Isn’t everything short of buying and holding an index technically gambling?

I personally define gambling as something where the expected return is negative (or chance of having a positive return is less than 50%). I wouldn’t say everything except index funds is gambling.

Completely agree. Gambling is where you’re putting your money into something where the odds are that you lose, investing is putting money in something which has a probability of a positive return greater than that of a loss.

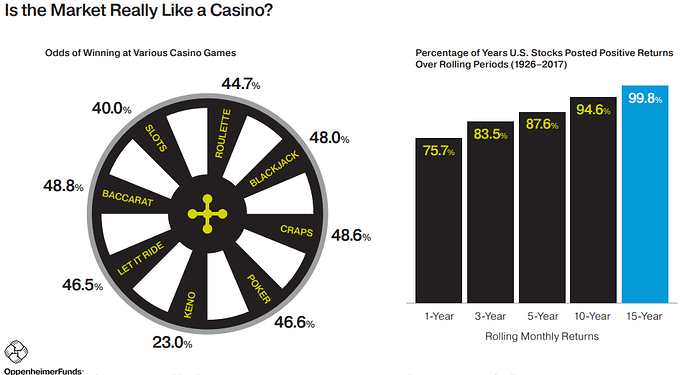

The difficulty is finding these odds. It’s easy to say that casino games are gambling, because there are fixed odds that can be calculated. CFD trading has no odds, it’s all perspective. Even investing in index funds, there is no fixed odds, but the existing data makes it a near certainty of a positive return and that’s why there’s it’s agreed that it’s investing.

I’d say CFDs are odds stacked against you, and therefore can be considered a version of gambling. It’s similar to betting, there are odds but they’re not fixed. The bookmaker is deciding those odds based on the information available. That’s the same as the trader, calculating their risk. But with ~80% of people losing money, we can assume that the probability of a profit is lower than the probability of a loss- and therefore from our definition it is likely gambling.

The stock market is gambling. Full stop.

That said, there is nothing inherently wrong with gambling.

Providing you can make informed choices to produce favourable results over the span of multiple trades, you will do well, and are using expected probability to your gain.

But having blind faith something will go up, and having blind belief some other person will later on down the line pay more for what you own. Well that’s just dumb. You’d be better off on a baccarat table.

That’s how I see it.

The stock market isn’t gambling, most peoples approach to it is.

Speculating on the market means having a sounds plan and executing it where you control your defined risk.

Gambling is buying a basket of stocks, thinking that diversification somehow protects you and planning to hold them through whatever happens, somehow thinking that a 3% dividend offsets your capital loss , which could be 40, 50% or more in a bear market…

For people who have started this yr, this market is not normal and neither was the crash or the recovery, 3 red days in 2 months…that should worry you, not give you confidence…

I dunno about that! At worst it’s 50/50. Just pick a direction and hope it works out. But stocks generally do go up, so buying and holding works equally as well with CFDs as it does with investing. The difference is when people get leveraged to the tits and margin called.

I’d argue the odds are in your favour with CFDs knowing that unless the company is a flaming trash heap, with time and patience, it will rise. Once I lost the opinion that CFDs were for day trading, and saw them as an opportunity for increasing my profits in trading, that was a game changer. I frequently hold CFDs for a few weeks. Why give up a winning trade?

Again, I think people lose money on CFDs because they either over leverage themselves, or they see their account in the red and panic sell.

I ‘invest’ in CFDs at a sensible level of cash and last time I did a count, 97 out of my last 100 trades were profitable. i.e. buy 5, maybe 10 CFDs at a time, not a crazy amount like 500. If the trade goes against you, theres really on harm in waiting a week or two for it to become profitable. CFDs don’t strictly have to be bought and sold daily.

Edit: must have been a bad streak, just had a look and 90 out of my 100 last trades were profitable. Funny thing was, 6 out of the 10 which weren’t, would have been profitable had I held 1 extra day instead of buying and selling on the same day.

Yeah I guess in isolation the odds are 50/50: up or down. But strictly speaking there’s no fixed odds, it’s not like a roulette wheel where there’s and exact chance of an outcome. Depends on your scientific paradigm though. If you’re generally positivist, like myself, you’d actually believe there is set odds for each trade, and of course this makes sense, but if it was easy to figure them out everyone would be rich. I think trading is trying to use as much data as possible to figure out the odds. But as you say, put money in and leave it, odds are it will have went up.

I made my first dabble in CFDs, I shorted NKLA. Thought for sure there would be an insider sell off and the price would plummet. Never happened lol, actually went up. Oh well, was just a bit of fun

I get what you mean with regard the roulette wheel yes.

For me I most frequently buy ‘ProShares Ultra QQQ’ which is an ETF on the CFD side. I ‘buy’ CFDs on this almost daily. When the market is in pullback I try to not buy it (and don’t even bother trying to short it), though this is hard to time. Being an ETF does give it that kind of smoothing effect you don’t get from investing in individual stocks. Generally in a bull market it will rise. The reason I don’t go crazy and buy like 100 CFDs at a time, is of course like with your NKLA example, this all could go against me. I’m fine seeing my account go red holding a small number of CFDs, not seeing it getting obliterated holding a tonne of them though.

Yeah it’s probably a good strategy, you can make small gains frequently which will add up, and will have very limited downside

Thats what I find anyway. I’m happy taking small cash daily rather than a massive win that gets wiped out several days later!

Also with the CFD side with stocks like Snowflake, Asana etc. we can get in early for some reason. So if you think Roblox or AirBnB may skyrocket, it could be good to buy 1 or 2 CFDs before it opens to retailers.

Fully agree in some parts, but I’d still argue it’s gambling, but gambling with or without an edge.

If you have an edge, your a god … if you don’t, well then that person is just another retail “investor”.

Stocks are a gamble though, I’m certain of it. But that’s not a bad thing, as you can actively create an edge. Take for instance gambling at a casino - with a big enough bankroll, something as silly as a martingale system will work (providing table isn’t capped). All that makes it work is just increasing the edge the player has by probability odds. (Silly analogy I know - but it’s the same thing). Just the traders call it price-action / TA / Fundamentals / Macro / etc…

It’s all the same thing - and if it isn’t - please show me the trader with a hit rate of 100%. Never is and never will be, things are out of their immediate control - meaning … drum roll … it’s a gamble.

If it wasn’t gambling then there wouldn’t be a need for a risk/reward ratio or a hedge.

If it’s not a guaranteed outcome, or the outcome has sufficient probability of uncontrolled circumstance - then it’s a gamble.

The only thing that matters though is having/creating an edge.

I could lose more trades than I win, but still make money if money management is set up right and R/R is suitable. Everyone knows this - but it’s a simple example of one aspect of creating an edge.

- lol sorry rant/rave over

So create a definition by yourself, repeat it enough times by rephrasing it in a few ways. After hearing it out loud, your brain familiarised yourself with the idea, and you can start rationalising many things in your head.

It is an “ok” debate technique but in the end you created yet another fallacy. Reading through this even I started thinking “if something does not have 100% probability it is gambling” which is rather naïve to say the least. In the physical world there aren’t many things with 100% probability. It is only yourself that came up with the assertion “anything that is not 100% is gamble” and kept piling up on this.

I can here say “if you are eating rice almost every day, that makes you a Buddhist” I can repeat it is as many times as I like. Hell if I were to try googling it and I can find a blog “article” that found a “scientific” correlation between rice consumption in a country and Buddhism per capita.

I am cognitively biasing myself to believe a fact that I’ve just manufactured and after a while I’ll start believing in this. Then again, I couldn’t be further away from truth and I’ve just created yet another fallacy. If I am pressured by other people, cornered by the facts I can still say “repeat my definition” and say “hey! this is what I believe”

“Never buy one door” Grant Cardone. When you did the effort to get one apartment, you could have used the same effort to get 8-10, and either shortlet to hire cleaning staff or longlet to hire a Manager if you are not into taking calls at 3 am

Anyways, a start is a start, check out Grant Cardone to get real rental investment advice.

I wish for you that you have made some sense to your mind. Start with an investment strategy.

Hey @kali,

The markets have inherent “risk”, so what I am surmising is that the markets have a degree of uncertainty - which in itself is a gamble until that degree of uncertainty can be actively reduced.

Adding to the aspect of 100% probability, I still agree with my statement. Unless the outcome can be actively honed and controlled (and improved upon until there is a near certainty that it will work in the desired way), then there is an underlying aspect of gambling.

The tactics people use to do so vary wildly, but I would still argue that 95% or higher of the trading world are basing their sole trading strategy on metrics that would otherwise be deemed as gambling odds. Example: Stocks have gone up the past 10 years, so they buy expecting the same future expectancy. Or they use fundamentals of a company to base their judgement going forward, which in itself is a good idea until the likes of Enron appear again. Or solely using an indicator as a litmus test whether the markets will rise or fall, yet not understanding the computation of how that indicator is built. Those are valid “gambles” - but as I said, if it makes you money - roll with it.

If we say that everything in life is a gamble, then the real difference comes down to how much of the expected outcome can be controlled, to deem it not a gamble and more of a certainty.

In a nutshell that’s all I was trying to say, as I don’t think it’s possible to reduce the level of uncertainty enough, to deem the stock market not gambling.

This form of ‘gambling’ does seem to produce the highest return on average over all other methods. Decreasing diversification leads to a wider range of possible outcomes, with a disproportionately larger probability of a negative outcome. Intentionally under diversifying relative to an index in an attempt to add value (active share is a metric of it, basically it measures how diversified you’re compared to the index).

As active share increases the results of portfolios differ more from the index (as could be expected), but with lower average returns. Showing that having less diversification lowers returns. This is because only a small percentage of stocks drive most returns (entire gain in US stock market since 1926 is attributable to only 4% of stocks), thus we would want to hold as much as possible to just have those stocks. Diversification is the only thing that actually increases the returns of a portfolio without increasing risk (measured in standard deviation), or reduces risk without decreasing returns (depends on how you phrase it but it boils down to the same thing).

Even more research that backs this up:

As you said this approach is even worse than buying a basket of diversified stocks as this leads to increased emotion, stock picking and time out of the market (all things which decrease expected returns for an investor).

Visualasition:

A random walk down wall street really illustrates why active trading shouldn’t be done, if you think you have an edge over professionals who even themselves significantly underperform with their (presumably greater) resources, go ahead. Only active trading I could think of that actually provides good returns is providing liquidity or being in the business of being the connection between an ETF and the market (the market maker who sells/redeems ETF units when the premium gets too high/low and buys/sells the underlying, effectively arbitrage).

Just How Much Do Individual Investors Lose by Trading? (if the above visualization wasn’t enough)

For timing the market we all maybe remember this thing:

Sorry for the lecture (I probably wrote down a bit too much at this point ![]() ) but diversification is like the only ‘free lunch’ in investing as it does increase expected returns without actually increasing risk (measured in standard deviation), while active trading doesn’t really work. There’s a place and reason for stock picking and having reduced diversification but it isn’t because of higher expected returns but more for investor psychology. Y’all now go and enjoy life!

) but diversification is like the only ‘free lunch’ in investing as it does increase expected returns without actually increasing risk (measured in standard deviation), while active trading doesn’t really work. There’s a place and reason for stock picking and having reduced diversification but it isn’t because of higher expected returns but more for investor psychology. Y’all now go and enjoy life!

@adm I’m just saying you’ve invented/accepted a definition of gambling and based on your definition a wide array of utterly different things are gambling.

See this is why John Literature invented literature ![]() We don’t call all animals that walk on four legs dogs anymore. There is a distinction between buying a share of a company, putting number 11 in bookies, and assessing your pre flop bet size depending on the implied odds of your hole card.

We don’t call all animals that walk on four legs dogs anymore. There is a distinction between buying a share of a company, putting number 11 in bookies, and assessing your pre flop bet size depending on the implied odds of your hole card.

anyway, my last post about this subject. Since your bias is to say everything with an non 100% probability is gamble, no amount of debate will defeat this dogma.

Great response  20 characters.

20 characters.

Granted it is indeed my thoughts and thinking. Maybe I’m the odd one out then.

But if risks are involved, inherently there is a gamble, based on probability.

I can quote Merriam Webster definitions all day long, but at the end of the day, if the outcome has an element of chance or uncertainty - that by definition is a gamble.

I’m not making a dog into a horse there, I’m just saying it as it is.

If you don’t agree, that’s fine -

I can’t be bothered to respond to most of that, yes the average investor looses money or does very poorly. If your aim is to achieve the average investor then so will you. The average or even slightly above av investor puts basically no time or effort into the stock market, thinking they can do well spending a hour or so here and there and buy on whim and other peoples tips. They think, that because they can press a button to buy easily that they are investors / traders. You need some yrs, market cycles and make it a dedication to outperform the market consistently.

Private investors/ traders to a large extent have huge advantages over pros and funds, we trade far smaller size and can make decisions immediately. Liquidty is not an issue for us.

There are countless examples of outperforming the market and timing it to a degree. Simply following IBD would have kept you out of the worst of bear markets with majority of your cash ready to invest once the market begins to turn up.

If one aims for mediocre performance then im sure you’ll never be disappointed but will you be happy with mediocre returns? me ill aim my sights high and be happy if I hit half way there.

There’s a Mark Minervini quote I like, “convential wisdom produces convential results…”