That’s why it’s important to remember about the risks. I have mostly boring stocks, just a little bit of high risk ones and my risk tolerance would never allow me to go all in on risky stocks.

Seems like gambling here without much, if any, research. Sorry to sound harsh. Your best bet might be to single out a few (proper companies) that do have potential and hold on to them and cut your losses on others.

If you bought last year there’s a chance you’ve bought at the top and could be a while for you to see a return in some of these if ever.

I wouldn’t be surprised if some run the risk of being delisted.

Please enlighten me dude?

Honestly you need to stop picking individual stocks. Some of these are hot trash. Others are merely very speculative.

If your time horizon is less than maybe 10 years in the stock market, either you are gambling or speculating…

I don’t think that’s entirely fair to say. What about people who are day or swing trading? I don’t think that counts as gambling or speculating. How about people who hold for 1 year, then reassess their position? Also not gambling or speculating. How about when you hold a stock and some highly undesirable event happens to either the company or the market a few weeks or months later which causes you to sell? I wouldn’t call that speculating or gambling either!

On a pure math basis, if your stocks are down 70% you need them to return more than 200% just to get to your initial investment.

For example: if you invested 100$ you have 30$ now. You need a 233% return on those 30$ to get to 100$ again.

Even the best companies in the world take years if not decades to return that so, even if your 30 stocks are the best companies in the world (very unlikely), you can expect a very slow recovery. Keep in mind that there’s no guarantee that those stocks won’t keep falling, 10, 20, 30% more.

My advice would be to sell out of those and put that money into Big Tech + S&P500 which have a probability next to 100% to have a positive return over the next decade. Also, if you are investing small sums (<1000$) 30 positions seem to be a too much “diversification”. God luck.

Statistically untrue. Big Tech - i.e. the big dogs quite regularly shuffle who the biggest companies are and once-unshakeable giants get disrupted and have prices either stagnate or reduce.

Not saying it will happen, just saying it has done lots of times.

Just saying what Buffet says. Lol.

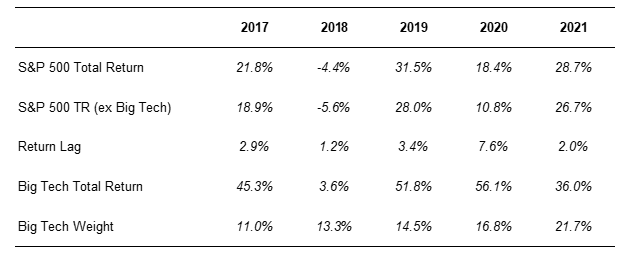

By “Big Tech” I’m referring to MSFT, AAPL, AMZN, and GOOG (also FB even though I don’t consider it to be as strong as the others). These companies are quite different from the biggest companies from decades ago. Big Tech are aggregators which own different businesses by themselves (you can look at each one of them as a concentrated technology ETF) and can easily acquire smaller competitors. A growing percentage of the aggregate market cap of all publicly listed companies is shifting toward these few dominant, very well researched and understood companies. The burden of underweighting these companies should only increase moving forward.

As is shown below, at least since 2017 (it has been happening since 2002), Big Tech has always outperformed the S&P500 by a wide margin and its weighting on the index is actually growing with no signs of decelerating.

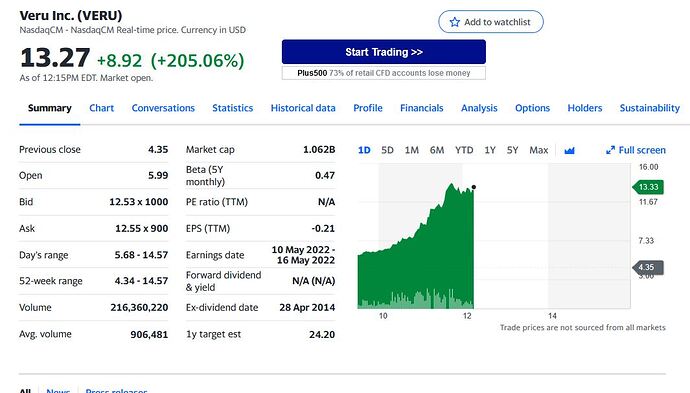

This is how BioTech stocks perform in just one day. when there is a new Catalyst. This is not triggered by P&D or short squeeze, but from successful COVID-19 drug trials. It just happened today.

If you are lucky with your Bio-tech stocks, you might get this spike and escape with some profit.

But keep in mind they might also go bankrupt if they are running out cash and they can not raise capital to fund their operation. They might also do a reverse split to avoid to get de-listed. For that reason it will need DD, DYOR of individual stock to make decision.

I’m guessing the caveat with that quote is that you’ve done your homework and know exactly what you’re holding.