Our campaign has made it into a national newspaper!

Sadly, paywalled. Can you summarise? =)

We have launched a campaign against this takeover, with over 300 private shareholders.

Between us, we have over 23 Million shares, and feel this is a low-ball offer.

More than 300 retail investors in Aim-listed Bacanora are calling on institutional investors to side with them, while urging the Government to back their efforts. The investors, which claim to control more than 5pc of Bacanora, have described the offer as “derisory”.

Bacanora has received a £190m bid from its largest shareholder, China’s Ganfeng Lithium, one of the world’s largest producers of the material. Ganfeng has a 17.5pc stake in Bacanora, which it plans to increase to 30pc.

The Chinese business took a stake in Bacanora’s Sonora lithium mine in Mexico three years ago.

Ganfeng’s non-binding offer of 67.5p per share values Bacanora at more than £250m, a premium of more than 50pc.

Source: The OP link.

The 300+ retail investors are only ~5%…

It’s a Canadian Micro Cap ($207M) company that was listed in LSE (AIM) and that have a joint-venture lithium mine in Mexico with the same Chinese shareholder that wants to buy more shares on Bancora, from actual 17.5% to 30% (buy more 12.5 per cent). It seems that the Mexican Government have some interest in the nationalization of the mine.

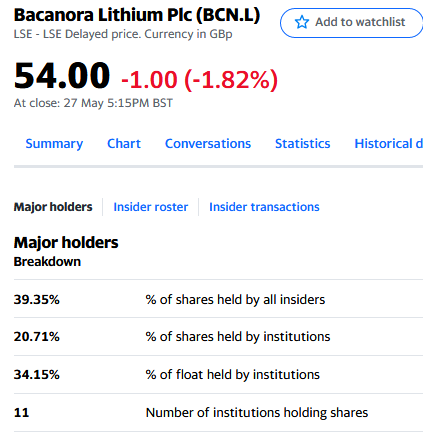

The existing Chinese shareholder could increase its stake by buying the others insiders’ stake (institutional or the board’s stock options) → The most probable scenario, see below :

→ And if we do the total, the institutional and insiders represent 94.21%, that leaves 5.79% for retail investors. Take your own conclusions:

We’re at 6.5% now. And growing.

Once they breach 30%, they have to launch a full takeover. We’re counting on our numbers growing, and seeing other private shareholders vote against this - Whether we know them or not.

In the meantime, we’ll keep pushing.