Hi DD - There are a few free platforms out there. I use T212 as it was recommended to me. I really like it. Just keen to know the ETA of the feature being discussed here … or whether it will never be provided. I’d like to know either way so I can decide what I do from here. TY.

None of the fee free platforms have this feature by the way. Not even in stop or limit on their own.

Hello guys,

I’m looking for a bit of clarification regarding the trading process in my ''Invest" account; i’m looking to implement both a “stop loss” trigger and “limit” trigger to my stock selling order, but the only options are either one of the two that i’ve mentioned or “stop limit” in which the “limit” would only act as continuation to the “stop loss” order, as opposed to putting a higher “limit” order to sell my action.

Let’s i want to sell “xyz” which is currently at 25$, i would want to put my “limit” order on 30$ and my “stop loss” order at 20$. Is that feasable with only the “stop limit” order? or do i have to put both orders separatly? and if so, how do i proceed to do so since i’m only allowed to choose one?

Someone please clarify for me this issue as i’m currently stuck

Thanks a lot in advance.

Recently came across this platform and am currently in demo mode… I was going to join this platform but as I cannot attach a bracket order to easily set a take profit in the same setup as the order itself think i will give it a miss. FYI to any other seeking a simple take profit attached with the order… eToro allows you to do this.

Currently, you can’t set a Sell Stop (stop loss) and Sell Limit (profit take) for the same investment, but t212 plans to remove that limitation in the near future.

Yeah George said that a while back. I have asked when that feature is due but no reply on timescales as yet.

do you know when by anychance?

I have no idea, @George said “in the future”, but didn’t specify when.

cheers… @George if you can get your trading 212 platform integrated with tradingview charts and functionality that would be a better move. I understand that might be on the horizon - any date on that?

Hi guys,

Wonder of anyone can help…

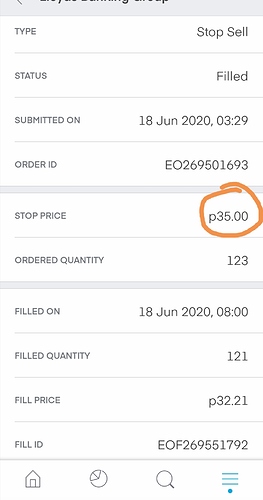

I’ve set the sell pice to be minimum of 35p

But it has sold for 32.25p… Why did this happen and my shares been sold as soon as the market opened?

If you have used a stop limit order. The stop price is a trigger price. When the stop price is triggered, the order will be executed as a limit order, that is the limit price.

If you want to sell for a specific price, just submit a limit order with the price you want to sell for.

When the market opened, the price was already lower than your stop price, so your shares were sold at the best offer at that time.

If you don’t want to sell below a specific price, use STOP LIMIT orders.

Dear fellow community members. As most of us know, a risk management is a crucial part of any type of trading. The thing which bothers me the most is that it seems the way how Trading212 trading platform is set up, is for new investors to lose money, quickly. How else can you please explain the fact, that it’s impossible to set a simple thing as “Stop loss”. I want an efficient tool/platform, which allows me to set STOP LOSS, meaning if it goes bellow X per share, SELL EVERYTHING. In the same time I want to be able to create Take profit at the same time when I place the order. I prefer a risk ratio of 1:2, take profit if it’s +200 USD, take loss if it’s -100 USD, simple as this. Unfortunately, as this basic/core feature isn’t provided, I don’t see how anyone can take your platform seriously? Maybe for Mike, or Jerry from Kent it’s okay when investing $10 per trade. How can you trade efficiently without being able to manage risk to protect your investment. As far as I can see, currently the biggest risk is Trading212 platform itself. Please fix this.

Is there a stoploss coming in future on invested account ? like in the CFD account ?

i hope it will come because it will help me very much !

Stop is a trigger, as many said above.

Ex. Stop Sell 15 --> When price hits 15 it converts to market order (aka it sells) at the best available price.

Limit is a wall. It limits the price range for a transaction.

Ex. Limit Sell 15 --> You sell for 15 or more ONLY. If not available, the order doesn’t happen.

So I think Stop Sell would be used as your Stop Loss

This can’t be set up straight away when placing an order. Also I can’t have Stop Sell + Limit Sell active at the same time for all my bought shares. I think Trading212 platform would only benefit from a more advanced feature, where you could set both Stop Sell and Limit Sell when the order is created, even maybe calculate risk for you (or make it configurable, like some sort of strategy 2:1 risk ratio).

For example ninjatrader (https://www.youtube.com/watch?v=Hqaaz-arKtY) provides this functionality. All you need to do is to select the entry point and it automatically calculates your take profit/stop loss based on your provided risk ratio.

Thanks for your reply, yes it seems Stop Sell is the same as my Stop Loss. https://www.wyattresearch.com/article/stop-loss-vs-stop-limit-order/

Example I have 30 shares and the current price per share is 10.

I set a Stop Limit Order

Stop Price 9

Limit Price 8

Now when the market opens the stock as already went down to 7. As a result it will not sell which is expected behavior.

Question

But what would happen? If the market rebounds and the price raises to 8.50, would it sell now?

If “yes” then that’s a big problem because i’ll lose any profit I am going to make, for example to stock price raises to 8.50… it means it is going up, the next increase from 8.50 could be 10 as well… so the question remains what would be the behavior?

They are so important concepts and they are not explained in a reasonable way.!

How is it not explained well enough?

The drop below 9 triggers the stop that places a limit order @ 8.

if the price then recovers over 8 it triggers the limit order and sells.

Thanks a lot for your help. I am sorry I am not a native English speaker, probably that’s why I didn’t understand it at first.