Cavan, don’t want to sound arrogant but that is not true.

Even with your definition:

T212 will take percentage (0.15%) of your trade value at very regular intervals (each transaction, buy, sell and CAs). This is a fee and commission!

Commissions are not for example taking a percentage of one’s account value at a regular interval say monthly, quarterly or yearly. That is called account management fee, custody fee, TER or even a service fee!!

It’s on our own yes! But this is 2021 and people will want to almost exclusively even, invest in popular and meme stocks, which just happen to be US stocks, (which is not a T212 target customer market) and hence are forced to pay this FX fee multiple times!

Take yourself in this case, you are balls deep in Tesla, you’ll have to pay the FX fee soon. Even if TSLA splits or issues dividends or you sell or buy more!

Truth is hard to believe sometimes, but it is indeed free of cost for them them to place FX trades with IBKR.

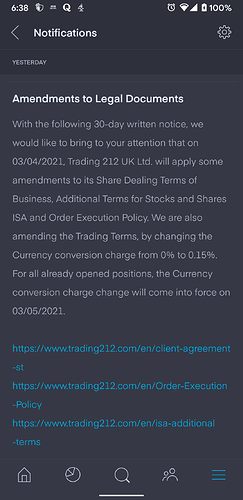

NOPE! That is no longer the case, they are not what they used to be and say they are. As the OP correctly pointed out, they are no longer commission free, fee free or limit free.

And big brokers, I know, have long left commissions in the past. I am not just talking about Robinhood or Webull etc. Think Charles Schwab, TD Ameritrade, e*Trade, FirsTrade and so many more.