Does anyone hold this / have any thoughts on the current entry level?

https://www.theaic.co.uk/companydata/0P0001KU9Z

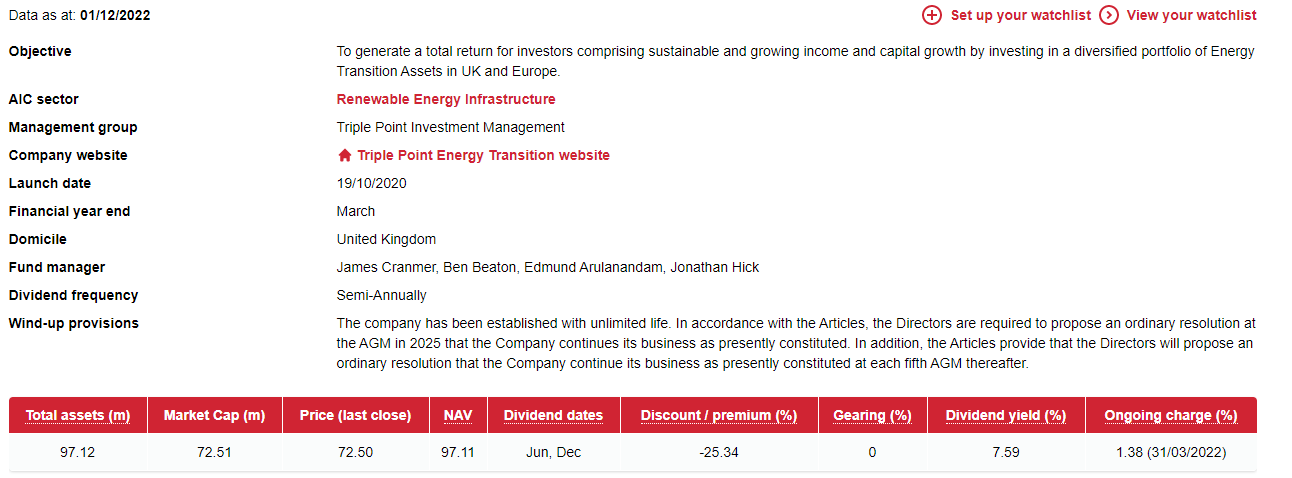

As far as I can see, it’s a fairly new VCT that has approx £100m AUM, and the investment team have a further pool of £500m targeted, so we may see further shares issued to raise the capital for this. This is good news as shows growth and would help with diversity.

As I see it, it’s a fairly defensive energy investment company, that sadly is fairly non transparent in its holdings.

Their idea is good. 3.6 TWH of wind energy was wasted last year, enough to supply power to a million homes a year. And that’s not the only issue with energy supply in ![]()

They invest in a variety of energy solutions, and the last set of accounts were as at March 2022, yet the share price has not taken off like other energy trusts / assets.

The current energy prices should give a strong tailwind, along with a 10% discount to NAV, but their last published dividend cover was poor at 0.14% and they are forecasting to return 7-8% by 2023.

https://www.tpenergytransition.com/investors/72/

So with a 10% discount at present to AUM, my plan is to research what they currently hold and what they expect to produce/store power wise and compare energy prices between peak/low times to forecast current / future revenue if things return to previous levels.

The team behind this have a decent track record and the fees are fairly low for a 100m trust. It could prove a decent income generator at current prices I think with a current yield of around 6%, with room for further capital and income growth.