Even most of the US Stocks (large cap) are listed in Europe (frankfurt).

The market is defined as the S&P500 - when people want to beat the market, that’s what they’re refering too.

If they want to beat the UK it’s the FTSE, the German markets it’s the DAX, the Japanese it’s the Nikkei.

But if you want to beat the market, it’s the S&P 500.

Institution-wise, the market is defined as a All-World index.

Only US YT Finance and retail who learned from US YT Finance generalise the S&P 500 to be the default “market”.

I’d prefer to use that too. It’s usually a couple of percentage points lower!

Yeah, again, institution-wise, when talking about returns of any security/portfolio, we talk about excess returns, in excess of the risk-free rate.

Hence a couple percentage lower indeed ![]()

the drop seem not to be finished…

Time to short Nasdaq I’m on it

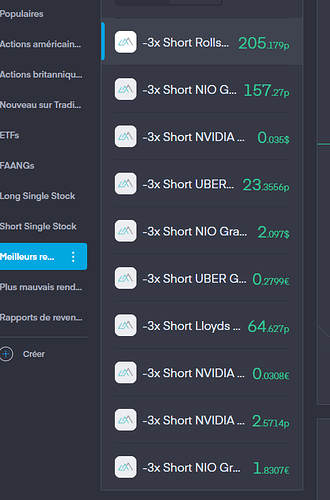

If “FANG” and all derivatives were not part of Nasdaq I would 3x short this and sleep well at night

You can short 3x Nasdaq and keep open 3x FAANG ![]()

I mean keep open 3x Long Nasdaq ![]()

French CAC40 start the day with -3% ![]()

Some analyst expect -40% on the market this year…

I’m truly worried, not just for the markets, but for our wealth being. I thought we got over old war mentality, but it seems there’s still someone there that thinks war is the only solution…

Will this recover? Hopefully soon.

I really hope you meant well being!

looool, just realised my mistake, what a meme situation ![]()

Borderline WWIII, When the bear is taking physical territory, Nasdaq fights off the ‘bear’ territory.

I don’t get it, I hate Nasdaq lolz at me.

Did someone else than me use the Bitcoin price during night and week-end to anticipate EU Stock market opening ?

What pattern did you discover? ![]()

Swift in play = market volatility, so what’s the play for Monday 28th?