And for anyone interested in Funds as well:

Nice. Thank you. 20 letters

Interesting, I’m very tempted to switch my Sipp mutual funds out for investment trusts as and when equivalents are on offer at a discount.

For me, they have a fair few advantages from better governance and the closed structure to gearing and suitability for private equity.

Another big one is there are hundreds of ITs compared to many thousands of funds, which makes research an awful lot easier.

When I get a mo, I’ll go through the AIC website and request any missing from T212 although I think most of the popular ones are available now.

My pension is something I generally dont touch, but I get your view.

Did folk know some Trusts almost have mutual fund equivalents, or vice versa depending how you look at it?

Think of it as the investment trust/mutual fund is simply a wrapper for a product. They’re not always identical because the advantage of the trust is that it has a fixed pool of capital, so it can hold less liquid(private) investments long term.

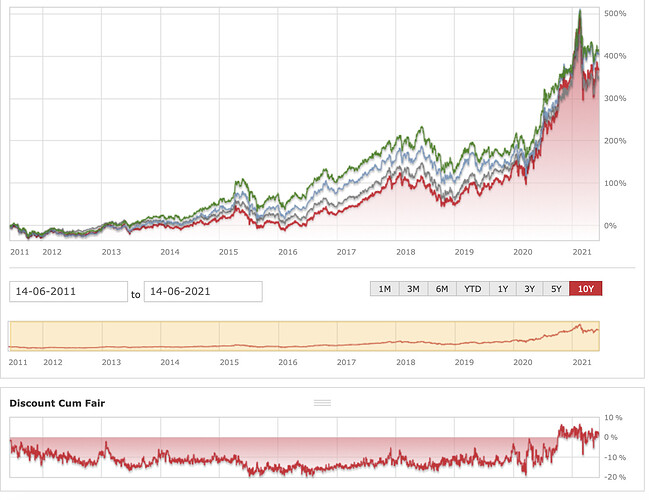

Maybe not the best example, but much and a much similar performance between two similar strategies, right up until early 2020. Early investors could have taken advantage of a nice discount to par up until that point too.

Its worth looking at the management team/strategy and fees in choosing between IT and Mutual Fund. I would generally buy in to the cheaper of the two, based on the IT premium/discount. In a good market, I would buy mutual fund, and vice versa as the IT prices have a lot more sentiment impacting their unit price rather than actual market value on the day.

Yeah, I try not to tinker with my pension at all costs. Mine’s with HL and the fees are capped for exchange-traded securities, so it would make sense to switch.

If, for example, PHI moves to a discount, it’s tempting to sell BG Pacific, which is broadly similar, to buy PHI. Conversly, you could sell BGCG when it’s at a significant premium to buy BG China.

As you say, probably best to leave it alone though. Funds are more conducive to a ‘set and forget’ strategy as you can’t buy and sell in an instant.

Worth considering depending on where you hold your wrapper, definitely, as many providers don’t charge for one type of product (typically funds) but do for others (typically exchange-traded).