There are a couple of ETFs out there (small AuM, elevated expense ratios >0.7%) that allow to get some exposure to rising carbon prices (notably in Europe):

- GRN

- KRBN

But there are not available on the platform. Any other alternatives?

There are a couple of ETFs out there (small AuM, elevated expense ratios >0.7%) that allow to get some exposure to rising carbon prices (notably in Europe):

But there are not available on the platform. Any other alternatives?

Are these UCITS ETFs?

Also a nice bump to the thread, in case anyone knows of alternatives and can answer your question ![]()

An article about an European Carbon ETP:

Another European Carbon ETP, this time a physical carbon EUAs ETP, not a futures-based carbon EUAs ETP, like the WisdomTree Carbon ETP.

Seems like a better option than WisdomTree Carbon despite a higher TER.

Offering physical redemption means CO2 also avoids some of the negatives associated with futures-based products, including counterparty risk, the cost of rolling contracts and underperformance when the market is in contango.

Will look into it. Thanks ![]()

Also the new carbon ETF is still small comparing to the older WisdomTree ETF. It will need some time to grow more.

HANetf has used to surprise us with interesting ETPs, like the crypro ETPs, “their” (HANetf is a white-label issuer) BTCE is the largest crypto (physical) ETP, at least in Europe.

After checking it out more thoroughly I really like this ETC. The best part is probably the fact that being a physically backed contract means every tonne of carbon you buy is removed from the available supply that can be bought by utilities and other obligated companies. This structure has the potential to have a flywheel effect driving price higher.

I have a position in WisdomTree Carbon, but I might consider switching. It’s available on IBKR so it shouldn’t be a problem adding it to Trading 212.

Yep. I also liked it, at first sight.

Because it could take sometime to be added in T212, I still didn’t do proper due diligence on it. And its new, the liquidity could be smaller than a more experienced ETP, meaning higher bid/ask spreads.

I’m also in WisdomTree Carbon, after seeing this new Carbon ETP, I thought the same, to switch in near future for the physical ETP, mainly because of the potential contango and counterpart risk of futures contracts. Although the WisdomTree has 2 counterparts, lowering that risk.

In the recent new US-domiciled crypto ETFs, a recurrent critic about it, is the type of ETFs, futures-based crypto ETFs, due to the risks mentioned above. And that the investors instead also prefer physical crypto ETFs. But like the Carbon ETPs, if there are only futures-based ETPs, the investors have to use it until the physical hit the markets. Now we have it, a physical carbon ETP.

Very interesting read, would love it if T212 added a product like this although liquidity has to be taken into account in comparison to the future based ETFs. Also 0.89% TER is really high, although not generally for an ETC for such a unique commodity.

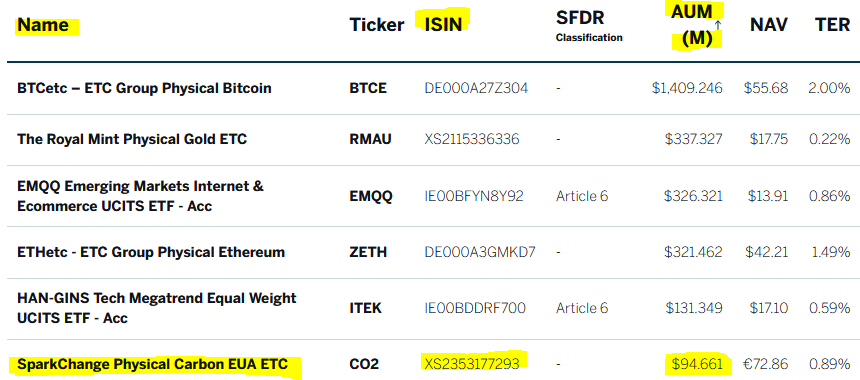

Good news, the SparkChange Physical Carbon EUA ETC is a success, it’s already the HANetf 6th largest ETP (ETFs/ETCs/ETNs), in short time.

In only 15 days since its launch, it already catched 82 million USD in AUM.

Maybe T212 could add this ETC and be one of the first brokers with a Physical Carbon ETC.

@David @Rumen @Y.M @S.K @MihailM @Bogi.H @B.E @Tony.V

| Exchange | Ticker | RIC | SEDOL | ISIN | Valoren | WKN | CCY | Listing Date |

|---|---|---|---|---|---|---|---|---|

| LSE | CO2 LN | CO2.L | BNLYQ70 | XS2353177293 | - | - | EUR | 04/11/2021 |

| LSE | CO2P LN | CO2P.L | BNLYQC5 | XS2353177293 | - | - | GBP | 04/11/2021 |

| LSE | CO2U LN | CO2U.L | BNLYQH0 | XS2353177293 | - | - | USD | 04/11/2021 |

P.S.: Maybe T212 should hire me for giving them business development ideas (e.g. crypto ETNs, carbon ETCs, thematic ETFs).

Thanks T212, for the USD-denominated version, could you also add the other 2 currency versions? ![]()

Btw, almost 100 million USD in AUM in only 3 weeks of existence:

MANY THANKS T212!!!

Boys and Girls, still fresh, all currency versions of the SparkChange Physical Carbon EUA ETC, already as fractional shares and in time for the Black Friday in the financial markets:

Now that it is listed in euros this might be one of the first non-ETF ETPs that I’m personally considering (main thing is the 0.89% expense ratio, yikes).

Yep, a 0.89% fee is something, but it’s “normal” for niche and new ETPs. Generally with more AUM, ETFs/ETPs tend to lower their fees, due to economies of scale and especially with the entry of new competitors.

For me that fee isn’t much shocking, I already saw more “simple” equity ETFs with also high fees.

Imagine that 0.89% is an inflation rate.

Will be interesting to see its correlations, with S&P 500 (although this is EUR exposed ETP, and S&P 500 USD denominated, so some FX divergence), European stocks (especially industrials and other heavy pollutants companies) oil, natural gas and other assets.

I will put only a few % on it, it will be part of my alternative asset allocation (commodities ETPs and crypto ETPs). A high risk/high return and small % portfolio weight, a kind of an “Exotic Pie”.

For environment activist investor, or an ESG-awareness investor, it could be a way of contributing to clean the environment/climate change and/or offset his portfolio carbon-footprint (“net-zero”).

its a high headline TER but when you add contango costs and financing rates for futures trackers like WisdomTree that adds another 2 to 2.5% fees. Also I generally prefer physical to synthetic. CO2 holds the EUAs in a wallet with the EU and not a swap with a bank like WT.

News about the HANetf SparkChange Physical Carbon EUA ETC:

Interesting article, could consider myself among those early investors I guess

@Etypsyno, Funny, today I saw the fees of a new equity ETF (theme: NFTs) that invests in stocks of blockchain, cryptos and NFTs companies (e.g. Coinbase, Cloudflare, Playboy), an ETF domiciled in US, and it has a total expense ratio (TER) of 0.65%.

And I remembered you telling that the 0.89% expense ratio was “impressive” for these exotic Physical Carbon ETP.

Next, I will want a Physical Scotch Whisky ETC and Physical Fine Wine ETC.

There is already an whisky actively managed fund, but it’s very alternative for me. I rather prefer a passive physical ETP/ETC:

https://thesinglemaltfund.com/en/

For Fine Wine there are several indexes widely accepted and that could be used by ETPs/ETCs: