I like their Alpha funds in general.

I moved my workplace pension to a SIPP back in May. It’s predominantly populated by BG funds and they’re all doing very well for me;

BG American - 36.82%

BG Global Discovery - 22.35%

BG Positive Change - 26.36%

BG Scottish Mortgage Trust - 42.55%

I also switched out of Royal London Sustainable World fund last week as it was easily my weakest performer this year with only 8%. Switched into BGCG, which is already up 8.15% - no brainer really.

The only other one I’m still considering is the Long Term Global Growth but (with the above exception) I only intend to make changes once a year.

Excellent portfolio. You’ll have a very nice pension pot come retirement

That’s my main driver with investing. Trying to build my pension.

And I’m pretty much on par with yourself in terms of fund split. My SIPP investing is in HL with me just doing a little on the side for fun here in 212.

Honestly it’s something I wish I had held more of an interest in a lot sooner than now.

Workplace pension funds are godawful and I’d recommend to anyone to do their research and get into a SIPP as soon as possible.

I have trouble with getting my head around this one???

I do have a workplace pension too, but I keep that going due to my employer contributions.

But I have tried and failed to work out if I’m better just having just my contributions in my sipp in funds I chose with HL, OR in the very poor performing fund my work provides due to the extra cash contributions. For me it’s a tough call.

I might have to do more work on this…

Would a disadvantage of having only a SIPP be losing your employers contributions? (If this is the case).

I’m just about to start a HL SIPP, but intended to have my workplace one and personal SIPP.

I have both. In May I moved all my previous workplace pensions to the SIPP except the current, which I take the employer conts benefit into. Once I leave a place of work I transfer over to the SIPP.

That’s a good point actually, I could move my previous into it.

They have a Cashback deal right now also.

Word of advice - you might be too young for it, but if you have any old workplace pensions that are Final Salary pensions, leave them where they are.

My parents lucked out with them, thing of past now unfortunately! I’m only 32

Definitely keep your current contributions with your employer.

If you were to contribute to a SIPP yourself you’ll still have the same tax saving but you’d miss out on the employer contribution part.

But if you have any past workplace pensions, from your previous jobs you can transfer them to a SIPP provider. and hopefully SIPP is coming here before new tax year.

Thank you. I thought as much

SMT have shares in space X that is all

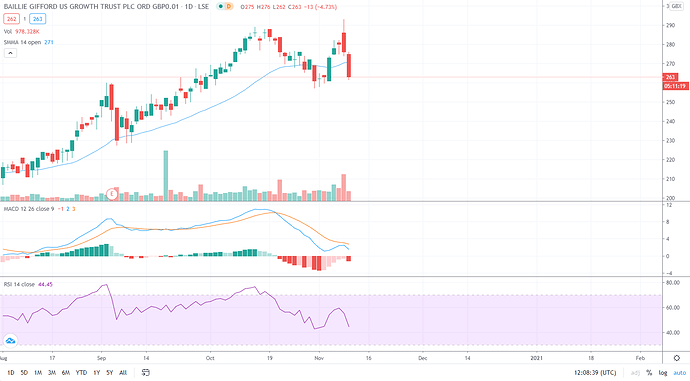

BGCG dropped a lot today, perhaps a good entry point

Dropped to levels not seen since last Friday lol

It’s a great entry point

Loaded a few more. Chart suggesting a further pullback through to next week so will hold on before going any further;

I’ll probs be holding on a couple of the BG funds that go live tomorrow also.

I’ve added to both today too. Always feels weird to do so when it’s dropping. But it is a long game. Great charts

Will USA be on ISA do you know Joey?