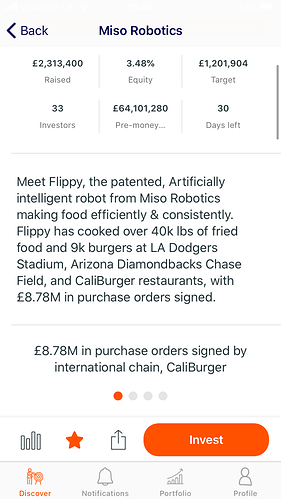

Is anyone an investor on Crowdcube ??? Have you seen what’s just landed

can someone tell me how this will fail

can someone tell me how this will fail

more robots to take over the world and kill jobs lol unless your the repair man of course

Love crowdcube, have a video to post soon on my YouTube channel about it. But yeah there are some investments on there you should stay clear of on there haha

Haha I’ve just got onto it now so I’ve not had the chance for my Crowdcube investments to fail! But some of them on there seem like could return some good gains! & what’s your YouTube channel will subscribe, I started a insta and gna do a YouTube soon @mediciieraassets

I know, as long as I’m invested they can take jobs…

Really interested to see what the long term win/fail ration works out to be for crowdfunded investing.

Hrmmm

Stocks you can just sell if they seem to be tanking, I wonder what options are available for crowdfunded investments, are you just stuck with it?

Most of them on Crowdcube you will be sometimes they say there plan is to go public on exchanges, but most of the time your stuck with the investment. There is websites like seedrs I think that has secondary market

I stay clear of clothing retail food etc as it’s really hit and miss. There are some good ones tho! Smart cricket seems like an alrigjt little play and there plan is so launch on LSE so could be some good gains! Also Mass Financial and Coconut

Cavan Hagan Investing, in my profile

Fairly 50/50, but that’s overall and there’s a lot of poor businesses since they let basically anyone crowdfund as seen above. There’s all the exits below: https://help.crowdcube.com/hc/en-us/articles/115000038984-How-many-exits-have-there-been-from-equity-investments-made-through-Crowdcube-

You can also hear about how it works on my channel, it’s my first video, about the platforms I use to invest. Should be timestamps to skip to it

Seedrs is my platform of choice - the secondary market is a big plus for me.

I’ve used Crowdcube for some very specific companies - Monzo and the likes.

Do you invest on seedrs or have you had a company invested into on seedrs, and what’s your experience of it been like?

Ah, sorry, good question as I wasn’t clear enough. I only have experience as an investor. No idea from a company’s perspective.

I like the fact that I can sell my shares in the secondary market. I haven’t done so mainly due to the EIS 3-years restriction, but it’s good to know that I can sell my Revolut shares before they exit at a very considerable mark-up.

I’ve also used Syndicate Room in the past but it’s a fund approach rather than individual companies. A bit like an ETF in the world of startups.

I might contact Crowdcube as ask if they’d be up for making a secondary market, that would be really interesting. How does it work on seeders? Do you just set a price and hope someone takes it?

Until recently the price was set by Seedrs (or maybe by the company?). Recently Seedrs announced that investors can set the price they are willing to buy/sell.

Interesting enough, maybe if we all send an email they might consider it

Thank you for your insight into it. I’m looking to start a business and was thinking about going the equity crowdfunding a la seedrs in order to get some starting capital once all my plans are more or less set in stone. I’m mainly worried that it will be too small scope for anyone to want to invest

From using Crowdcube, they really let anyone onto it, it’s quite a good platform, haven’t used Seedrs but quite interested in it now for its secondary exchange

If you are considering raising funds it would be best if you contacted both Crowdcube and Seedrs directly as there are certain legal requirements that must be met. Also they can advise you more on whether that’s the right path for you to take to get your business off the ground. I find both platforms great for investing and I am under no illusions that I will see all my money back. But I am looking to launch a VC firm in 5 years and there is no better teacher than experience  . The reality of startups is that 9 out of 10 fail so seed funding is not for the faint hearted. And you have to be super patient. But every now and again if you do your due diligence you might discover a gem.

. The reality of startups is that 9 out of 10 fail so seed funding is not for the faint hearted. And you have to be super patient. But every now and again if you do your due diligence you might discover a gem.

Yes, all of these are things I’ve considered and some are things I’m still considering. Luckily the business I want to create is on the lower end of the risk scale, and probably would be boring to many people. Kind of like my investing style.