International Airlines Group (IAG) the owner of British Airways, Aer Lingus, Iberia, and two other retail transport airlines, a cargo business, a loyalty program, and finally a dedicated restructuring and business transformation arm. Is my focus right now seeing how COVID-19 has spelt serious trouble for the group.

Even now we are seeing the UK government call out IAG’s actions relating to how they are coping with COVID-19.

Is IAG In Trouble?

Yes is the short answer. Supposedly the group is burning £20m a day with almost no revenue generation from the airline groups. Cargo, loyalty schemes, and business operations are still in full swing but this was never the big-ticket revenue generators.

That said there also aren’t going to be falling off the radar any time soon. Two weeks ago one of the owned IAG brands has brought out a competitor, - INCORRECT Two weeks ago one of the owned IAG brands has started to renegotiate the price it agreed to buy a competitor back in December but is still planning to go ahead with the purchase, a move which has attracted a lot of negative press due to their increasing dominance and seemingly inconsistent approach to how the airlines are doing. BA is firing its staff and rehiring them on cheaper contracts, while Iberia is buying competitors.

It’s this dynamic of moral issues, a damaged industry, the CEO stepping down in September, and a global pandemic which has made me want to look at IAG as a shorter-term investment opportunity.

Is IAG Fundamentally Strong?

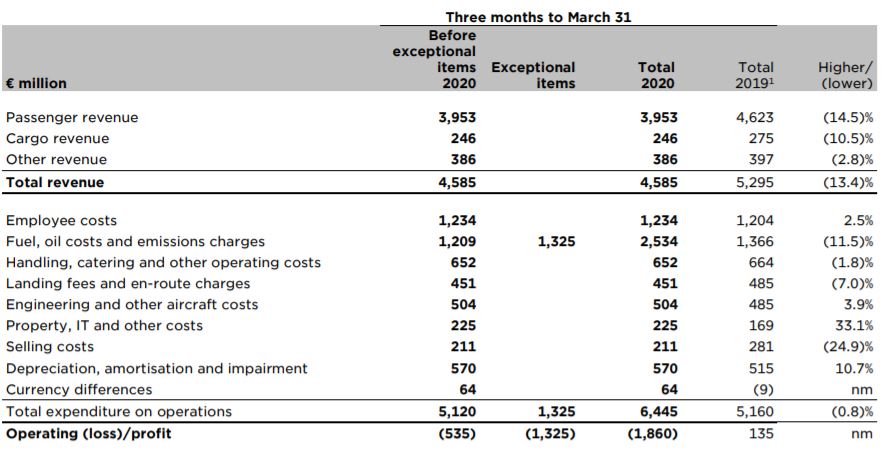

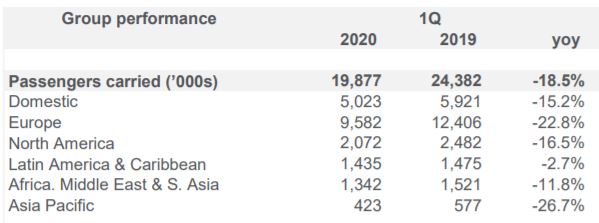

We only have the Q1 figures to go off and any announcements IAG has made to build up a picture of IAG life during COVID-19, which they have clearly been as light as possible on.

Source: IAG Q1 2020 Traffic Report

We know that flights have been grinding to a halt, domestic and international travel has been restricted or blocked. However, without a Q2 report, we don’t have any official insight into the impact. Given the massive cutbacks and use of government support, we know the impact is single biggest threat IAG has faced in its nine-year life.

Source: Genuine Impact

While the surface figures don’t look alarming, we are dealing with fundamentals which don’t include the current impact, the only dynamic bits to the company assessment is the current price and latest analyst ratings.

Source: IAG Q1 2020 Report

Looking at the annual figures IAG was brining in around €25m a year in revenue with a profit margin bouncing between 6-11%, 2016 and 2017 saw 8.56% and 8.69% respectively with 2019 dipping to a low of 6.72%. If you look at Q1 we even saw a -36.71% profit margin for a three month period where we had one a bit good months of travel.

It’s no secret that airlines struggle with profitability. With a gross margin of 28.48% in their 2019 full-year statement, that doesn’t leave a lot of wriggle room. Not to mention the pilling debt which has no doubt taken a serious turn for the worse.

In 2019 we had 80.85% debt to assets, with €12.7m in current liabilities. Even in that report the current assets only came to €11.3m. The biggest asset IAG has is it’s fleet and sites, coming in at €19.1m, however, the planes need maintenance and ongoing expense and the sites are only useful for other aerospace firms or Top Gear. The point is I don’t have a lot of faith in these long term assets being worth as much as the balance sheet claims.

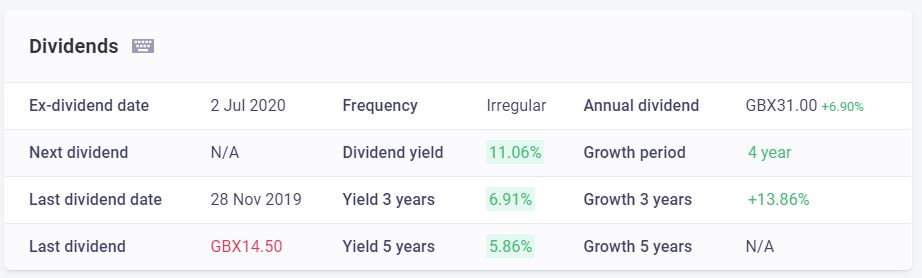

Source: Wallmine

With increasing debts, lower profits, and an increase in financing, even without COVID-19 this wasn’t the healthiest looking firm. Then why was this one of the hot stocks, and why is it making a comeback?

Source: Google Finance

News that flights would reopen gave the stock a recent boost, but firing their staff and rehiring them, as well as the UK governments isolation after travelling plans have restricted any upward momentum.

The value metrics are all very misleading, firstly we have had a negative quarter, the liabilities and assets are assumed to remain the same, and even looking annually we aren’t accounting for what could be three or more heavily negative quarters.

Source: Wallmine

While IAG is losing money I’m not expecting this dividend to be flowing, but once we get into a more stable position this will be a big attraction for other investors. Assuming that IAG isn’t going to fail within the next year, the company is taking steps to payout to shareholders in the long term.

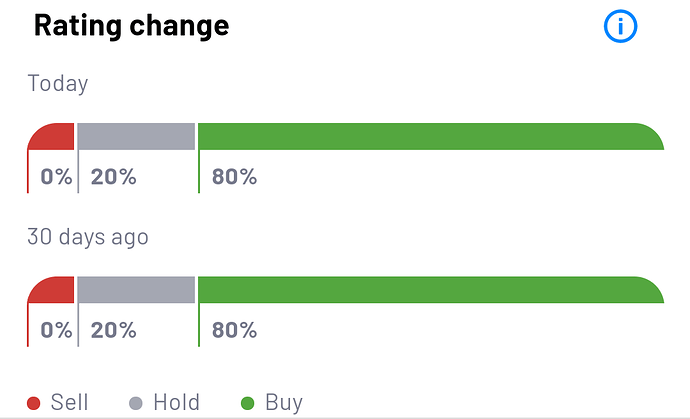

Source: Genuine Impact

The sell-side analysts are also pretty punchy in terms of IAG’s future. They can raise and manage more debt and can increase profitability by making the cuts which they have been performing over the last month or so.

I’m not surprised to see strong support by analysts, and even a consensus share price target of £4.2781, compared to the current price around £2.70~.

Summary Pros

- IAG can generate large profits and is geographically spread out

- Buying up competitors while the market is cheap

- Taking full advantage of government support in multiple regions

- Already gone through the painful shrinking process

- The market is eager to invest back into the firm once travel restrictions are lifted

- Big dividend to tempt in other investors and give them confidence, producing more momentum

Summary Cons

- Growing debt and the new state of debt is unknown

- Very fragile and reactive to COVID-19 news

- Collecting a large amount of bad PR

- Growing size could attract government attention, especially if they need more government assistance

My Thoughts

Right now I am looking at IAG as a huge momentum play. News of the 14-day self-isolation in the UK and around the EU being eased would be a massive boom. I think fundamentally the airline industry is a tough sell, and coming out of COVID-19 is going to leave a stain on their balance sheets for the next couple of years.

I am intending to buy into IAG and set myself the £4.00~, just under the sell-side estimates. If we can hit that price point in the next three months and the price begins to wobble again, I’d be happy to sell out and put my cash elsewhere.

Best case we see a closer return to old figures, but I don’t see that happening once we see the state of the new debt. It would be overwhelming momentum and lighting in a bottle moment if we saw the £5 mark within the next six months.

Let me know what your thoughts are on IAG? Is this a company you are invested into, or one you have been watching? As always I love to hear your feedback!

Thanks for reading and stay safe.