Agreed – it’s not. But if a stock is marked down by the value of its dividend on its ex-day I’m not sure how collecting the div and reinvesting it later advances anything. Maybe I’m being thick(er than usual) here but I’m struggling to see how having a stock marked down by $2 and then being paid a $2 dividend makes any difference to anything. I now have $2 in free funds and $2 less in invested funds as far as I can tell. Dividend investing is too hard for me…

Same as having an infinite growth stock, as long as the company is growing - compounding will happen whether the company is investing in itself or paying out via dividend and you investing it back into the company.

However if I’ve reached a point in a position I’m comfortable with, with dividends I can then open a new position or grow an existing one further using the dividends from the position I don’t want to grow. Or if I have a phone bill but don’t want to sell part of my position somewhere I can use the dividends which will lower the growth but not the positions

It’s a side effect of owning good companies, frankly don’t know much of them without one , even if I ignore dividend, I usually circle back to same company list. Darn dividend.

But then you have same limitations to growth. People say P/E not good metrics for growth stock, then recession arrives and that same growth stock returns to PE 15ish.

Thus we can say dividend is irrelevant, but what is relevant is valuation. Which I see this days is largely ignored.

Yeah thanks. I get that you can do well with a div paying company. Just struggle to see how that has anything to do with the div.

Energy transfer wtf though surely they can’t maintain that dividend. It is tempting but what can they do to offset transition to green energy would they turn their infrastructure into hydrogen piping etc?

its not complicated really, it’s also worth noting that on the whole, dividend paying companies have done better over the longer term than their non-paying counterparts, so I can’t support any statement which goes along the lines of “dividends are irrelevant”.

they aren’t everything, but they are most certainly not irrelevant.

the point of dividend investment compounding is that while the price temporarily drops due to the payment being made, human sentiment is what determines the stock price in the first place. not some perfect market theory. the price dips, even without dividends paid, and you still own all the shares you owned before, but now you have some cash paid to you with which to purchase more of these now temporarily cheaper stocks, or to put towards another position that has dipped as a way to cost average down a little and capitalise on the next upswing.

the bold part is where the dividend investment approach differs from trying to compound and receive cash from growth stocks, in which you would have to whittle away your position as it grows in order to be paid, rather than growing it further. dividend stocks often still see growth, it’s just slower, but put together it will outperform typical growth stocks. for plenty, dividends show the most benefits towards those investing with retirement in mind, towards the later years of a portfolio plan as they are often a sign of a stable company and can be reasonably reliable ways to supplement a pension.

I find myself between dividend and value investing. I only really have dividend paying companies so I don’t need to time the market to succeed, but I want them as much as possible at good prices too.

![]()

Words to make this the minimum length.

Thanks. This is a pretty nice statement that confirms everything that I was previously thinking.

with just a growth stock that bounces up and down at the whims of the market:

“your cash” / “cost of share” = number of shares you can afford

put dividend into the mix and:

“your cash + dividend” / “cost of share minus dividend” = number of shares you can afford.

its doubly beneficial. but relies on you picking solid companies like any other approach.

the counter to this is if anybody knows the next Tesla, then investing in that early will prove the best investment method over any other approach LOL xD

Do you have a % range you aim for 3-7?

Below 3 pointless, above 7 too risky. In general…

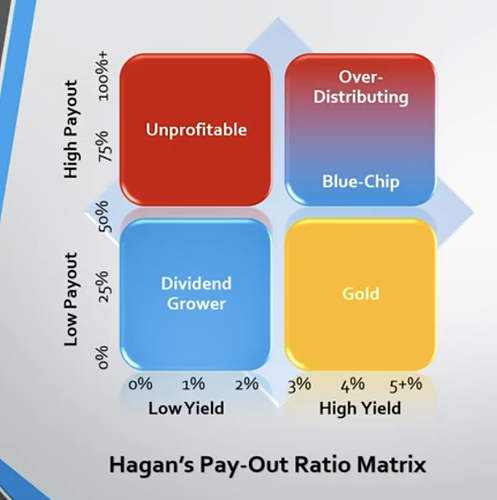

This is my Payout Ratio Matrix which makes it really easy to identify good dividend stocks. What you want depends on your time horizon. Under 10 years you’re wanting more blue chip, anything over that you’re probably better going towards dividend growth stocks like Visa, MasterCard, Apple etc.

You can see more about how to use it and examples here:

judge the company first and then assess whether they can afford the dividend. then decide if the dividend is large enough to be worthwhile compared to a similar stock with a better overall growth.

since I keep to a small list of hand selected companies I don’t bother to assign ratings against an arbitrary range. what I consider a 4, would to someone else be a 1 or a 6. but I don’t keep large reserves of cash on hand or invest in bonds/ ETFs in general. I have 2 specific ETFs for markets I can’t access yet and everything else is in stocks

Cavan’s graphic above is a nice way to assess good or poor choices. but doesn’t necessarily apply to REITs since they are required to pay out the majority of their income as dividends to avoid paying taxes on that money. REITs are also supposedly looking to outperform Tech sector this year xD

Thanks for pointing that out, I forgot to say. You need to look at funds from operations for REITs, payout ratio is nearly irrelevant

Dividend investing is human driven.

The same as growth really.

A lot of the ‘dividends are irrelevant’ theories are solely based on mathematics and don’t consider the real world application.

It’s much the same in growth where we have a book value and market cap that don’t match, all driven by human sentiment.

However, I would say that dividends in soemthing like ETFs are less useful because the dividend is not likely to be a driver.

I had not seen that payout ratio graphic before! That’s great!

Called Hagan’s for a reason

No way, the name didn’t click!

That’s awesome dude!

And now I realise that does has said it way better than I could

You can use it if you want, with reference. Think it is pretty cool! Would love to see it used by people tbh

You should call it Hagan’s wall