I guess the reasoning is that it was bought in the pie and therefore the dividend is received inside the pie, even if it was sold. I think it would be confusing having money going into your free funds

Yeah I get that. But if I’ve deleted the pie, I think it would make more sense to just give those dividends as free funds. Otherwise, like in my situation, I have these funds “blocked” and don’t actually even know what they’re about to be used to buy until it’s actually executed. Not really a big deal because it was only a few quid, but I imagine people get much larger dividend payouts so might affect them a lot.

Also I’ve just had another look and my 3M shares are not in any of my pies, yet I am unable to manually sell those shares because I have deleted the pie that they used to be inside. Can anybody from the T212 team help me out please?

Yes @TradingTom We’ll review your account

Been playing with pie, I had removed few companies from pie, when withdrawal sell was done, it failed on some. Now I have few positions with 0.12$ value which are not possible to sell.

Message minum amount is 0.20$, so not sure how to fix this without re adding to pie, buying again some.share and then hoping sell will pass Ok. Is it possible to have manual intervention?

Cheers

Hi,

Apologies if this has been mentioned in a previous post.

When I try to remove one of my holdings in a pie (from 10 to 9 holdings) by using the “EDIT PIE” function, it does not allow me to “Save” the changes until I add another share with the same % holding (to make it 100%) Is this meant to happen?

I was assuming that if I “Save” it that it will readjust the % for the 9 holdings of the pie to become 100%.

Has anyone else had this issue?

That makes sense to me. If you reduce from 10 to 9 holdings, you should edit the %s to, say, 8 x 11% and 1 x 12%. I don’t think the app can be expected to guess how you would like to do it.

Tbh maybe it should keep the same proportions and readjust the percentages for you and you can confirm or edit

You are thinking exactly what I thought it would do! I was hoping it would automatically rebalance it for me.

Although @Richard.W I can see your point of view. Maybe I am just lazy and hoping the software will do all the “guessing” for me.

We will investigate. Usually this limit shouldn’t apply when selling the entire position.

If there were to be any “automation”, I think a sensible one would be one to allow for purchasing based on numbers shares owned, rather than on target percents of value. I.e. I should be able to say “Increase each of my shareholdings in this pie by 2%” The system would give me an estimate of the cost of doing that, and if I have sufficient funds let me make those purchases. That is what is needed to build one’s own ETFs. Purchasing is “pari passu”, Latin for “on equal footing”. Where I had 5 shares, I want to buy 5x0.02.

@George

Also I noticed scenario.

I posses Stock A under normal Invest account. (Average price 70$)

I buy stock A in Pie. (Average price 80$)

I sell Stock A from Invest.

Return in Pie gives returns on Average price in Pie. (80$)

Return in Investment tab gives returns based on Average price of Invest account(70$), however including only Pie shares now.

So there is discrepancy between returns from 2. I imagine this scenario will be rare once we can plug in stocks from invest to pie. But I wonder what happens if one has same stock in 2 pies(different weighting), and then sells in one pie. I imagine same scenario will appear.

Very nice feature. One small nitpick so far: the projected value of a pie is based on the last 5 years, which in my opinion is… overly optimistic for the MSCI World pie I’m looking at. Maybe once the feature is basically done, I’d like to be able to manually set an estimated performance percentage p.a. – or maybe the app could look up historical performance data going back as far as possible?

Oh, also, the projected value seems off to me. Mixing 80% SWDA and 20% EMIM (combined TER roughly 0,2%) shows a 5 year p.a. return of 9,79%, the projected value of 400 GBP monthly over 35 years is shown to be 1,45M, while my fund calculator projects 1,23M. Where does the diff come from? Accumulated dividends?

Having skimmed through the thread, I think I might not be the only one:

I am afraid one of my pies have stopped investing and only accumulates cash

It was after I wanted to change some of its parameters and had to cancel an ongoing investment process at a point where European stocks had already been invested into but the US market had not opened yet.

The only workaround seems to be to rebalance the pie, which needs to be done every day manually.

How can I make it work automatically again, please?

Alrighty, new day, new bug to report (or just new stupidity on my part  )

)

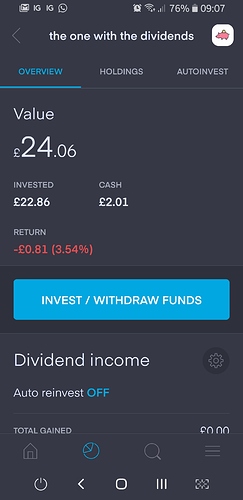

So, I tried the shiny new autoinvest feature for the 1st time. It picked up £2 just well but never bought anything. I’ve got a mix of LSE ETFs and US stocks, so a little surprised the 2 quid is just sitting there as cash. Bug or me being stupid again?

Ps - smallest fraction is 3.1%

O and I checked the history too, nothing bought today yet

Please add an ESG-Screened ETF to the pie feature. Thank you!

Hey there @Vedran,

We’ve solved it! You’ll be able to sell your positions now.

Hey @H2T2,

Please check your DM, I’ll send you a message there.

I have OCD for Pie Free cash 0.10$ been traying yesterday with 10 orders to finally get everything invested always some 0.xx is left un invested.

Please for sake of all good, help

just withdraw it to free cash buddy. i have a similar OCD, probably to a lesser extent as yours it seems

just withdraw it to free cash buddy. i have a similar OCD, probably to a lesser extent as yours it seems