Where can I find the list of all leverage 3x products?

When I search for ZM, OXY, F etc I don’t get any results

Where can I find the list of all leverage 3x products?

When I search for ZM, OXY, F etc I don’t get any results

also there are many of these in XETRA and not oly on London exchange. Can these be added?

I don’t know it would be useful to have a definitive complete list.

However, have you tried doing a search on T212 for “leverage” or “3x” or “granite”. Also Granite and Leverage have their own website that list their products I think

Thanks this makes sense. These are all ETFs right? The max loss can be the invested amount I guess.

Obvious the exact terms may vary from one company to another but when I had a look a few months ago the companies have videos etc explaining the products. My understanding is, as you say, you can lose a max of what you invest but not more. The daily calculations mean that the price of the eft just gets smaller and smaller. The only problem being if the share price of the underlying company gaps down by a big amount (ie 33%) then the price of the eft will go to zero. However, because of the way that the daily calculations work the share price wouldn’t go to zero if the price of the company’s shares dropped by 3% per day for 20 days (the eft price would just get very small)

Yes on their webiste they mention: Magnify exposure without the need of a margin or CFD account.

Are those Xetra ETP more liquid than the original ones traded in London? ![]()

This type of ETP can have high Bid/Ask spread (besides their trading volume), specially due to the underlying asset (a volatile stock), or due to volatile markets and before the US markets open.

I don’t use them very much but I have used the Leverage and Granite products a bit. You do have to watch the spread but I use limit orders which helps to manage that. The “before the US markets open” isn’t a big issue now (I think). In part because the US trading starts well before the official market open and also because they are traded in London as well (eg Nvidia is 0R1I on LSIN). Essentially on the big companies there is global trading so the price is being set somewhere. What I have seen on some shares is the early morning trading in NY can drop the price perhaps shaking out stop loses and so if anything the leverage products can give a buying opportunity before the US market officially opens thus in some ways its giving extended hours trading. Yes watch the spread and also watch the price (ie the lower liquidity of the before hours trading can give an artificial price) but in general I think they are good products I just wish the spread was a little more aggresive

I’ve been using them .

My takeaways -

If the base stock is US, ( I think they pretty much all are) then do not buy or sell the ETPs when US is closed. The price will drift horribly and the spread may be TEN to TWENTY percent or more. If you want to buy during that time, buy a tiny quantity and see what you get. In the active period the spread is 1% or less.

That means effectively you only access them from 2:30 to 4:30 UK time.

There is a small overnight fee, and they recommend (I forget if it was Granite or one of the others) that you hold them for less than a day. Also they readjust from time to time, which means you might not quite get 3x.

Well, OK. but if you held QQQ5/5QQQ/5QQE ( top 100 tech shares, x 5) for 6 months,y you’d have cleared 230%. If you’d sold for a week or so when the index was falling you could have netted nearer 300%. (Now the 220 is ~180)

If you download and read the prospectus, basically they aren’t liable for anything. They might run out of money, etc!.

They are a handy way to try shorting a stock, but it has to move a lot to cover the spread.

The BOT told me that if you buy a -3x and and it becomes worthless which it would if the stock went up enough, ( about a third I guess) then the "position " would simply be closed, nobody chases you for the extra money. The BOT does lie, though…

If you just type “lever” in the search box you get a list.

They’re “from” an Irish company. So if you’re buying Chinese car stock that’s on the US exchange, in GBP, and the Irish are in there too, … with all the exchange fees and currency shifts,

Upshot is that long term you got less, to current date, from the GBP “p” versions. The other two currencies are close to each other. The look of the charts for the US$ versions is horrible - long shallow empty steps, so I use Euro versions and pay a one-off fx fee, as I hold them a while. Dollar versions have highest levers.

They won’t match each other or the mutiple you’re looking at, especially in the short term. The prices only update periodically, so for the same base stock, one can happen to be up on a day and another down.

I looked at some figures the other day. The Granite ones are a little less “leveraged” than the plain-named ones. For spreads, I haven’t checked. (I must)

I checked Nvidia, 100 techs (like qqq5) and XPEV; the differences were mostly consistent between Granite and not, and p / Euro / $

Over a year, you would have got 541% fron NVD3 , but a paltry 473% from 3LVP

The QQQ5 ($) got about 200% in the year I looked at. Not bad considering the use of 100 companies.

One I have now is for 3x Brent Crude , which has gone up about 5% in 2 days.

Nice summary.

Yes, I am interested in US stocks and I want to use these leverage ETFs to buy long leverage 3x or x2. E.g. NVDA as you said

I will keep in mind to only buy/sell the leveraged ETFs when the US marker is also open to reduce the spread. Nice point!

Moreover, I am in France so I usually buy the ETFs in EUR. I activated yesterday the multicurrency option and when I sell now whatever, I get the money in the original currency and not in my fiat. So, it might make sense for me to change now and start buying the ETFs in $ cyrrency so that I avoid convertions all the time. When I sell it the $ will go to my $ fiat trading 212 backet. I hope this is clear.

They’re “Irish” somewhere in there, so I can’t guess what internal exchanges there are. No idea!

I would have thought Euro would make sense to use.

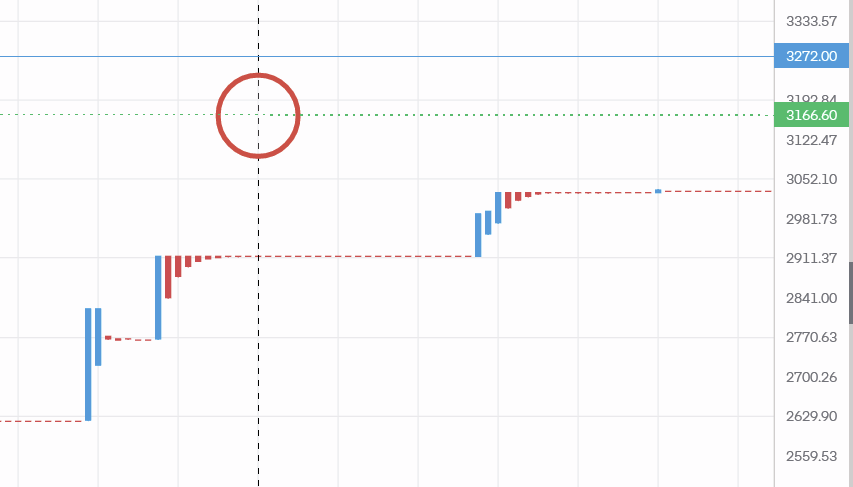

See what I mean about the $ version chart? It’s harder to see what the price is. Iirc it updates more slowly

I was just looking, and was for a moment befuddled by the chart . I’d typed in 3BLR instead of 3BRL

These charts are identical, obviously, aligned as best I could …

C ![]() nfusing.

nfusing.

Makes sense the price trend must be the same. small differences across these plots can be due to the currency exchange rate of the underlying asset - GBP vs underlying asset - EUR.

I don’t think it is confusing. One of the products is priced in $ and one in GBP (p) and they have different liquidity but have the same underlying price behaviour. If you change the scale so that you have 1d (1 day) then the charts are essentially identical (albeit I’m sure there will be some fx variation in there). All you are seeing is lack of liquidity affecting the transaction log of one chart when looking at a time resolution less than a day.

They are as near the same timeframe as I could get! I haven’t checked liquidity, have you?

It looks like the two have a different way of representing their prices?

It’s certainly harder to look at the dollar version and say what the price is.

Waiting for te open.

Watch ELF!

I bought some yesterday, but I’m not going to say what else I bought ![]()

![]()

The $ one is the top one and the price seems clear to me using standard candlesticks

Well yes, the top one’s easy to read. The bottom one less so, I think you’d agree.

They are aligned, I checked.

I had compared the stocks I mentioned above. not oil, but the point is clear I think.

Brent crude isn’t a US Stock, so that’s different. What’s the price in the lower one at 14:30?

Actually you wouldn’t see the price in either if you tried to trade a US stock before the US market opens, it wouldn’t be very near the trace at all!

I went back to look at one I tried. If the data is still live I’ll post it up.

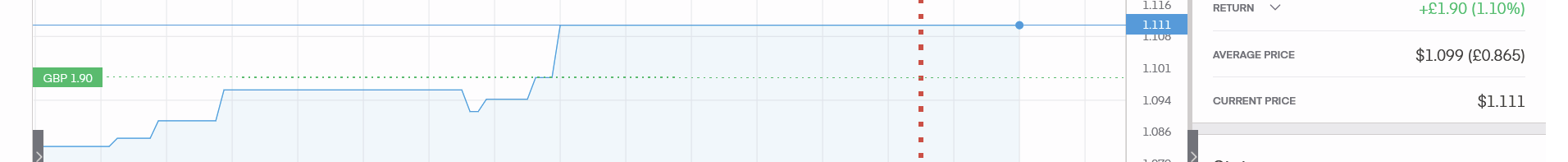

Found it. There’s the price I got.

It is NOT a US stock, but even so:

8.7% above the line, so a 17-18% spread.

Here’s one you may like to work out for me.

I need coffee.

I checked the spread at theLSE for 3NGL

1.11 1.10

OK that’s delayed

The chart just now - for a while - is a horizontal line at 1.11.

How come I bought at 1.099. ? at the dotty red line ![]()

I’m immediately showing a 1% profit.

Maybe I’ll try £100k…

what time scale is this? and where do you see this price? tradingview?

Market makers will often do trades off book that aren’t at the market bid/offer prices. I didn’t think T212 had direct access or went via market makers but trades are frequently done inside the published prices especially if a market maker has a large order that they want to fill. I nearly always use limit orders to avoid unexpected prices/spread but if you use a broker that gets a market quote it will generally be better than the market published price