Since inception in March 2021, 3x GAFAM ETP did +84% performance

I did a sondage on Twitter

An article about the GAFAM or FAAMG (Sep 26, 2020):

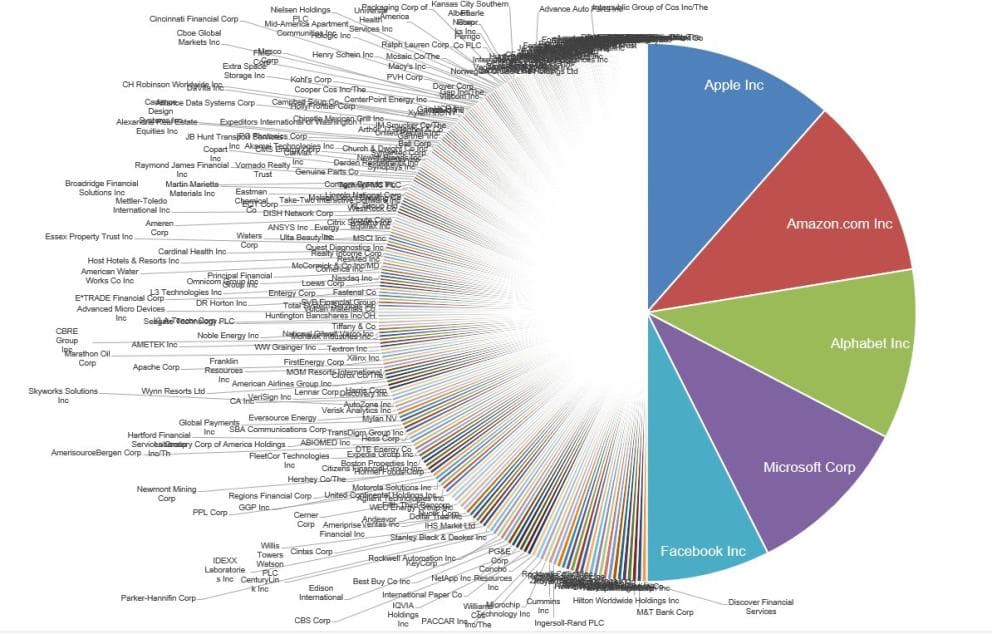

Facebook, Amazon AMZN +0.7%, Apple AAPL +2.6%, Microsoft MSFT +0.8% and Google GOOGL +1.3%/Alphabet. This is due to their accounting for about 25% of the value of the S&P 500 Index

He also estimates that since the end of 2017 with the S&P 500 up 23%, that FAAMG accounts for about 72% of that performance. And that 15 companies in the Index account for approximately 96% of the gain. Which means the other 485 company’s stock performances are essentially flat.

And from the end of 2018 O’Rourke calculates that the index is up 32% and FAAMG is responsible for half of it.

thanks for sharing it, I will share it also on Twitter and Linkedin

It’s a bit outdated, as it was written in last September.

It’s interesting to see that the relation between their weights and return contributions to S&P 500 changes with time, but it always very heavy. Almost 100% with the top 15 companies, all the others companies are dead-weights.

yes, you are right even if it is a bit outdated it is still very true.

That’s why GraniteShares decided to make a FAANG equity weighted.

It is enough to outperform the S&P500

Keep one eye on FATANG ETP of GraniteShares today.

It is FAANG Index including Tesla and with the last $1 billion of net income announced by Tesla yesterday, we can expect some reaction at the London Stock Exchange opening.

What should our other eye be doing?

Check the investors reaction, market price reaction… and maybe taking the opportunity which come out. Could be done on FATANG ETP or directly with 3x Tesla ETP (3LTS).

With GraniteShares ETP, you can trade US underlying stock during London hours

FAANG stocks are making a big comeback this year.

Investors can use GraniteShares suite of FAANG ETPs, available for trading with T212, for undiluted exposure to the tech sector.

Tickers for long exposures FANG, GFAM, FTNG

About US Tech companies

GraniteShares created a pure FAANG exposure ETP, equally weighted and available with Ticker FANG, -1x SFNG, 3x 3FNG & -3x 3SFG

I like this quote:

"Any time a sector gets to around 30% [of the S&P], something bad happens and it will go back down,” said Brendan Connaughton, founder and managing partner of Catalyst Private Wealth. His examples: the 1930s industrial sector, oil and energy companies in the the 1970s, and when dot-com bubble burst more than 20 years ago.

“Tech was over 30% of the S&P [in the early 2000s] and we saw it blow up,” he said. “At some point, things get too weighted and they unwind themselves.”

Tomorrow, GraniteShares will list 2 ETPs on Euronext.

3rd August – 2 baskets

-----Name -------- ISIN

| 1X FAANG | XS2305050556 |

|---|---|

| -1X FAANG | XS2305051109 |

Thanks for sharing this pie chart, impressive how big are the GAFAM into the S&P500

I think I never shared here our video which explain FAANGs ETP

You can see it via this tweet:

At GraniteShares we definitely think it should be. That’s why a created the first to market FATANG ETP, FAANG + Tesla.

Investors can find those investment products on T212 platform with ticker for a 1to1 exposure - FTNG - and 3x and -3x leverage.