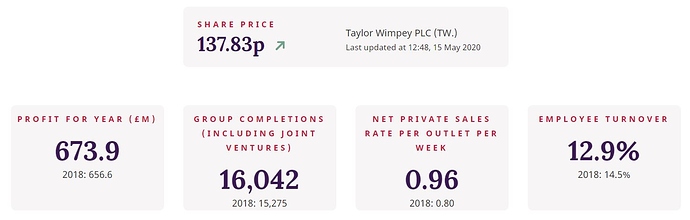

We’ll be looking at a British classic (with some operations in Spain) today, the home builder Taylor Wimpey. They saw their share price being slashed with the COVID-19 outbreak, however, their staff have returned to work yesterday and they are optimistic for the future.

With several COVID-19 announcements, full-year results already out the way, and the next update coming on the 29th of July, we have some time to assess the company and potentially take a position.

Source: TW Corporate Information

What Does Taylor Wimpey Do?

It’s always good to have a refresh of the different business lines for each business. We’ll look at the last annual statement to see how they explain their revenue lines and work from there.

House building private sales, this is where Taylor Wimpey will build new homes on land they have purchased, and sell them directly to people like you and me. This business is half construction and half sales. TW will get a large lot of land, build some new homes and supporting local infrastructure, and then sell this “ready-made” community.

Source: TW 2019 Annual Report

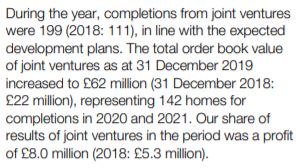

House building partnership sales, rather than TW doing everything themselves they also partner with numerous other firms as a joint venture. In these cases, the other firm may handle sales, or provide the land, or it’s simply a joint project between the two.

Source: TW 2019 Annual Report

Finally, we have the land buying aspect of the business. Finding and purchasing prime lots of plan, getting building permissions, and developing the area. While this is part of the building sales, they do occasionally sell land as well. While this is a smaller part of the business they did make £37.9m in 2019 selling land.

Source: TW 2019 Annual Report

While not a business line, TW also runs a lot of their building materials and sources the supplies required efficiently. It’s worth mentioning as this is one of the factors involved with optimising your margins, controlling more of the value chain involved with home building.

Source: TW 2019 Annual Report

As mentioned they are expanding out into Spain as well.

Source: TW 2019 Annual Report

For a relatively new aspect of the business (in housebuilder terms) commanding an impressive 26.7% profit margin in a new country is worth taking note. The UK does come with higher wages and more of the businesses operational costs, it’s encouraging to see highly profitable international expansion.

What About COVID-19?

I can, and I will, go into the financial and look at the fundamentals but right now there is one question on our minds.

Will they survive through COVID-19, how have their sales looked, what happened to all the homes under development, what has happened to their cash flow? That may have been four questions but the point stands.

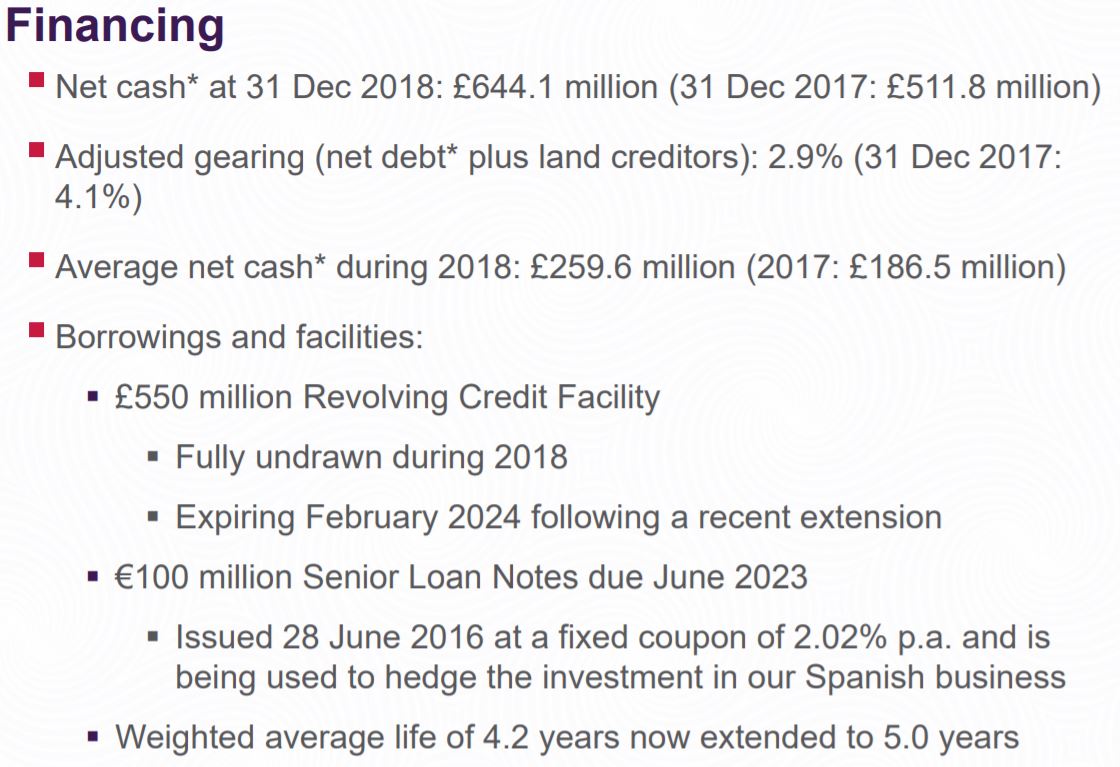

They made two key decisions on the 24th of March. Firstly they have stopped all discretionary land spend. Then they started drawing down their unutilised Revolving Credit Facility of £550m, resulting in a gross cash position of £807m and net cash of £165m. Finally, they cancelled the dividend until the situation was better understood. As a high dividend payer (even during down periods of the year) this would have been a nasty blow to many investors. Though cancelling this year’s dividend means a cash flow saving of roughly £485m.

In April we had another update. The directors took a 30% pay cut, no cash bonuses will be paid (equity is fine) and no annual pay increase.

At the end of April, a trading update was released. The key takeaways were, the order book increased in value to roughly £2.6bn which is still a £300m increase on the same period last year. The cuts and credit facility meant they had a gross cash position of almost £836m still. They had moved to virtual home viewings, were still making sales (slower than expected but still up on last year), and Spain was starting to ease up on the lockdown rules. Additionally, they started looking at land opportunities again, seeking to maximise on the discounts from fearful sellers. They even secured the UK’s first significant remote planning permission for a joint venture of around 750 homes with Waltham Forest Borough Council in East London.

Finally, on Wednesday we had another update. With the UK’s government telling employees in the construction sector to return to work, this was the moment TW was waiting for. Surprisingly housing market conditions have remained stable with signs of increased sales activity and customer interest, giving a very positive sign that TW will be returning with a bang. While it will take a few weeks, the plan is for TW construction to be underway on the majority of their sites across England and Wales this month.

Fun fact, during the lockdown period TW sold 408 homes net of cancellations, averaging a net private sales rate of 0.30 homes per outlet per week. Some people took up baking during the lockdown, others brought their dream home!

How Are The Fundamentals?

After some surprisingly positive news, while they fell short of their growth target for the year on year numbers they are still ahead of last year, we can look at the overall company.

Source: Genuine Impact Taylor Wimpey

These are some very strong ranks. Do take the quality with a pinch of salt. The last financial results did not include drawing down £500m of debt.

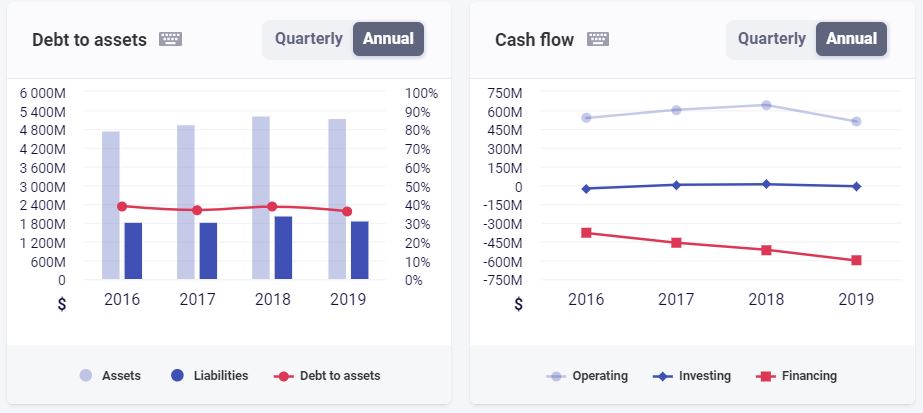

Source: Wallmine Taylor Wimpey

Looking in more detail about the quality, we can see a very healthy cash flow rich company, even if the profit margin is on the tighter side (15%.) Previously we can see the financing cash flow was negative, as they paid off debts in favour of more attractive terms. The next financial update will give us more flavour as to what this means. With a maturity date of just under five years, this debt was taken on as a protective measure.

Source: TW 2018 Presentation

Good thing they extended this in 2018!

In terms of the value, the massive slashes in share price has TW very attractively priced. With a 40% discount and strong activity even during the lockdown, TW is in a very strong position given the value of their assets. 1.51 price to book ratio and a 6.80 price to earnings, will raise some eyebrows. We are expecting lower results this year but all signs are pointing towards a faster than expected recovery.

Source: Google Finance Taylor Wimpey

We are expecting to miss targets, we have seen a bit slash in value, and a large amount of debt has been taken on which will need to be paid back. Does this mean everything is priced in already?

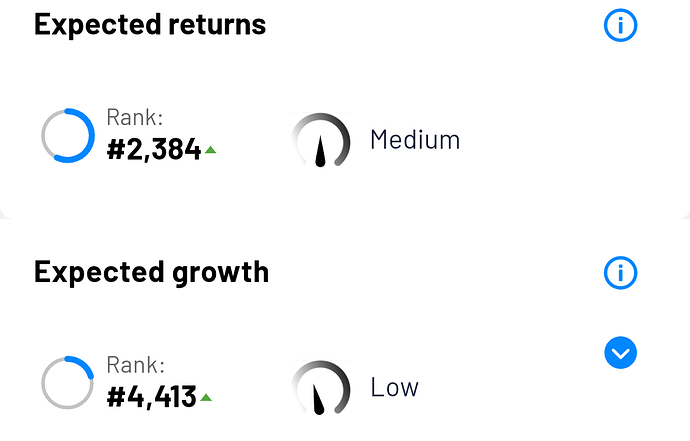

The lower momentum rank makes it seem like a slow recovery is on the books.

Source: Genuine Impact Expectations for TW

While the expected growth, the revenue and earnings, is very low we are more interested in the return. The target future share price.

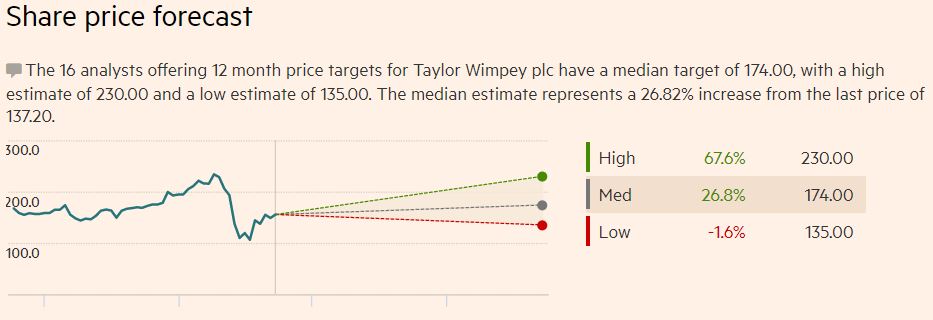

Source: FT Factsheet for TW

With a medium 12-month target price increase of 26%, half-year results just over a month away, and a quick return to business as usual. This looks like a strong shorter-term play.

Source: Genuine Impact Analyst Ratings for TW

The sell-side analysts also have a generally optimistic view. With the stagnant period being much shorter than expected, and home safes not disappearing, there is a lot to love here.

The market has priced down TW very aggressively on the assumption of no more home sales, it looks like this has not been the case. Even if we enter a second wave we know that TW still can sell homes (just can’t finish them!)

In Summary

I would describe any investment in Taylor Wimpey as an investment in British recovery. If you are optimistic about exiting lockdown and the slow unwind to “normal”, this stock represents that optimism.

Ultimately it is in the British mind that we must become homeowners. With over 1.2m homes needing to be built, Taylor Wimpey will always have a place and purpose. This year will be a more challenging one which will focus on share price recovery. I’d expect from 2021 we will be returning to our increasing dividend and hopefully the continued profitable expansion into Spain.

Let me know what you think, is this a company you are interested in or trying to avoid?

I know this isn’t a comparison but hopefully, a deep dive into one homebuilder helps shine some light on what COVID-19 is doing to them.

As always, thanks for reading!