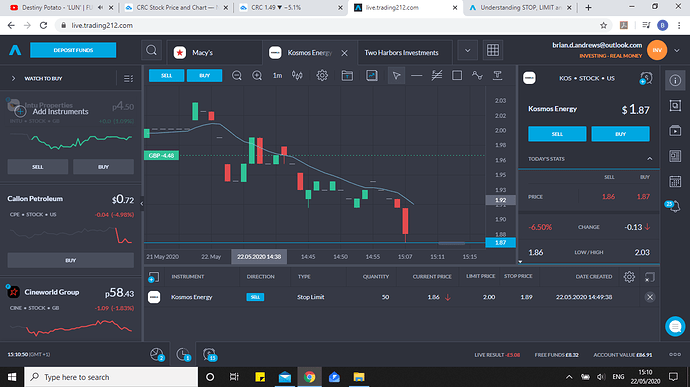

The app and desktop have descriptions when you click into the sections.

Basically a Market and Stop which will just try and get the best price.

A limit or a Stop limit allows you to specify the max or min price per share you are willing to do the deal at depending on buy/sell.

The limit can save in situations where the price say might blip temporarily above the trigger point, if you have it at give me the best price it might be higher/lower than what you wanted to either buy/sell at when the deal is done.

Buy

Market

Buy now at the best price you can get

Limit

Buy now only if the deal is at or below the price you specify

Stop

When the price reaches this amount, then buy at the best price you can get

Stop Limit

When the price reaches this amount, then buy only if the deal is at or below the price you specify

Sell

Market

Sell now at the best price you can get

Limit

Sell now only if the deal is at or above the price you specify

Stop

When the price reaches this amount, then sell at the best price you can get

Stop Limit

When the price reaches this amount, then sell only if the deal is at or above the price you specify