.

The combined ratio is another metric of assessing the insurance side of the business (the formula is also simple: (incurred losses + expenses)/earned premiums) this shows how much money they make from the policies, the lower the percentage the better. Anything above 100% means that the premiums coming in aren’t large enough to cover losses + expenses (this isn’t necessarily bad as a company also makes a lot of money with investing but it’s definitely something to look out for). In general the lower the better.

With ASR we see that the combined ratio slightly worsened during covid with 0.1 percentage point but, per line we see that pre covid lower margin product lines improved during covid and pre covid higher margin lines worsened. Still healthy amounts but worse than American peers like Aflac which have combined ratio’s ranging 70-90%

When looking at insurance companies it might be interesting to look at new business which is a metric which tracks the amount generated from new policies employed. If very high it could show that the company is trying to gain market share by providing new policies (innovative) or that it’s in a competitive market (much competition or disruption), it’s impossible to tell from the number alone though. Luckily I live in the Netherlands and my parents among others have first-hand experience with their policies and I would say that it’s more the first as ASR is one of the smaller insurance companies here with mCap of ~€5 billion and a more transparent, esg and low-cost business model.

One final thing on the insurance side though, their life insurance which is a very large part of the business is fairly stagnant, they have grown it by acquiring smaller insurers and other companies portfolios and have a good track record in doing so. But this is something to be kept in mind.

Investing side

Of course, asr doesn’t only make money from the insurance they also invest a lot.

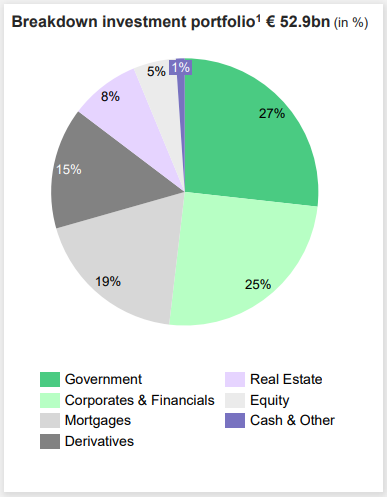

The portfolio is reasonably diversified and the bonds are in the following:

Gov bonds: 0% non-investment grade

Half in AAA

40% in AA

Corp bonds:

80% in A and BBB

15% in AAA and AA

Rerisking will come though so maybe reduced gov bonds and higher equity and corp bonds among other things can be expected.

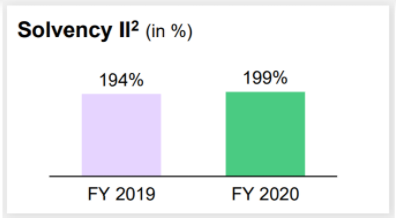

Company health

Solvency II ratio is basically a ratio that shows how much own funds a company has in comparison to the regulator’s requirements. ASR has almost twice the required amount which shows that it derisked a bit during covid and handled it very well. This gives room for more shareholder distributions in the form of higher dividends or share buybacks and a re-risking of the portfolio to generate higher returns.

Being just a €5 billion mCap company looking at shareholder might surface some interesting things, but with ASR it did not. The distribution shown bellow is very normal for a larger company.

Share metrics

- Operating result per share: 7.1% growth

- Shares outstanding: -2.0% (2019-2020)

- FY20 dividend raised by 7.4%

- Share buyback of € 75m announced for 2021

- P/B of 0.7

All in all ASR is growing at a reasonable but not high rate and imo isn’t priced accordingly.

Disclaimer: I hold about 4 and a half shares of ASRNL with a total value of ~€160, Also own 3 shares of Aflac which also was mentioned

.

. , gonna edit it now

, gonna edit it now