There is interest on debt. I disagree, you cannot just push it over to next generation.

At some point interest will become unbearable.

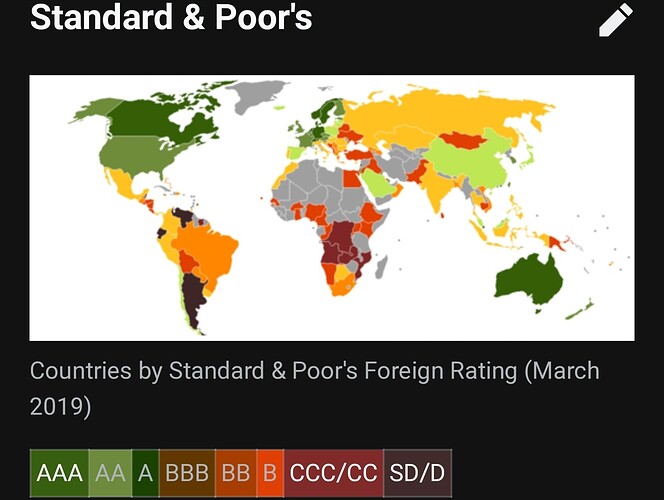

Ask Greece and Italy

The American banking system is skilled at doing that, every 8 to 10 years there’s a market crash that acts like some kind of reset, greece and italy are a completely different scenario first of all they don’t have full control of their currency and they’re debt is not as attractive as the US, they have been pushing that debt to the next generation for decades it’s almost like a normal thing, if you think the world will crumble because of debt then you might really be shocked when those economies begin to grow rocket speed in the coming years, there has never been enough money printed to pay all the debt in the world, we run this planet based on credit that is the system so unless the world is about to end I seriously doubt that the burden of debt will crush us, the worst that can happen is that another market crash is triggered in which governments and central bank will take part in a beautiful de-levraging, watch how the economic machine works by ray dalio and some other video about the credit and the economy, the worst scenario especially for the US is another market crash which typically last for about 2 years and then another 8 to 10yr massive growth and bull run

I would consider the EU to be the next big crash/correction, it will be interesting to see what Germany does if Italy does default on its debt and exit the EU.

It’s all well and good increasing German and northern EU house prices to give back what hasn’t been paid back by Southern Europe, until the “actual” debt is paid there is a real risk to Europe as a whole and then unfortunately the whole world.

This would be the largest crash in history

@Lenos1980 Italy’s economy is big and should they default not sure if Germany & France can afford to bail them out.

UK is out remember?

Still in it if the EU crashes out again.

Why do you think Germany is seeing an exponential growth in house prices? They can’t even self regulate it as the whole of the EU would have to be on the same interest rate.

This is the issue with the EU no economy can control its own finances so when one side is in trouble the other is booming.

Yes I wonder if one of the few positives to brexit (i voted remain) is if there is financial crisis in EU? or are we no better sheltered from it than before?

I don’t think it will change anything the world will crash when the EU does, the only advantage we’ve ever held on to is our currency

There are three ways to reduce debt: inflation, taxes or war.

One might also imagine some sort of perpetual debt system.

Nobody wants war, inflation in ageing countries with mature economies seems difficult. I don’t think more taxes would be welcomed by people so we gonna keep digging the debt blackhole. Free money for all, no need to repay anything. A bit like states right now but for everybody

There isn’t no free money. Someone will pay for it.

Low interest rate is a phenomenon that transfers money from the savings/creditor to the consumption/debtor.

Inflation is like a hidden-tax, it transfers money from the private sector to the public sector.

So the Central Banks QEs and printing money, will help the debtors at creditors cost.

And helps the zombies companies and zombies states to survive. Makes the economic growth to be very low, as it creates incentives to the zombie companies to stay alive.

@RLX thank you

I am aware that a low growth is good because the environment has limited resources.

Yet I’d the economies are growing people then to forget this is compounding actually l, hence the economy doubles every so many years. So a low growth of 0.5% or less is welcomed!

This guy wrote a book on it!

Circular economy and sustainable economics are some of the most relevant areas of my field of work as an economist. I also started to implement ESG factors in my investment strategies.

If you like ESG and climate matters, some book suggestions on a today FT article:

https://www.ft.com/content/e21c10e9-3577-43b2-adbc-68b73aa99c98

@Tedk99 Free money or even money your getting paid to borrow. The money comes from central banks and those institutions can lend as much as they want and don’t really care if they don’t get the money back (those are the words of Gita Gopinath, head of IMF).

Weird thing is regardless of the money they lend, the system seems to be stuck. It doesn’t work… It’s a bit like we’ve reached some sort of limit in our ability (or maybe willingness) to imagine new ways to move forward.

Even tech is affected. Did you know that out of 1 trillion dollars invested in digitalization by the fortune 500 companies 700 billions were invested in projects that eventually ended up dead because those companies had no idea how to disrupt their business models ?

That’s probably the reason why they are drowning the system in cash. Nothing evolves anymore and if they didn’t do so, we’d have a tremendous wave of unemployment and revolutions everywhere. I’m pretty sure this is also the reason why some advocate for a universal basic income…

@RLX You just said you were an economist. I’d like you to tell me something. Why don’t we see any inflation even though the system has been drown in “free money”? That’s something I don’t understand. Is it ageing population, the fact that we have already everything we need… ?

@Enlil

No inflation, I would need to to a proper investigation to fully understand the matter.

Rather than saying other things.

But yes you are correct, it’s funny how the fed can print or now digital money with no inflation repercussion but if Romania or Croatia would do it, they will get inflation straight away.

Yes the model is broken, capitalism is what it is.

That what I thought too but now I’m wondering if it’s not deeper than that and if the problem is not modernity as a whole. It brought us so much yet when I look around me I see drained people barely able to find the will to move forward. It’s like massive burnout or something… Rich (old) people don’t realize it yet but they will eventually.

Ageing populations in the developed countries for me is one of the main reasons of the descending trend of the inflation rate on these countries.

There some mainstream economic theories about the people life cycles and their consumption/savings way of living. Simply put, the young people consumes and put a part of their income for retirement. When they retire they mainly consume.

Japan is a case study about “free money” and low inflation rate for decades. Even the recent Abenomics with aggressive ease monetary policy and fiscal policy didn’t manage to put Japan in sustainable 2% inflation rate.

There is some concern that Europe and US are next in the “Japanization” economy.

Japan entered in a liquidity trap, they even asked for help from the economist Paul Krugman (Economics Nobel Prize).

If you want to know more about the “Japanization”, liquidity traps, monetary policy (Monetary Economics), an excellent documentary based on work of Richard Werner, an economist that is the father of Quantitative Easing (QE), adopted in Japan, and later adopted also in US by the Fed, in Euro Area by the ECB and in UK by BoE, besides other Central Banks:

And I’m a critic about the way is calculated the inflation rate. For me, “free money” is not going mainly to the real economy as it was in the past, for me, the inflation is on the financial markets (stocks and cryptos mainly).

Last years, sounds familiar with dot.com and pre-global financial crisis periods, lots of “free money”, extreme low interest rates, and exponential growth in the financial asset prices (also on some real estate asset prices).

Thank for the reply, @RLX.

I’m gonna watch that documentary right after this reply.

That funny. I thought older people consumed less. You know, they have their house already, they’ve got most of the things they need, they eat a soup in the entire day, they don’t go out that much, they save for the grand-children, etc… Guess I don’t have an accurate picture of our elders way of life ![]()

So why are wages so low in Japan if they print so much. As an economist wouldn’t you say that give people money to consume would be a good way to push prices up ? You know, people get paid more, they consume more, so prices can go up, so they ask for better wages, then the prices can go up again, etc…

Would you say it’s because there aren’t any investment opportunities in the real economy ?

Thx

Yes, the older people consume less than the younger. What I want to mean, was that the older people mainly consume and saves very few money (if they save anything) comparing when they were young.

Even with more active old people, cruises, travels, other leisure activities, also the higher expenditures in health, their expenses are lower than when were in active young age.

The old people don’t buy new cars or houses or other high ticket assets with the same rhythm as when they were younger. They also don’t spend so much on clothes and apparel or luxury items as before.

So why are wages so low in Japan if they print so much. As an economist wouldn’t you say that give people money to consume would be a good way to push prices up ? You know, people get paid more, they consume more, so prices can go up, so they ask for better wages, then the prices can go up again, etc…

With more money, people tend to spent more money. But there is a decreasing marginal consumption (utility) propensity:

E.g. imagine you receive wage x, and eat 1 steak or 1 lobster every week. Than you get a wage x+x (2x), now you could eat 2 steaks/lobsters per week, but imagine that your income goes to the 5x, would you eat 5 steaks/lobsters per week? (Of course, you consume other things, but using “Ceteris paribus” principle.)

You could buy a yacht/jet, but with 2x the income, would buy 2 yachts/jets? Ok, 2 yachts and 2 jets (1 of each as a backup), but if it’s a 3x income?

Bottom-line, more income = more consumption + more savings.

This brings to another aspect, the richer people will consume less when they fulfill their needs (utility in economic words) and saves more money that will enrich them more…

Income inequality rising will bring more income for the people with savings and their consumption isn’t infinite.