If estimates are a slight loss, why is the market still pricing in a profit?

If estimates are a slight loss, why is the market still pricing in a profit?

After the “short shorts” sale I think they will be making a profit…

Otherwise it is a bit of a reckless move, pumping the price before results are worse than expected.

I’m not sure those short shorts are in the Q2 earnings. Probably going to need to wait for Q3.

Does that mean that you don’t think that the results will be “good”? (profit)

I am not a Tesla shareholder, at least not currently.

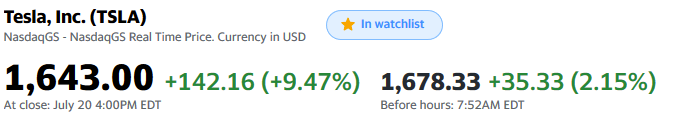

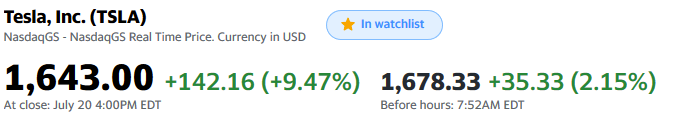

Not at all, I put my money where my mouth is and sold a whole bunch of holdings and put it into Tesla at around $1500. Like everything. The only stock I hold is now Tesla along with my ETFs and two REITs.

Still got good margin of safety as I bought in at $200 originally.

A serious CEO will never do that… a serious one ![]()

Instructions unclear: Bought more.

Would consider adding if price dropped to 50$. As speculative investment.

Elon has subtly hinted in a lot of other ways that there will be a profit this quarter. It will be a profit. And even if it wasn’t, the committee from the S&P 500 said that Tesla will likely be added to the S&P 500 on exception even if they don’t make a profit

I may put 1000€ on it today and sell it when price reaches $2500 in few weeks.

Zacks and Marketscreener, among others.

-0.28 is what I’ve read, which does give room for surprise either way

Each time I check fastgraph to see if TSLA has growth potential. I come to this chart.

That is with PE 30, Apple for instance has historic PE of 24. Or gamble that TSLA will be treated as AMZN with historic average PE 131. Which would make this current pricing in realm of possibilities.

I just wonder what cause all folks to join bandwagon now when stock skyrocketed first to 900 then 1500, it was drifting around 200-300$ for almost a decade… except for obvious FOMO , I am interested what flipped the switch/made you press buy?

Joseph Carlson has published a very interesting video yesterday, exactly pointing some aspects of Tesla that doesn’t make any sense, but also, how the fact that all analysts and specialists just went all wrong about the company, may have contributed to this current scenario.

It worth a look

For me, there was no flicked switch. I bought fairly early and have only ever wanted to buy more since it crossed $400. Instead I waited and put money into apple, disney and other nice blue chips out of fear of overvaluation at that point. Recent profitability and just the momentum of the company overall has just increased my conviction that the company is a fantastic long term player. My conviction is 35% of my portfolio.

It’s the Apple of the automotive industry. And if I could’ve bought Apple at any time in that past I would have, and have done so. But I see a future where half of all new cars sold are Teslas and therefore it’s valuation of 267B is still low. It’s a sniff of Apple or Amazons valuation.

Also I am under no delusions of S&P inclusion really pushing the price up that much. These guys already own a crap ton of the company:

Elon is usually too high. 🤦:thinking:

I may be wrong - I normally am

But I have a feeling that this is one of those moments when everyone is expecting something - so the other happens.

I have trouble calling it Apple of anything tbh.

Apple had a brand even before IPhone came and made the future growth/transformation. Apple was known as Premium brand.

Tsla on other hand doesn’t have any history let alone quality products behind its name.

While I can see glimpse for optimism, I cannot see Tsla car monopoly, while they have advantage near term, I believe most of legacy ICE producers are shifting billions into EV R&D.

From what I see their current backlog demand is not even considerably greater then current production levels, so I am puzzles how does one expect to sell 1-2 million cars per year, if they don’t have backlogs that even dwarf current production…

Anyway, I see potential for good investment, but at much lower valuations. I am not apple fan nor tsla fan as brand. But I respect apple as company, tsla still has to earn this respect.

![]()

![]()

![]()

It’s not about the earnings call really.

@Vedran I totally get it. But from my point of view the 2012 model s shows the quality of it’s products. Along with the highest ever vehicle safety ratings. Tesla in my opinion cannot fail now. Back when the price was jumping up and down from $200-$400 or below, there was question as to the survivability of the comapany. Almost all doubt has been erased from my mind. I am very bullish, but keep myself in check with ETFs and I’m not allowed to sell those to buy anymore Tesla