I’d say our tolerance for pain/risk was also heavily tested recently. I think mine is pretty good. Never sold, averaged in, followed the lessons taught. I think I can handle some single company risk after the most heavily volatile period in stock history. Just buy and buy and buy …

I agree on your points, and I hear you about chart, but what this 20+ years chart don’t show is actual drop on each correction/bear market.

For instance in 2008 financial crash, Apple had high around 30$~ , and low around 11$~.

Which makes it around 60% drop from the max, but you need to take account it never went parabolic because 2007-2008-2009 highs were around 27-30$.

In 2000 dot com, it went high 5$, low 1$. Which is 80% drop, I consider current market closer to dot com then 2008.

So I guess I would try to time the market when we discuss TSLA. But with 80% discount on current price it brings it more to previous 300$ price…

Current market has some very overvalued companies, but that has some profits, or are delivering their products. These one may have (or not) a correction.

The biggest problem are the companies very overvalued that has nothing, has delivered nothing and are promising some earnings in few years. These one are close to burst.

Everybody:

Elon: Hold my

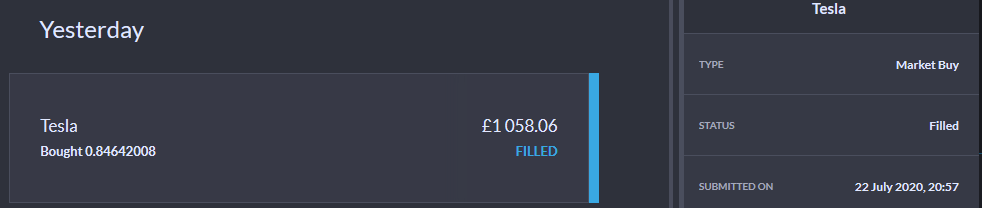

Did you invest in the end?

I did

Also increased my positions on AMD and PFE last week… but all on long term, not because of the earnings.

at the very least we know you are good for your word, though the market may try and spite you for that

wish you all the luck haha.

I swear I read truck ![]()

![]()

![]()

![]()

I wouldn’t deny you the chance to win a free truck either

There is a bit of creative book keeping going on with TSLA though. Strip out the 100% margin regulatory credits and their gross margin was 18.7% in Q2, lower than any of the last four quarters. Now they are scaling up, fixed costs are starting to bite.

I don’t think you can say that it is creative accounting. They did indeed sell those ev credits and got 100% margin because it’s literally a waste product of theirs. I don’t see how it can be labelled as “creative”. In my opinion it would be hiding profits to reduce tax liability to not include them.

What could be argued as creative is the revenue recognition from self driving. Although, depending on what milestones they use to recognise the revenue it might be fair.

Edit: It’s like saying Apple’s software revenue doesn’t really count. And if you don’t include it, they have had falling revenues and profit margins for the last few years. How is that relevant to the overall profitability of Apple?

Well, you can call it anyhow it, fact is, it turns unprofitable company into barely profitable with regulative/federal income. Which is not product of direct Teslas product sales, rather byproduct of government/regulatory imposed tax/support depending on which side of fence you are at.

Comparing it with Apple software revenue which is their direct development, proprietary ownership, not government made compliance/regulatory tax/support, Is like comparing apple to orange.

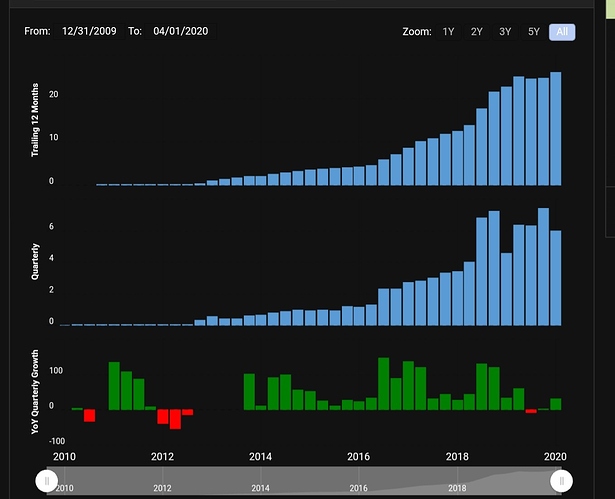

But anyway I would be more concerned by Revenues growth slowing down since Q1 2019…

??? Which growth company is this???

If you tailor your business to take advantage of govt/state income that is still part of your income as long as you’re aware that it might change/be removed. The same was true of a lot of renewable energy companies (which is a major part of TSLA’s offering) over the last 10-15 years.

It’s temporary income that won’t last and masks a deteriorating profit margin due to increased fixed costs. So yes, they’re totally right in reporting it, but it’s also negligent as an investor to take it at face value.

I have no idea what you guys are talking about

- Buy TSLA

- ???

- Profit

- Buy Tesla

-

- Unrealised “gains”

- Depression once price collapse

- Panic sell for loss

Or

I think the only concern on Tesla is about how “far” the stock valuation is ahead of the real company value.

Tesla has two factories on construction/expansion, they still have models to be released while also boosting their battery / clean energy business… there is no doubt that Tesla as company is very promising and it’s ahead of competition right now.

Stock price will drop?

It will, 100% sure!

When?

Not in 2020 for sure.

How much?

Doesn’t matter.

Will prices be at the current value again after the drop?

It will, 100% sure… again, the question is, how long it will take.

I wrote above that I may sell it after few weeks, but I really won’t… actually I have a small increase in my position next week and wait, IF/WHEN the big drop comes… then I will do a big buy and forget for some years.