You can’t use the pinpass but you can use the bank credit card and I think also iDeal (not fully sure atm, I checked it in the past but I don’t remember).

Otherwise you could open an online bank like N26 and get a proper debit card (not like our pinpass). Free to open and to use. In case you want more info or referral just let me know.

If i open a account with n26, can i then use autoinvest?

My autoinvest picks money from my Revolut. Then in Revolut I have set auto-top up when my balance drops below certain value. N26 should work similar, but I don’t have that account to check.

Yes. Basically at the moment to use Autoinvest you need either a credit card or a debit card (16 digit cards). The pinpass we have in The Netherlands is a debit card that doesn’t have the 16 digit number. This is why it’s popular to buy online with iDeal.

If you open a N26 account (free version) you will get a debit Mastercard (16 digit card) and that one can be used to top up your T212 account and used for the auto invest feature. Transfers between dutch banks and N26 requires max one business day.

Does anyone know if there are any plans to allow you to add more than 10 individual holdings to a pie? Would be great to see a ‘pie information / stats’ tab too, showing things like pie performance, avg dividend yeild to date etc…

If you have a Pie that is say 80% equities and 20% say in US Bonds. Your shares in equities could grow at a faster rate given a 1 year or 2 of growth. So you could have a pie that should be 80/20 but would be more 90/10 in favour of Equities. Based on just performance growth. That why you should either rebalance or maybe sell off some of your Equities to turn it back to 80/20.

I have been using the new pie functionality since beta testing and now I have some thoughts.

The pie functionality is a great idea and user friendly however moving instruments in and out of the pie seems a bit clunky.

For example, I think there should be an auto import and adjust if you bought some more of the same instrument… let’s say on impulse purchase outside of the pie as an example.

It should be as easy as ‘pie’ (sorry it was too temping) but it’s not. You have to import the new purchase into the pie and then adjust the percentages for each slice of the pie in order to incorporate the purchase.

The annual return of a pie can also depend on how each of the instruments performs over a given period which can be optimised if you adjust each instrument slice of the pie individually.

The annual return percentage will show either an increase or decrease as the adjustments are made. Its feels to me that there should be an optimisation tool to help maximise the return but obviously there are no guarantees.

Why can’t I see the pie function on my iPad?

I know security is tight and rightfully so, but I would like to be able to view my account on two smart devices at the same time…

the iPad app is outdated and will take some time to catch up with mobile and web platforms that is why you can’t see the pie there. as for auto-import, seems like a bit of a niche worry to me but perhaps they will think it useful enough to include. I do think however if there are impulse buys, then perhaps you are doing something wrong while investing.

I deliberately buy shares both in and out of a pie as I want the freedom to sell some shares without having to adjust the shares pie balance due to export, also you can import and export and it won’t affect where your funds go until auto-invest gets a self-balancing option so if you know how much of your next deposit you want to put in a share, why should it matter how much of your pie is already taken up by that share?

I think there won’t be an optimisation feature based on the returns calculator as it’s merely a record of the last 5 years and is not a prediction for how your shares will perform over the next 5, so it seems pointlessly risky to have your pie adjusted according to old data and would become a problem when people allow auto investment based on this only to not get the “promised” returns

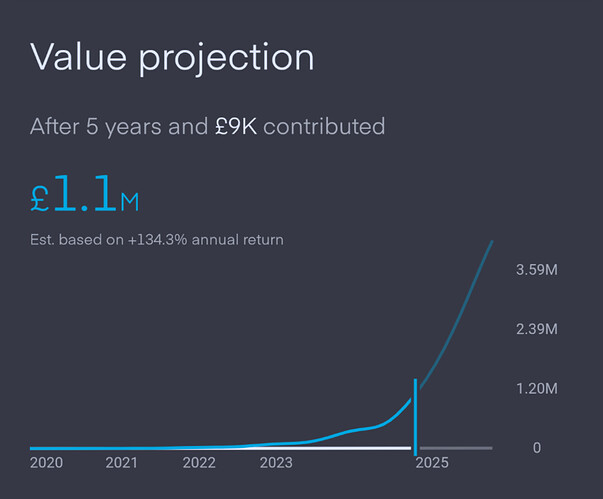

Wait why’s your line not smooth. Why’s it all bumpy

I noticed that too, I have no idea.

For anyone who wants it, 163.88% return pie:

www.trading212.com/pies/l7A7kC5dYTUCY7QqaHObH7Eu3Grt

Good luck, I’m not going to invest in this

I’m not sure how many people use their phones, but I can never open pie links, because it redirects me to the app and doesn’t open the pie. It needs implemented into the app, otherwise I’ll just have to copy and paste into a browser

My phone opens it in a browser, just a webpage showing the pie with the shares and %

Android or IOS? Idk if it’s just me

I’m on Android, having worked with both extensively I find android marginally less irritating. That said, I won’t argue with people who prefer iPhone as it’s just a personal preference

I prefer android, but iPhone just suits my current needs better

I have more than 50 stocks and growing. I also have 3 pies. Now I want to know which stocks are not withing any pie? It is so hard to keep track because the stocks that I have put in the pie are for long term but I would like to hide stocks that are in the pie. In the search bar you can also implement a filter functionality. Also it would be great to show a small pie icon on the stocks which are included in a pie.

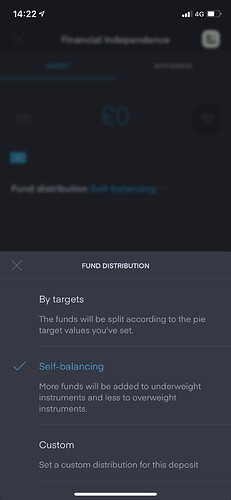

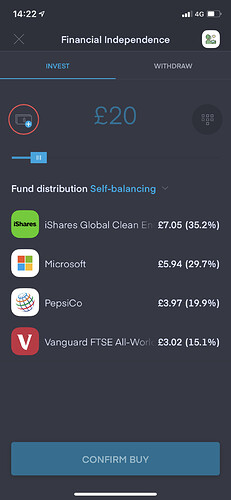

Is there a way to auto-invest more in the laggards in the Pie w/ the goal of bring it back to the original balance, thus not necessarily needing to sell shares as often? (I realize this won’t always be possible given the money auto-invested, but even in a best-effort basis this would be very useful)

Through manual deposits only, not through auto-invest as of yet

- Invest/withdraw funds

- Selected value

- Fund distribution: self balancing

You’ll then see it will invest in your underweight stocks:

Hope this helps, if this is helpful it’s not that difficult to do this once per interval manually, rather than auto investing and having to rebalance

I am using the same method for my REITs pie. Don’t forget to turn off Auto-reinvest for dividends.