Vox is quite good for RNS feed on LSE or AIM

Nice one, I’ll check that out thanks.

Wallmine is pretty good though it’s slow to update tickers (spaces) and add new ones.

Webull gives you a lot of info too. I’m in the uk and although you can’t trade you can hold watchlists and get level 2 data free for three months.

- RDSB 31.74%

- Intel 23.11%

- Unum 17.11%

- Alibaba 16.97%

- ABBV 5.56%

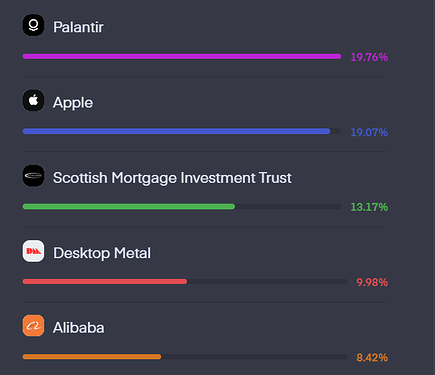

It’s interesting to see a couple of you having a such a large conviction in palantir.

It’s one of them I’ve owned before, but I thought I was an expert and was “trading it”, and regretted it since.

What do you see the long term view being? I’m half thinking of taking a small position, say 15-20 shares, but invest it in tranches as it can be quite a volatile stock

Moderna +218%

Alphabet +90%

PostNL +80% +huge dividends

Hugo Boss +78%

Nvidia +70%

It’s $21.40.

20 characterz

Well, no crystal ball here.

My take: they’re a company with 20 years of expertise with big data … as the big data getting bigger and bigger, I feel confident that they’ll thrive. And Peter Thiel being the co-founder of the company, gives me some reassurance. It’s a very long term for me, but you never know …

That’s also why I’m invested in SFTW (Blacksky).

Similar reasons to myself. I work as a data scientist so it’s an industry I’m familiar with. We haven’t even began to scratch the surface of utilising data correctly and efficiently. The usual metric thrown around is that we are analysing less than 1% of the worlds data. I could write an essay on the reasons why but one or two of them are ease of access, ease of analysis, interoperability between softwares and systems (i.e. moving data around within the organisation). In Palantir’s words: ‘We build software that empowers organizations to effectively integrate their data, decisions, and operations.’

Their core offering basically solves a lot of the challenges with big data and analytics.

Tack on their high value government contracts, and their partnership with IBM, and they’re a winner for me.

I have set a trigger to sell my shares at 40 dollars though which would be a market cap of around 75 billion which I do feel is realistic.

Palantir has interested me for a while, just need to take the time to look into it, at least one of my main holdings (BP) uses them, I think BP has for about 10 years to help with oil exploration. Also couple quarters back BP sold its stake in Palantir for about $400m, doesnt mean anything whether bullish or bearish on Palantir as was part of debt reduction phase for BP but interesting tidbit.

I got into ABCL mostly on the Thiel connection - bad idea!

Having said that I’m sticking with palantir mid to long term. I unfortunately have them it in an invest account so I’m hoping for an irrational short term jump to sell and buy back in an isa.

Another Palantir-phile here. Can’t see how this doesn’t eventually go exponential, especially when you look at peers and what they IPO’d at.

Invest;

My Invest account is a non-serious account used to experiment, dabble and try and grow a target of £20k for the next year’s ISA contribution. The below are its only holdings. They’ll change fairly frequently but the central holds are PLTR, JMIA, BIDS, and BEKE.

- WISH (29.30%)

- PLTR (27.39%)

- JMIA (17.55%)

- BIDS (9.74%)

- BEKE (8.03%)

- GOTU (7.98%)

212 ISA;

Swing account. No long term holds. Longest I expect to hold are GGPI, PINS and GBOX.

Other ISA;

My serious ISA. Mostly 2 - 5 year holds. Growth portfolio though so term can change. Can’t be bothered to calc the percentages but the top 5 holdings are;

- APPS

- TSLA

- IDEX

- CPNG

- CHPT

Although I just added DOCN to this folio and aim to make this a top 3 weighting, possibly even number 1.

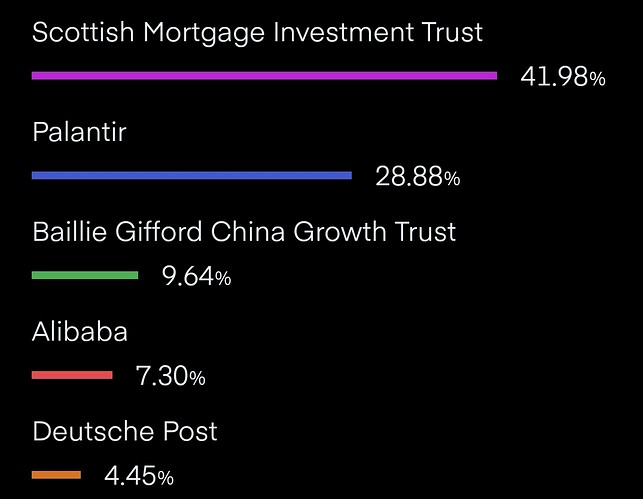

SIPP;

No experimentation. Simple LT investing. Mentioning the SIPP because the holdings are either funds or Trusts and most the fund choices have trust or ETF equivalents.

- BG American Fund

- BG Positive Change Fund

- SMT

- Polar Capital Glbl Tech Fund

- BGCG

I’m kind of thinking about it from a long term market cap perspective as well. The earnings growth on the last report was also pretty impressive, but in fairness, most tech players smashed, so it’ll be interesting to see the next few quarters. I’m guessing that the analysts are going to be overly optimistic for a while, and at some point we’ll get consistent misses across the board, that may be a good time to top up.

I’m going to pick up 5 shares on pay day to get me more interested, as it’s pretty richly valued and I struggle to remain resilient when paying a premium.

Then I’ll get some dips, and if it doesn’t dip I’ll just hold for a few years and see where it goes.

Time in the market beats timing the market as they say. Seems like a sensible approach to me to get some skin in the game at this price.

One concern I would have with this stock is the reports I’ve heard of heavy insider trading and stock awarding to the CEO and his co-founders. Further, some of the questionable practices done by some of the governments their are supporting.

To play Devil’s advocate and also introduce a questionable source of info…

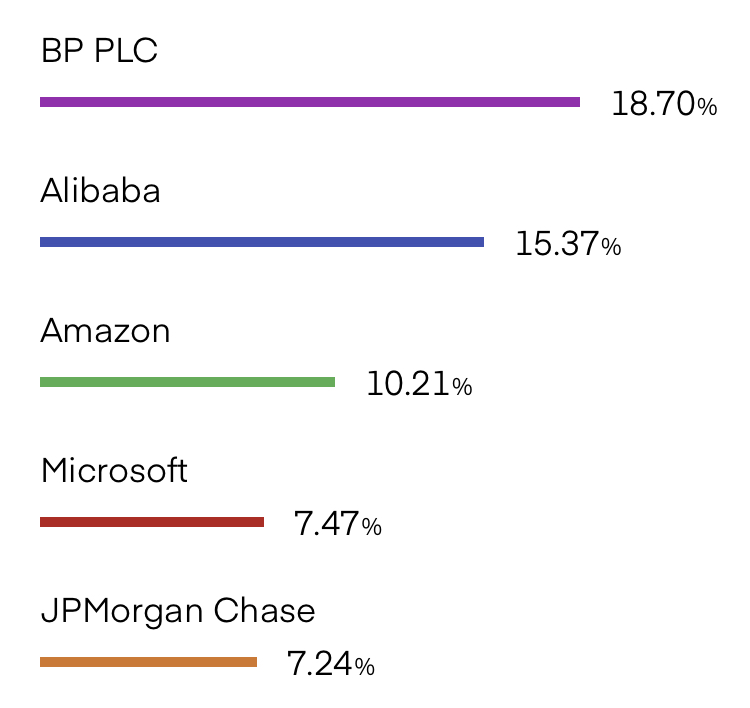

Boring top 5 compared to many of you ![]()

I would say if people are worried about morals then Palantir is the last stock they should hold, it literally is used in govt and security dark arts as it were, big clients also include companies like big oil. The fact we are unlikely to ever know their inner workings much wont help this. I am not saying dont invest as its on my radar, but previously I have had people (not here but elswhere) why I own BP, Chinese stocks, Banks or big Tech due to various moral pitfalls then find out they own stuff like Palantir ![]()

Its just a concern is all. I try to keep stocks and investing separate as much as possible. I try as much as possible not to feel I have a personal responsibility for these companies!

ESG and all them other lovely terms are becoming far more prominent for companies to have in their investment presentations. I’m sure many of them are out of necessity rather than willingness.

But like @obrienciaran, I try to keep it all separate within reason, otherwise you wouldn’t really invest in anything