Will T212 remain private forever? Would it make a difference to us as users?

I’m delighted to see Freetrade go under! I switched from them to T212 and have never looked back. But I will never forgive or forget their complete contempt for customers and the way they simply dismissed and ignored concerns. Final insult was the complete hash they made of my ISA transfer.

I feel very sorry for their staff and crowd funding investors just to be clear. But in typical Freetrade style, they’ve shown how little they care about either!

I agree, T212 service is second to none (so far so good).

Being a public company provides more transparency into how the company is performing. Public companies must disclose detailed information about their financial health, decision-making, leadership, and growth. This can be likened to a “glass building”—making it easier to assess their stability and operations.

Private companies, on the other hand, are not required to disclose as much information. This lack of transparency means that issues like poor management or financial instability may remain hidden until they become critical. It’s harder to gauge how financially sound or forward-thinking a private broker is, especially regarding long-term sustainability and protecting users’ interests.

Public companies often have better access to capital markets, which can allow them to invest in better services, more features, faster integrations, and improved infrastructure. However, this isn’t always guaranteed. Public companies also prioritise their shareholders, which can sometimes slow down decision-making or prevent them from adopting user-friendly changes, like reducing commissions, unless pressured by competition or market forces. In contrast, private companies may be more agile and willing to innovate quickly, allowing them to carve out niche markets or gain market share.

Feature- and service-wise, private brokers often target specific user needs and can excel in niche areas. Public companies tend to offer a broader range of features and services, but this can sometimes feel overwhelming or generalised.

When it comes to events like mergers, acquisitions, leadership changes, or potential sales, public companies are required to disclose such developments, often making it easier to anticipate and understand how these changes might affect your experience. Private companies, however, may choose to withhold or delay such disclosures, leaving users with less foresight into potential disruptions.

There are risks associated with entrusting your money to both public and private brokers. Transparency and resources might favor public companies, while innovation and personalised services may favor private ones.

Ultimately, it’s essential to evaluate brokers on a case-by-case basis. While generalisations can offer a starting point, they often overlook the nuances that make one broker a better fit than another for specific needs.

FT forum had sinking ship vibe way before the acquisition, not even SIPP and GILTS will slow down the mass transfer now.

Is this is just the beginning of a wave of larger scale mergers and acquisitions in the sector?

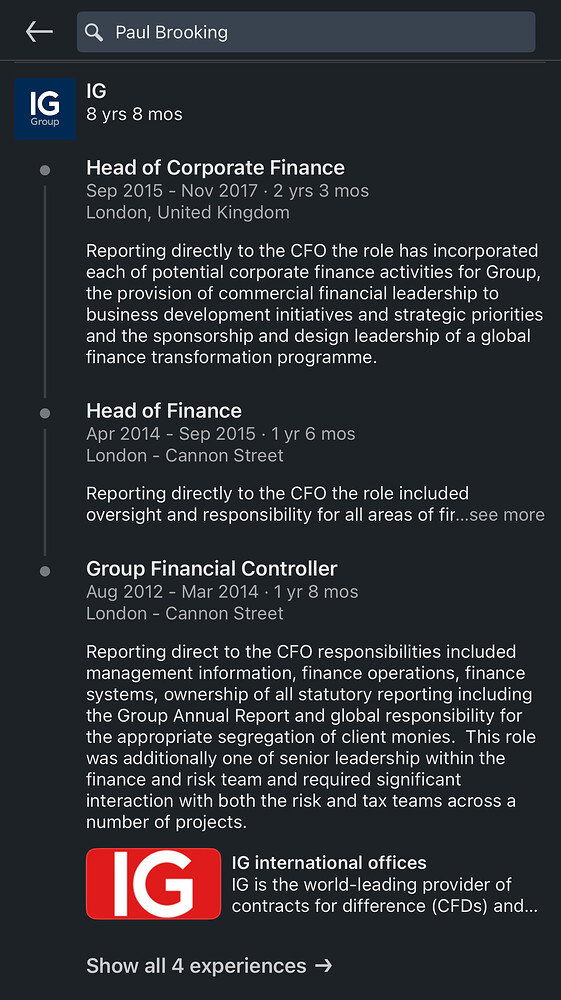

Nothing to see here… just that it’s coincidence that the CFO Freetrade hired to guide them through an IPO ends up guideline them into the hands of his former employer at mates rates. Marvellous!

The self-imposed Trojan horse ![]()

![]()

haha fantastic! Why am I not surprised.