Feel free to post referral links to your favourite broker (better service, better PR). We will not remove them.

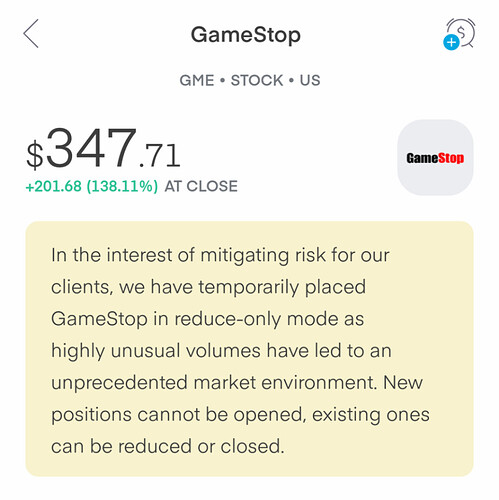

Buying means bigger exposure resulting in more collateral required by the clearinghouse.

Imagine having a credit card with a £20K limit based on you perfect credit history and a savings account with £5K in cash in the same bank. One day the bank calls to tell you that if you want to keep your £20K limit you must have not 5 but £20K in you savings account by tomorrow. Otherwise your limit will be reduced to £5K. Even worse - if you’ve already spent over £5K, the difference is due IMMEDIATELY.

Might it be the case that on Thursday things were a lot less clear than they are 60 hours later? Problems were being identified and solutions were being worked out. There were probably lots of high level phone calls taking place amongst various participants in the brokerage and settlement chain about how to find the necessary margin for DTCC and restore trading to clients. Banks like JP Morgan had to be consulted about raising finance and it may not have been clear on Thursday if and when this would be forthcoming. A lot of this background work is highly complicated and commercially sensitive and cannot be readily explained on public forums. And the risk of spooking the market with false rumours of melt down had to be avoided. People would panic if they thought they could not sell. But selling was always possible and contagion to other stocks was avoided.

I figure that Trading 212 are trying to deliver a product that works well for investors. When very unusual circumstances create pressures, it must be upsetting to staff to see the impatience with which people flock to Trustpilot to post 1 star reviews, all the while they are trying to find the best solution for clients and probably incurring unexpected costs.

This may sound sycophantic, but I want to cut them some slack. An explanation in terms of market volatility may be the best they could do given the information available at the time, so the explanation given by @AlexK above may not have been something he could have given on Thursday.

Think because clearing house looks at a broker’s client’s holdings aggregated as one big portfolio. Take GME stock for example. Imagine broker X’s clients hold 5m worth. Allowing selling decreases that net exposure, decreases the amount of capital required to be given to the clearing house. Buying on the other hand increases the net exposure, increasing the amount of capital required - basically making the problem worse.

That looks to be completely consistent with what we have learned subsequently about mitigating risk that clients would be entered into trades that the clearing house would refuse to settle.

So you are saying they knew on Thursday or things have only become clearer now, as per your post?

When they say ‘We’ they really mean ‘IB’?

Do you realise how bad the original notification reads?

Come on, Richard.

My worry now with Monday is that the T212 system won’t be fully functional, an inability to purchase certain amount of stocks and also severe delays in buying and selling transactions.

Then my question is how are we supposed to do our own research if even they didnt know. Now they are even mocking us for it.

note how it says clients, but nowhere does it restrict the definition of clients to those trading GME or AMC? the volatility was caused by those shares, but affects the entire client-base of T212.

@AlexK thanks for the update. you are right, very boring  needs more explosions and a theme track

needs more explosions and a theme track

I also think this will probably happen again !

I understand this interpretation but not your point.

Are you saying that T212 placed these restrictions then?

Makes sense, but IBKR didn’t make it clear they were planning to resume trading of these securities. Instead they said, it will resume once these securities are back to normal market volatility, infact the chairman said, when GME drops to 17$ a share. ![]()

IBKR, due to media, client and competition pressure, withdrew from it’s decision.

But the statement regarding clearing house requirements is true by itself. But not the only reason in my opinion.

Why would T212 really care? There is not much competition on UK market. They can do whatever they want as people can’t vote by moving to another broker.

Those issues are just crazy, I couldn’t execute my limit orders even on Friday.

I think we are all interested in what happens next. Seems like it is very uncertain.

By the end of the week, all three actors were still in the game. Who will be knocked out first is far from straightforward.

Why not pause trading of both stocks all together?

Only allowing selling (and holding) clearly has an one sided effect. I do not need to remind

anyone what the effect was. It is all covered by credible media outlets.

I am not fully blaming trading212 but the fact that all major brokers, intermediates acted together like that speaks volumes.

The post made by Alex explains why brokers did what they did and has nothing to do with some conspiracy that they coordinated against their clients… they didn’t act together, they were all affected by the same scenario with no other options available to them.

as for “credible media outlets” you have to be extremely selective, because all of the “mainstream media” has an agenda, that depends on the political and financial interests of their owners. don’t get people started on the number of revealed scandals buried in the histories of all these “credible” media outlets. it’s an extremely difficult search to find a credible, unbiased and well informed source of information, usually you only get to have 2 of these 3 qualities.

I mean can you imagine if they blocked selling and the price plummeted, people would be watching their money evaporate powerless to stop it.

Selling decreases their net exposure at the clearing house and so lowers the overall capital requirement and so lessens the problem that caused buying to be suspended in the first place. So whilst they have a justification for suspending buying (reasons Alex notes above), the same logic doesn’t work for selling so if they suspended selling they’d be acting off their own back to prevent clients from closing positions - probably on shaky legal ground and definitely not morally right.

But you have a point, seems unfair that retail investors couldn’t buy only sell, and would exert downward pressure on the price from a retail side. Exchanges could’ve stepped in and halted trading entirely so institutions didn’t have an advantage but they didn’t.

The uproar would be massive if people were prohibited from selling the stocks they own. Completely different from being unable to buy more.

The stock market does not work like that. From a regulatory perspective only the Exchange (Nasdaq, NYSE etc) can pause trading. And they have. At least 5 times per day in the past week. But they tend to unpause it after 5 minutes.