RIVN not falling as fast as I thought it would either. Not touching this at anywhere near the current price. Might think about it when it hits sub-$20.

When it drops to around $60, I will bite. This will bring its market cap to aroud $60b, quite similar to its compatitors.

Also, the original RIVN IPO price was prepared around $57-$62 but when about to go public they raised it up to $78 in anticipation that there is a higher demand.

RIVN is not NKLA as Rivian already has a ready EV Product. Rivian R1S and R1T customers already get their delivery windows: as early as March 2022.

Also Amazon has ordered 100.000 EVs.

I’ll bite at about $6

I missed the IPO at 78$ but I managed to buy last week at 93$

Good one. Wish you luck with that …

Touching the $78 mark and still holding my wallet tight

Just another 72$ down and it’ll be worth a punt.

Once fall below $60 I will bite

The topic in retrospective: The title should be “Rivian (RIVN) about to go public hopefully it wouldn’t have been available on T212…”

Once fall below $60 I will bite

Anyone biting @ $44 ![]()

I did. I have started it since $55 a while ago. Today I manage to add one stock it at $44.50. I only buy 1 stock at a time ![]()

![]() .

.

The Regulation about City Air Quality, clean energy is the constant driving force for EV sector. But with the price of Oil and Gas skyrocketing, the use of and EV demand make more sense. Not to mention the government incentive to move to this direction.

For people who do not want to nibble, they might want to wait until 10-03-2022 where RIVN (Rivian) will be reporting earning.

Damn, is Rivian dragging Amazon with it?

No record profits expected next quarter. ![]()

Rivian Automotive Inc Cl A (RIVN) reported a 4th Quarter December 2021

Result MISSES

Loss of $2.43 per share on revenue of $54.0 million. The consensus estimate was a loss of $1.58 per share on revenue of $61.7 million. The Earnings Whisper number was for a loss of $1.65 per share.

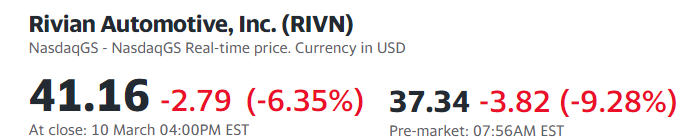

As A result of earning the stock fell 9.28% Pre market

Time to load the boat?? Remember about the current sentiment against high Growth, unprofitable business/Stock

To me I will use the rule of three days to search for another bottom before adding it 1-2 more stock. Of course I also use technical indicators

31 more dollars to go.

Analysts comment following RIVN (Rivian) reporting earning. The main reason of the stock to fall after reporting Q$ earning is the future guidance, due to supply chain problem and chip (semi conductor) shortage.

It’s looking tempting to open a position in Rivian, any thoughts?

Decided to bite at $30 ![]()

At the current $12 to think there was a time it traded for $128 per pop

For some reason, I think 12$ is still high for this stock ![]()