You must have meant to say you guy then I presume?

If you want to pm me like I have had the decency to do for you then do so if not then stop posting nonsense.

I’m investing in Tesla based off what I think the company will grow to be in 10 years. Firstly they have 80% market share of EVs in the US so for a lot of people in Europe we really find it hard to imagine what all of the fuss is about, this will change when the factory in Berlin is up and running and we can start to see costs come down due to high production and lower import costs. They have already proven they can scale up and manufacture excellent products. The current production capacity is well over 500,000 cars per year. The factories being built in Berlin and Texas aswell as capacity being expanded in Fremont and Shanghai will bring the production capacity up to 1 million cars for 2021. This will double the amount of cars produced in 2021 which will shock traditional analysts when they give this as there 2021 guidance. As these factories become completed and new products like the cybertruck and semi truck are built at Texas the capacity is thought to be 1.8 million for 2022. Other giga factories are likely to be built in places like India, USA and Europe you can see the production increases following a path to over 10 million vehicles per year before 2030. As they keep bringing the operating expenses lower and the cost of batteries lower which from battery day will be around 56% lower in less than 3 years it will keep bringing the cost of cars down creating even more demand to match the future production capacity (remember there is a wait for cars as the demand for their cars outweighs the supply at the moment). Elon musk also expects the energy side of the business (solar and battery storage with powerwalls and mega pack to store energy for wind and solar farms) to match the auto side of the business. He tends to deliver on his promises if anyone has ever looked into his past he just doesn’t always get the timing correct.

On to price

I’m sure most Tesla investers know all of this already but valuation is the hard part. I believe the company was undervalued in the past and the start of this year saw it catch up to a reasonable valuation of such a growing company which is one of a kind. I have invested this year and obviously done very well but during the recent parabolic run up the returns will be getting lower as the price gets higher. A pullback after the inclusion is needed and is very likely to happen so I would urge caution at this point. There’s not much that can stop it increasing until the 21st December, don’t be surprised to see prices of $700 plus per share by then. That however could lead very much sideways or downwards price movement for several months if not most of the first half of 2021. I am prepared for this as I am holding for the long term.

I have seen forecasts/models of revenue growth that show the revenue increasing in line with the expansion and the demand for products which would give valuations of between 2-4 trillion dollars at a P/E of 30-40 somewhere between 2027 and 2030. I will continue being a shareholder until I see evidence of them not hitting close to this valuation. At the moment they look on track for this so I am happy.

Please don’t use Apple’s name in vain ![]()

Thank you for your insight Mofojonno

My story will be to wait for the inevitable, then depending on the price I will decide

Nice post, but no offence. I read same story over and over. Seems like every tsla investor has same source of info.

Providing same data, without showing the full context. 80% here , 500000 there, some battery lower 56% there.

Most intriguing part. Which I seen thrown around alot.

valuations of between 2-4 trillion dollars

Musk him self states that energy business will have same % revenue as Automotive.

So if value of entire business is 2 trillion, it would mean automotive business is around 1 trillion? Or ok let’s add insurance, so 1/3 will be every business share.

In which case TSLA automaker is around 700 billion. While rest of business energy/insurance 1.3 Trillion, or in more optimistic, TSLA carmaker will be 1.3 Trillion , then energy and insurance 2.7 Trillion?

I just wonder on what logic does one project this numbers, is there some TSLAesk formula for growth? I would really like to understand where do folks get this trillions, 2-4. Why not 10 or 100?

A lot of that auto revenue is based on selling the software for full self drive at high prices and high margins, it is currently selling for $10k and obviously not everyone will buy this so each quarter gives an idea of how much they are selling and if it is allowed on the roads inlst countries or not. I’m personally counting that in for future cash flows, if the software sales do not pan out then I am out as that is priced in. Whether it’s 1-2-4-10 trillion or not will depend on what p/e people are willing to pay at the time, at the moment people are willing to pay massively for most growth stocks. Tesla is currently 1100 trailing pe with a forward pe of 150. I compare Tesla prices to Amazon in the past which has traded at high pe’s previously and even had a negative pe in only 2016 (for the whole year it made a loss) but it always has grown revenues enough to keep up. If Tesla doesn’t grow revenues enough then we will see soon enough

In all honesty guys, we’re kind of debating whose got the biggest crystal ball here aren’t we? No one can predict the future so then it does become a matter of opinion based on the current facts and forecasts.

To @Vedran points, which as much as some people do not want to take on board; the current valuation is absolutely crazy at this moment in time. There is absolutely no debating this and I personally believe we can expect a lot of volatility either way.

Then it will boil down to people opinions (based on news etc etc) on what the future may hold.

So here’s no two cents, I acknowledge they are overvalued. My opinion is that there is an upside in Tesla’s future TAM as they are currently only really tapping into one revenue stream. As my crystal ball is a little rusty I have therefore allocated accordingly. Tesla represent around 3-4% of my portfolio so I’ve got a little bit of skin in there and I’m not jeopardising my full portfolio on over allocation. Let’s be honest nobody actually knows if they will be a $2T company if we’re all honest do we? I think “yeah maybe”, it’s all a nice idea and I believe in them.

My opinion is if you are over exposed to it then you are taking a big risk. But hey, we all have

Different risk tolerances don’t we?

Sums it up really.

What I can’t help thinking too, is considering the knock on effect of having the economy shut and tons of people losing their jobs; for the average person out looking to spend what cash they have saved, who has the funds to really splash out and buy a tesla?

I know they are coming out with cheaper models every year, but still - it costs an arm and a leg to buy any EV right now. I wonder how many households will really want to slap down that kind of cash.

Then again, it seems like every other bugger is loaded up to the max on Boris’s bounce back loans  - joking aside though, it does seem a pricey item for the general public.

- joking aside though, it does seem a pricey item for the general public.

The lease option provides the numbers for required sales as with any other car manufacturer, the main ones being corporate which has been given with 0% bik and salary compensation

I take it that you are a “fanboy”?

I think you are missing the point, about the S&P500 entry and the importance of it.

Institutions are buying now Tesla shares, to have them in their funds, that is why the price went up so much in a short time. The price didn’t go up only, because of a buying spree of individual investors, trying to make a quick buck, finance institutions are buying them in bulk, driving up the price. Check on the file date Nov,. 27th for example in this overview: https://fintel.io/so/us/tsla#:~:text=Largest%20shareholders%20include%20Susquehanna%20International,FUND%20OF%20AMERICA%20Class%20A.

That is incorrect @Crow1967 because Index tracking funds will only buy when it is official and when they publicly announce what companies are coming out of the Index. They will sell something to make room to buy something new (in this case Tesla)

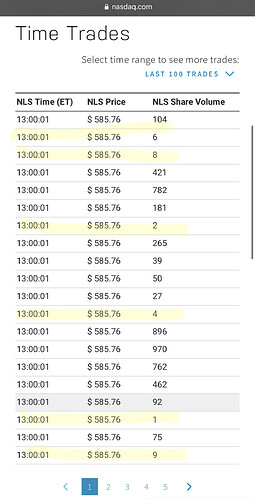

Institutional investors don’t buy 2 shares or 9 share. They also don’t buy numbers that are difficult to track in accounting such as 421

It might be that I am wrong as you said. I need to accept that I am too poor or don’t have the risk appetite to buy Tesla shares at almost $600

Well that would be me! Nice to meet you. I’m dollar cost averaging all the way up. Plus with my SIPP I can’t use a limit orders and I’m only using fractional shares on trading212 as not risk enough to buy large shares all the time

This sums up my thought process pretty well https://teespring.com/en-GB/don-t-wait-for-a-pull-back?pid=389&cid=100019

Or you wait for a dip, or you buy for example NIO, WKHS or another EV company you believe in.

Funny that you are saying that now, because in the topic Aug 28 TESLA Passed 2300! , you said:

5000 before close, split share value 1000$, then 5000$ by end of next week. Yolo

At this point, I am not even confident that TSLA will burst soon. It seems to go just one direction, up

What changed since then ??

Besides what I said earlier, in another topic, you said: "TSLA always go up, just keep buying the dips.  "

"

Why suddenly you say now: “Thus I rather put my money in BABA or AMZN who have track record, have growth”

What happened ?

Read his bio lol, sometimes hard to tell when he’s trolling or not

Why is nobody taking into consideration that other auto manufacturers are switching to EV and that Tesla won’t have a big market share? Look at VW, Daimler, BMW, GM, they don’t have that kind of valuation yet Tesla is going through the roof.

Yes, seems like, very inconsequent anyway, maybe he sold his Tesla shares and is now sorry that he didn’t hold on to them…

At one point, you give up reasonable discussion, just join the flow.

I have not joined TSLA discussions since, funny thing to me, there is no topics when TSLA goes sideways. But as soon as another top, again exploding with everyone crawling out of their S Models.

Anyway I am not Long , nor short TSLA. I mute most of topics which mention TSLA to avoid temptation.

But sometimes it just gets stronger then me. Probably won’t see me in TSLA topic for few months again.