I’ve been looking for some cheap investments while COVID-19 has the market in a slump. Ideally trying to find stocks which hadn’t returned to their original potential, and appear to be cheaply valued. Potentially Reach (RCH) on the London Stock Exchange meets that criteria.

Who Are Reach?

If you haven’t heard of the name before, don’t worry. Reach is a collection of UK print and digital newspapers and magazines, some focusing on national news, others on gossip and celebrates, and a few on hyper-localised news. They are the largest commercial national and regional news publisher in the UK, with over 150 national and regional multichannel brands including the Mirror, Express, Star, OK!, New!, Daily Record, Manchester Evening News, Liverpool Echo, WalesOnline, MyLondon and BelfastLive.

Source: Reach 2019 Annual Report

You might think a print-based company would be the last investment you would want to make when you think about the world in five or ten years. Keep in mind, in December 2019, Reach sold 40m newspapers and reached a digital audience of over 47m people in the UK, their digital offerings are growing.

With a new CEO who joined back in August 2019, a period of operational focus after buying the Daily Express and Daily Star, and now with COVID-19 there are a lot of headwinds that Reach are battling.

As this is a UK listed company, it’s harder for us to get up to date information, as the fundamentals update bi-annually. Thankfully we have seen a trading update which we can talk about later on.

How Does Reach Make Money?

Print has been in decline for several years now, with that in mind it’s important to make sure Reach is actively looking to diversify their income.

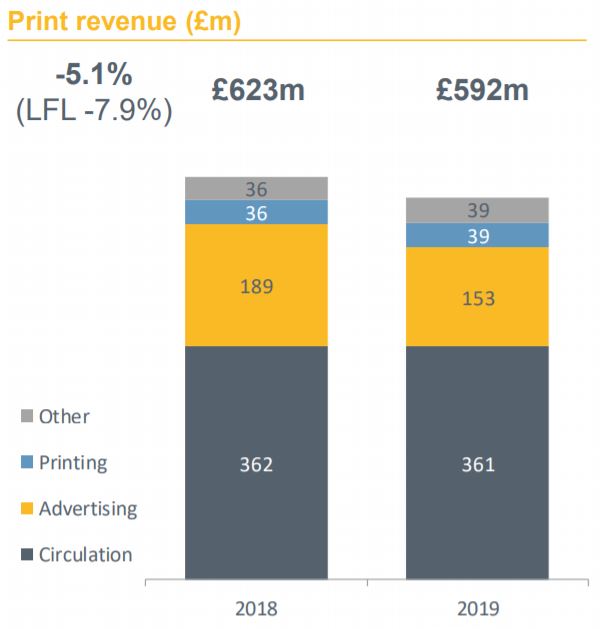

Source: Reach 2019 Presentation

As we can see, they are expanding the digital revenue but it is massively behind print, and print is declining faster than digital can replace it.

Source: Reach 2019 Presentation

Looking at the breakdown for print it’s the advertising which is in decline above everything else. As advertisers move to more holistic, trackable, and cheaper methods it’s hitting Reach’s top-line revenue.

That isn’t to say Reach doesn’t love advertisers. The digital offering is the new powerhouse in terms of what can be done for advertisers with customers data.

Source: Reach 2019 Presentation

The digital aspects of Reach have been tailored to build up a complete picture of you across all their brands. The more data they collect, the higher fee they can charge for more targetted advertising. Reach has already made this a priority within their traditional print outlets to ensure they have a strong digital offering. The vast expanse of outlets and the hyper-local solutions drastically increases the odds of Reach being able to offer you up to advertisers.

Is Reach Fundamentally Strong?

Reach has brought up other brands, currently going through an integration, and digitally upscaling their efforts, which all sounds very expensive.

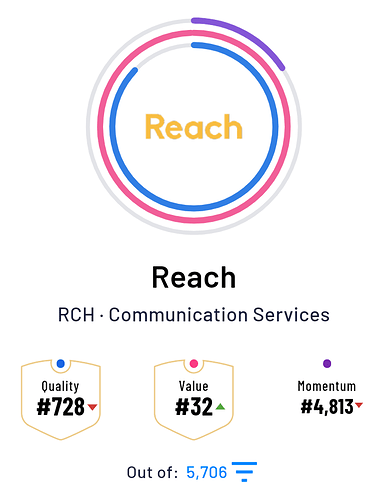

Source: Genuine Impact

I was taken back and impressed to find some pretty sable fundamentals for Reach. Even compared to investments in the US, Reach was showing up as a cheap buy and had a solid balance sheet behind it.

Naturally, we want to dig into the raw data to make sure we understand the business a bit more.

Carrying on with the finances, let’s talk about the revenue again. Bringing in £702.5m worth of revenue is a pretty decent figure, as we know it’s what happens next which matters.

The gross margin is not as high as I normally like, 47.23% means you are losing half your revenue just to make any money at all. The print business is an expensive one to be in, and this is something Reach is looking at reducing. With the two new brands on board, there are more savings to be made there operationally speaking.

Where I start getting impressed is the profit margin of 13.42%. This dipped in 2018, due to buying the other brands.

We also see a return on assets of 6.60%, and a solid return on equity of 15.81%. One thing Reach gets right is putting money to good use.

Seeing how Reach just brought some new brands I wanted to check out the debt to see if there were any clear red flags.

Source: Wallmine

Debt to assets of 52% is higher than it needs to be but not uncomfortably so. We do know they have drawn down an additional £25m in debt to protect their cash during COVID-19, considering the current debt is £693.2m this isn’t a dramatic change. They also have £35m left on their credit facility if they need it.

Speaking of debt, I wanted to have a closer look at the balance sheet. In terms of cash, we have £20m plus £102.2m in net receivables. Then things get weird. £224.9m in equipment (told you printing was expensive) and £810m of intangible assets. These very high intangible assets could well be the value of the “brands” rather than anything you should be taking debt against. When you consider this, the debt to assets percentage isn’t as attractive. Removing £810m from the assets brings it down to £518.6m, and suddenly the debt looks a bit more serious.

While COVID-19 has stalled many dividend payouts, including for Reach, it’s worth mentioning as when this dividend returns it’s one to hold onto. An 8.34% dividend yield which has grown for the last four years, it’s suspended right now but will be returning. The payout ratio is only 20.79% meaning as the price increases the yield will drop again. Though keeping 80% of the profits does allow Reach to keep building a war chest and hopefully chip away at that debt.

Is This A Value Purchase?

The price has seen a COVID-19 related drop, and we have had some tame news about revenues being down but digital being up. We already know that a hit to print is a meaningful cut against the top-line revenue.

Source: Google Finance

The price still hasn’t recovered, and until the UK is back to work it’s unlikely to. Reach won’t be able to replace the missing revenue, but they can speed up their digitalisation.

It’s worth noting the high intangible assets will inflate any figures for value hunters, and Reach has used this to help them raise more debt. Assuming we think these assets do hold their value, what does that mean for Reach’s numbers?

A price to earnings of 2.55x is extremely attractive compared to the rest of the UK market, this is being boosted by a strong EPS of 31.50x. Looking elsewhere the numbers are much lower. Enterprise value to sales of 0.32x, and a price to book of 0.39x.

This gives us some nice headway in terms of the assets they hold, but it comes down to your belief in their balance sheet and how successfully will they bounce back.

What About The Future?

Reach-ing into the future the sell-side analysts are optimistic but not sold. In terms of the share price growth, the expectation is recovery is incoming. For a one year position, this makes Reach very interesting.

Source: Genuine Impact

To turn this growth into hard numbers, we are looking at a target price of £1.25~ versus the current price of £0.80~, a 55%+ increase. However, this is not enough to push all analysts into a buy position.

Source: Genuine Impact

With no clue about when the UK will return to normal, and will the UK buy as many papers again, this is a dark cloud above the share price.

Analysts are moving into a more defensive position to wait and see, for either the momentum to pick back up again or until Reach announces more promising news in future trading updates.

Summary Pros

- A massive brand which is focused on improving its operational ability

- Big focus on going digital and expanding their offering

- The promise of higher dividends in the future

- Undervalued still because of COVID-19 and the print business

Summary Cons

- No clue about the success of print post COVID-19

- The assets and debt against them is questionable

- After spending so much money having COVID-19 means another profit slowdown

- Will advertisers come back and what does advertising look like right now

My Thoughts?

It’s an old business which is trying to go digital but it still makes so much money through print. Will COVID-19 make them change their ways and drive forward with more digital innovation?

Long term the debt can get out of control, and being the biggest doesn’t mean being the best. They have a strong digital appeal but they aren’t making the most of it.

As a long term investment, it comes down to what they can do digitally and turning digital into a meaningful revenue stream.

Short term if you are hopefully about the UK returning to “normal” then we can expect a spike with more people returning to work. If working from home becomes the new normal, there will be long term damage to Reach.

What do you think? Is this a hopeful buy based on the UK returning to work, or do they have more to offer on the digital side? Or maybe they are an old company which has seen their day?

Let me know what you think, I always welcome any feedback!

Thanks for reading and stay safe.

.

. .

.