Gravity based storage, so you what use excess energy to lift a weight, and then drop the weight when you need the energy back?

Exactly,when say windmill power could be generated but isn’t due to lack of demand it would be used to lift the weights or charges batteries for lifting weights.

It’s the same thing proposed for green hydrogen ect.

As I don’t think there can ever be a one answer solves all in this situation I tend to invest in multiple options when it comes to energy storage.

Excellent - you have me interested in ‘crowdfunding’ again - I’ve submitted interest to buy.

I’ve also discovered that PACKd were profitable this past year, and are expanding into the US and Canada, so things are not as dreary as I thought with my crowdfund investments.

dilute investors and increase number of shares. Simple.

Surely they’re profitable by now with their paywall?

Not a fan of freetrade due to charges for access to AIM ect.

Handy if you just want to put money into dividend kings though and it’s what I used when I was comparing growth to dividends.

Growth on 212 won.

I tend to steer clear of any money app on Crowdcube I like sustainable energy storage and tech.

Just keep an eye out for the good stuff that’s all.

Has anyone ever been successful trading in the CubeX secondary listings?

I’ve been doing a lot of research on this Gravitricity and wish I had found out about it sooner. I would quite like to invest and have submitted interest.

What I might also do is contact CrowdCube to help them engage with companies more to take part in the secondary listings. I’ve previously discovered companies have to also ‘opt in’ first to allow investors to take part in a secondary market.

Can keep people updated on the response if there’s interest.

I’ve never used the the secondary market on Crowdcube so can’t help there sorry.

But I imagine Gravtricity will be raising again at some point I’ll post on here next time I get some news about it.

Here to me is an example of a bad crowdfund and poor due diligence.

The company is not raising a lot compared to others, and I like their stuff BUT they had a crowdfund for 180k back in 2019.

As a potential investor because I do like the kits, I would like to see their projections from 2019 vs actual to assess how on the money their future projections may be.

I could do this myself and I will, BUT that’s not the point. We need a complete picture of their past performance to assess the future.

Mine will be Monzo, 250 shares

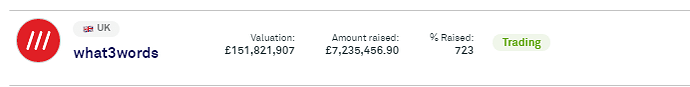

Wish I’d have invested in what3words when I had the chance,such a simple idea but so effective.

Also I’d like some view on this news.

I’ve invested in Orbital Marine Technology on Crowdcube and love the concept infact I think they will be more productive than wind once dialled in properly.

Now I view this as technip moving in a new direction at a rock bottom share price.

Sue you guys have any more info on them?

Changed my mind on advice this is now a go for me.

Has anyone on here claimed EIS relief, any ideas how long it takes?

I sent some more forms away to HMRC to adjust my tax code. That was like 3 months ago now, not sure what’s happening.

This is still the current status of my EIS forms. Apparently if I fill in my own tax return, I will get a faster response but I dont want to start that. HMRC website says to contact them by post or twitter. Twitter says to contact them by post, and well by post I get no replies.

In other news, one of my first Crowdcube Investments is either about to be sold or wound up. My other ones are still a going concern, and one has even expanded into Europe and the US so, might have some success yet.

Recycling Technologies:

We are pleased to inform you that Recycling Technologies has appointed us, Computershare Investor Services PLC, as the new share registrar.

The share for share exchange between Recycling Technologies Limited and Recycling Technologies Group, and the re-registration of Recycling Technologies Group as a PLC has now been completed.

Therefore, we will be shortly despatching a hard copy of your share certificate to the address we hold on the company’s share register. Before we dispatch your certificate, please take this opportunity to check your details via Computershare’s online platform, Investor Centre, by following the steps below:

- Register at www.investorcentre.co.uk using the SRN shown at the top of this email. In certain cases, to complete registration, a verification code may be sent via post to your registered address.

- Once logged into Investor Centre, please check for any errors or out of date information, and update accordingly.

- If no change is made or you do not register, we will print the certificates based on the information we currently have.

- We will dispatch the hard copy of the share certificate to the address we have on the company’s share register.

The share certificate will be despatched on or shortly after 21 March 2022, so please ensure you have checked your details before 17 March 2022. If you do not register with us, we will use the information we currently have for you to print and dispatch your share certificate. However, please note that a share certificate is a valuable document and there is a cost to arranging a replacement should the share certificate need replacing.

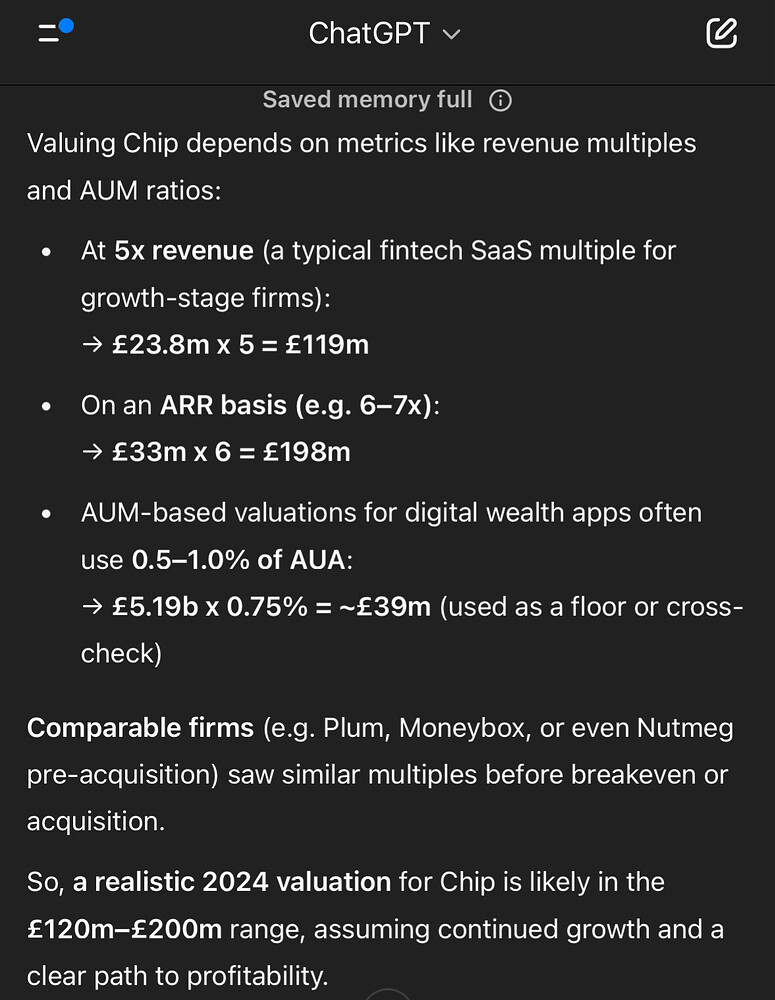

Anyone else invested in Chip Financial Limited?

I’m always pessimistic about them as they have in the past over egged their numbers, but to summarise from their latest set of accounts:

- Revenue: £23.8 million (+62% YoY)

- Annual recurring revenue: £33 million at year end

- Gross margin: 90.6% (vs 83.3% in 2023)

- Q4 EBITDA: positive

- Full year loss after tax: £703k (vs £3.6m in 2023)

- Cash at year end: £8 million

I fell out with them a few years back and wasn’t expecting to see any returns but looks like they are finally considering a secondary share round. They almost seemed to be a bit of a ship without a rudder. They spent a few million developing a savings mechanism where they would cover you overdraft, but reserve the cover so you couldn’t spend it. This could have potentially saved users up to 50% interest (some

Banks did charge this and/or minimum fee). What they realised was they didn’t have the user base to run at scale, nor would the AUM/return prove profitable so that was shelved.

Then over the years they kept changing how they quoted users. First it was registered users, then they didn’t allow users to switch off auto saving permanently, so savings would kick in again after 90 days, even though you had switched it off and requested your account deleted. This inflated active user numbers.

Then they initiated multiple fee schedule refreshes. You had a fee every 28 days, and a platform fee if you invested every month.

They have given away millions in signup incentives over the years, but didn’t actually have an easy to use intuitive product that would keep users.

Oh and they took over a company that offered alternative assets I believe too, so for a while you could buy a fractional share of a Ferrari or a bottle of whisky.

Anyhow I think their last crowdfund was at £2.3 but happy to be corrected so I might actually see a return from this one!