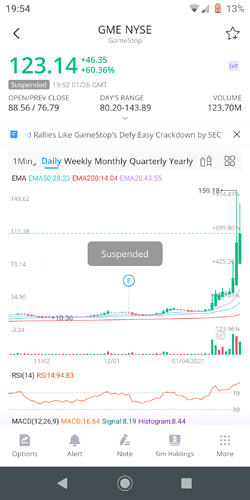

When Volkswagen went through a short-squeeze in 2008, it briefly became the most valuable company in the world. GameStop sports high short interest and some strong-handed owners, setting up a potential for a squeeze of similar magnitude. Shorting GameStop was a crowded trade, and now the crowd is stampeding toward the exit. The stock has already surpassed its fundamental value, but technically, there is not much stopping it from a violent move to the upside. Investment Thesis

GameStop (NYSE:GME) is a sleepy video game retailer that is shuttering stores and losing sales due to the digitization of video games. Fundamentally, it is at best a cigar butt with a puff or two left. At worst, to repeat the tired comparison, it is the next Blockbuster Video.

This made it an attractive target for short sellers, as the stock was easy money to short from over $20 a share all the way to below $3 during the pandemic.

The trade became quite crowded. As a result, it was quite expensive to borrow- I was personally lending out shares at interest rates around 100%, with half of that paid in cash through Interactive Brokers, resulting in a ~50% cash yield on my shares. Most stocks give an additional 3-12 basis points of yield, not 5000.

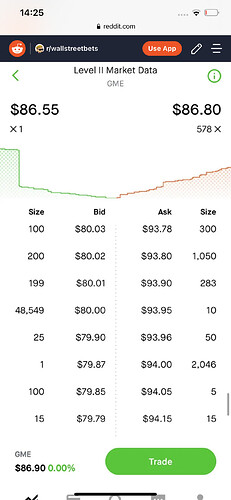

The decline in the price and the core business made it an obvious short. That all changed when a mob of savvy retail investors realized that it wouldn’t take much to ignite a short squeeze in the stock and send it flying. Through buying calls and stock, they forced short sellers to cover by purchasing shares aggressively. As I write this, the stock last traded hands after-hours at $88.90, over 30 times higher than its pandemic-induced lows.

How much higher can the stock go? If history is any indicator, GameStop could technically ‘become the most valuable company in the world’ if shorts are unable to find the shares to cover their positions. That would lead to a share price in the thousands.

A Share Price in the Thousands?

Yes, you read that right. There is even historical precedent to back it up.

Back in 2008, while most of the world was nursing its economic wounds from the great recession, Volkswagen (OTCPK:VWAGY) briefly became the most valuable company globally.

To make a long story short, the company was a great short target due to its high debt load and exposure to the business and credit cycles. When Porsche announced it had quietly increased its stake in the company to 78%, it telegraphed to the market that it would try to acquire the entire company.

This sent short sellers panicking to cover their positions, sending the share price over 1,000 euros intraday. Volkswagen had 300 million shares outstanding, giving it a market cap at the time of 300 billion euros, more than any other company at the time.

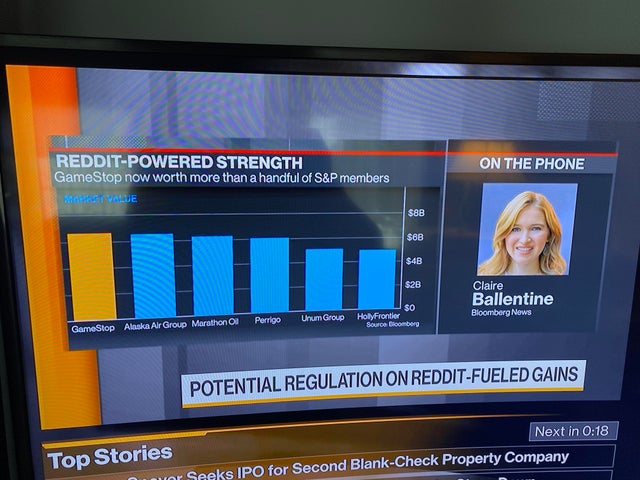

If GameStop were to become more valuable than Apple (NASDAQ:AAPL), the most valuable company in the world today, it would need a market cap of $2.5 trillion. With just 70 million shares outstanding, the share price would be over $35,000. Even with a rally to $363 billion in market cap, Volkswagen’s market cap in USD during the short squeeze, the share price would be over $5,000.

While this is a farfetched scenario, we are talking about a stock with over 100% of the float sold short that has an improving fundamental picture. In today’s market, anything is possible.

Market Technicals Lift The Price

The stock price was sent higher when a group of traders began purchasing shares and call options to spark a short squeeze.

Purchasing shares can ignite a short squeeze because it increases the demand for the stock and thereby the price.

Call options have a multiplier effect compared to shares- for every call option purchased by a speculator, there is a market maker on the other side of that trade with potentially huge downside exposure in the event the underlying moves against them. To hedge this risk, they purchase shares on the open market. Each dollar of call options purchased can result in multiple dollars spent on shares by market makers hedging their risk.

A Higher Price Changes The Fundamental Picture

The buying of shares and calls produces upward price momentum, which the company can use to its advantage. Whoever tells you that stock price and fundamentals are completely disconnected is wrong.

A great example of that is Tesla (NASDAQ:TSLA), a company that never would have been able to survive without external capital was saved from bankruptcy time and time again through equity raises of overpriced stock. Even blue chips that don’t raise equity capital like Amazon (NASDAQ:AMZN) rely on a high stock price to attract talent through stock-based compensation.

Changing Fundamentals Eliminate Bankruptcy Risk, Produce Asymmetric Upside

When the stock price rises and the company raises capital, the bankruptcy thesis is all but eliminated, ruining the fundamental short thesis. Thanks to an exuberant market, GameStop can essentially eliminate bankruptcy risk by selling equity.

But GameStop’s transformation is already in process, with or without a capital raise.

Ryan Cohen, a Chewy co-founder, saw some value in the stock below $10 per share. He accumulated almost 13% of the company and pushed the board to make changes, including a commitment to beef up its e-commerce operations.

If Cohen can enact the change he desires at GameStop, it could lead to profitability and a changed Wall Street sentiment. Cohen’s previous project, Chewy (NYSE:CHWY), is a Wall Street darling. Ironically, both Chewy and GameStop have around $6.5 billion in annual sales.

Chewy currently sports a market cap of $42.3 billion. At $88 per share, GameStop is only worth $6.2 billion. GameStop would need to trade at $600 per share to catch up to Chewy’s valuation.

Conclusion

The GameStop short squeeze we are witnessing is a fascinating case study into the psychology of markets. Nothing changes sentiment like price, and the momentum rally in GameStop shares has changed the narrative completely.

While GameStop is no longer deep value, it isn’t quite overvalued either, pointing to just how oversold the stock had become.

If short sellers continue to stampede toward the exits, the stock could see some truly eye-popping price levels. Even if the company executes a basic business turnaround, the sky is the limit in valuation. The asymmetric upside and extremely high cash interest yield from lending shares keep me long the stock.

Written by SeekingAlpha

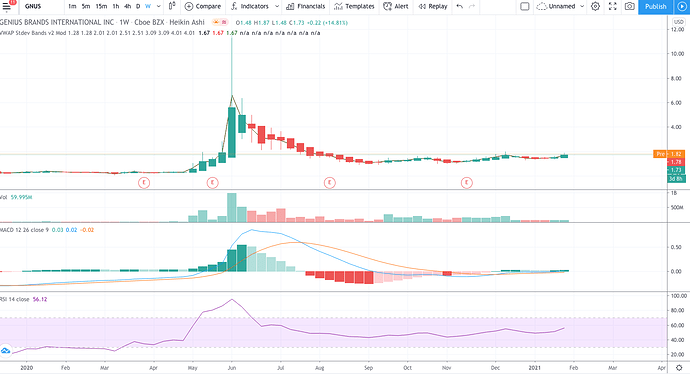

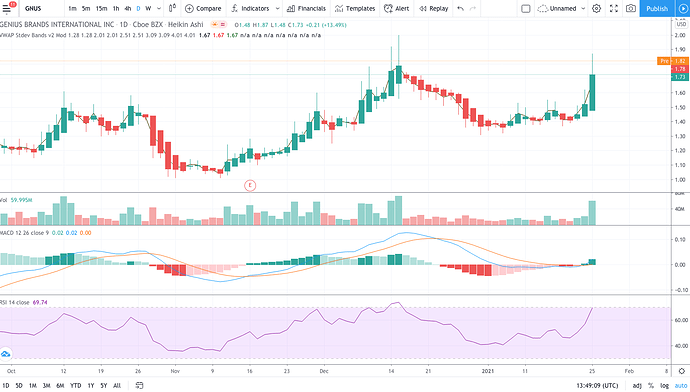

I mean I think it might be pumped but it could be wishful thinking.

I mean I think it might be pumped but it could be wishful thinking.

![Braveheart: William Wallace Freedom Speech [Full HD]](https://europe1.discourse-cdn.com/flex013/uploads/trading212/original/2X/0/07a441319aca5ee41dfe8532edf92a218e2aef30.jpeg)